Let’s look at the growing popularity of ESG investing in the public markets and the risk of hydrocarbon assets falling into the wrong hands.

Be sure to check out our ESG Channel to learn more.

Investors Embrace ESG

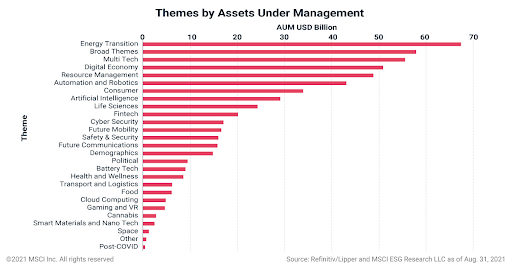

Energy transition topped thematic fund inflows in Q3 2021. Source: MSCI

Europe’s Sustainable Finance Disclosure Regulations (SFDR) set specific rules for how and what sustainability-related information financial market participants and advisors must disclose. The goal is to prevent the ‘greenwashing’ of financial products and advice to help investors meet their sustainable investment objectives.

In February 2021, SEC Acting Chair Allison Herren Lee directed the Division of Corporate Finance to enhance its focus on climate-related disclosure in public company filings. The agency hopes to update its 2010 guidance to take into account developments in the last decade and further improve climate disclosures in the U.S.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Dark Side of ESG

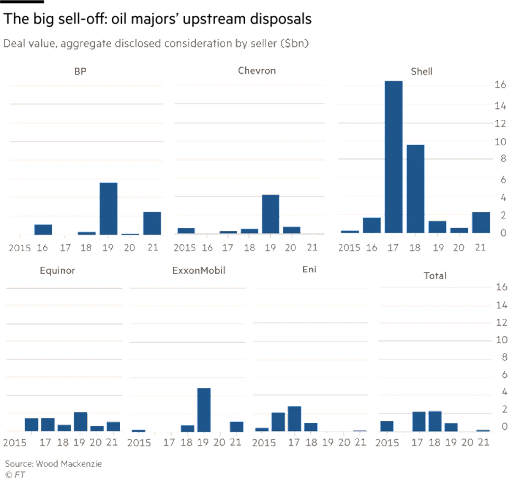

Big oil continues to sell hydrocarbon assets. Source: FT

BlackRock Chairman and CEO Larry Fink points out that the transition is problematic because hydrocarbon assets are moving from transparent public to opaque private companies. These private companies face much less scrutiny over their activities, squeezing as much production as possible without disclosing the environmental consequences.

In addition, many of these private companies could make a fortune from investor enthusiasm over ESG trends. ESG-compliant assets are becoming overvalued as oil majors divest at fire-sale prices, while private companies are snapping up fossil fuel projects at a steep discount. The result is a massive arbitrage that could be counterproductive.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.