Let’s take a look at how ESG could become a significant driving force behind mergers and acquisitions over the coming year.

Be sure to check out our ESG Channel to learn more.

M&A Focuses on Sustainability

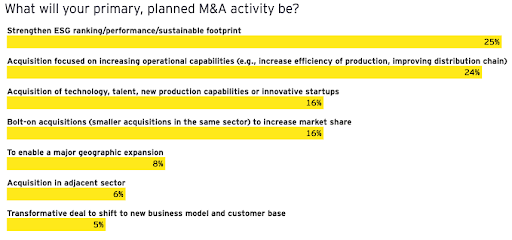

CEOs list ESG as a primary motivation for M&A. Source: EY

More than 80% of CEOs see ESG as a value driver to their business over the next few years, and virtually all have adopted a sustainability strategy. These trends mirror existing trends in the European Union, where executives have come to recognize the benefits to their bottom lines and ESG reporting mandates exist across the spectrum.

The sectors that saw the most value in ESG include:

- Consumer Products (85%)

- Life Sciences (85%)

- Financial Services (84%)

While regulations drive some of these trends, nearly three-quarters of CEOs adopted ESG for strategic reasons rather than pressure from regulators. These reasons include competitive differentiation and a lower cost of capital. Climate change also ranked above talent scarcity and cost for risks to their business’ future growth prospects.

Implications for Investors in ESG

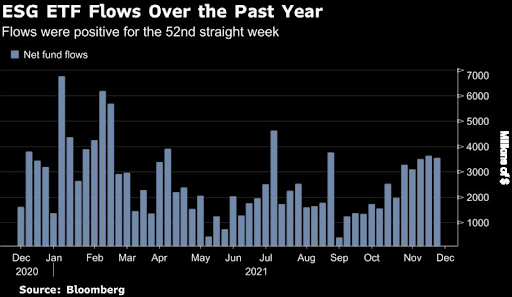

ESG ETF inflows continue to rise. Source: Bloomberg

EY’s latest survey suggests that CEOs are listening to investor demands for companies to meet ESG goals. For example, Engine No. 1 famously installed three new board members at Exxon Mobil to push climate-friendly policies. Meanwhile, ESG funds capture billions in net inflows each year, rewarding companies that meet the standards.

Investors could see the ESG universe increase as a result of these efforts. As more companies meet ESG criteria, ESG funds could expand their portfolio to provide greater diversification. There could also be a greater number of green bond issuances, creating opportunities for investors to participate in ESG-friendly fixed income.

Of course, investors may also need to exercise caution. Greenwashing has made it difficult to separate genuine ESG-friendly companies from those simply seeking funds earmarked for ESG initiatives. Companies making ESG-focused acquisitions could also face an uphill battle when containing costs and realizing an attractive return on investment.

Be sure to check out this article to know more about the dark side of ESG.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.