The COVID-19 pandemic has dramatically changed the corporate landscape. Let’s take a closer look at how ESG investments have outperformed during the COVID-19 pandemic and what the future holds.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

ESG Outperforms During the Crisis

Click here to learn more about ESG investing.

There’s evidence that these best practices have paid off:

- HBS Professor George Serafeim found that companies with ESG-like employee and supply chain practices outperformed industry peers between February 12 and March 24, 2020.

- Bloomberg and Morningstar confirmed these findings by showing that ESG fund returns exceeded non-ESG funds.

- MSCI found that bond issuers with higher and improving ESG ratings outperformed competitors during the first quarter.

In addition to an easier transition to the “new normal”, ESG-focused companies have faced less criticism from consumers—particularly after they accepted public funds. The public image of ESG-focused companies tends to be better than competitors, which could lead to a more resilient business long-term.

Shake Shack Inc.’s (SHAK) decision to return its government PPP loan after finding $10 million in the credit markets is a solid example.

Some ESG Concerns

There’s also some debate about what exactly constitutes an ESG investment. MIT’s Aggregate Confusion Project found a very low correlation between ESG ratings from top ratings agencies, underscoring the difficulty of evaluating ESG factors.

The COVID-19 pandemic has also had an uneven impact on ESG-focused companies. In healthcare, socially responsible hospitals and medical offices have closed for routine business and doctors’ revenue fell 50% to 90% in some cases. These dynamics could lead to consolidation in the market.

Despite these higher operating costs and other concerns, it’s difficult to quantify the impact on investors. ESG-focused companies may have more productive employees and less turnover. These could contribute to faster revenue growth and less hiring or training costs relative to non-ESG companies.

Learn more about mutual funds here.

Impact on Mutual Fund Investors

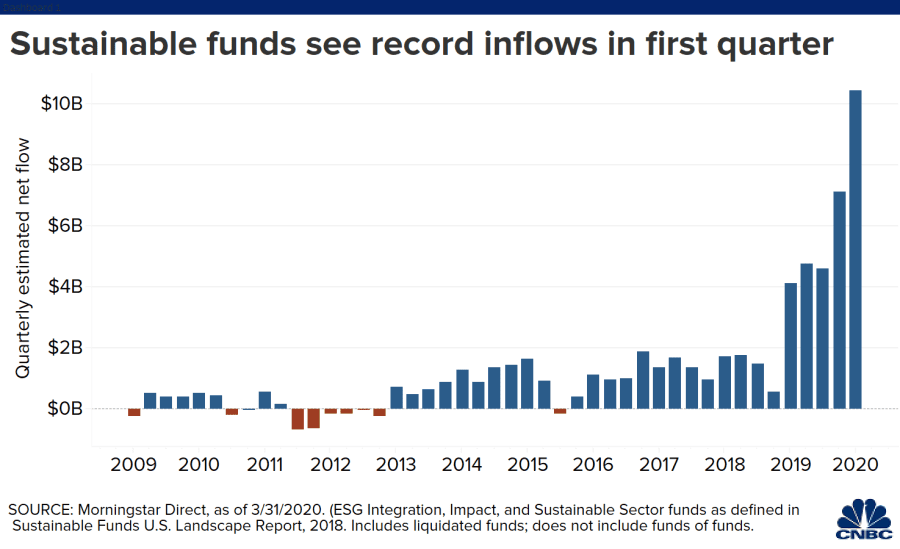

The COVID-19 crisis has already led to a significant inflow into ESG funds as investors shift their priorities.

Investors should carefully consider the criteria used to judge the ESG attributes of a portfolio before committing any capital. With the wide array of definitions, everyone has a different idea of what it means to be ESG-focused. You should find the ideals that most closely match your investment goals.

Don’t forget to check out ESG-focused mutual funds here.

The Bottom Line

ESG mutual funds are an easy way to align your investment holdings with your moral objectives and potentially realize higher long-term returns due to improved brand reputation and greater resilience during crises like the current pandemic.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.