Let’s look at how investors can become part of the solution rather than the problem by investing in affordable housing projects.

Be sure to check out our ESG Channel to learn more.

How Investing Creates Problems

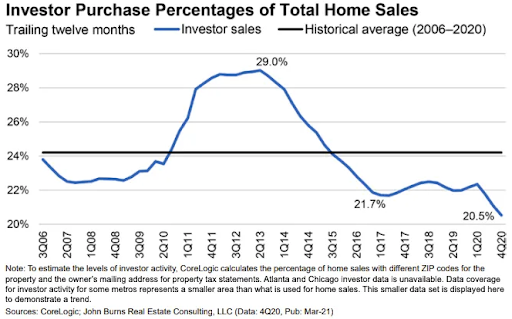

Source: John Burns Real Estate Consulting

There are also signs that the single-family rental market is just getting started. For example, Fundrise and other crowdfunding platforms make it easier for anyone to invest in real estate. And institutional investors continue to purchase homes on the open market and collaborate with builders to construct rental property portfolios.

Ultimately, supply constraints and ongoing investor activity is pushing up housing prices. As a result, individuals and families unable to afford their own homes are renting from investors. And the lack of new housing also enables investors to increase rental rates, pushing up their yield and encouraging further acquisitions.

Fixed Income Opportunities

Fortunately, a growing number of fixed income products address affordable housing concerns. For example, the actively managed Nuveen TIAA-CREF Core Impact Bond Fund (TSBHX) invested $488 million in affordable housing in 2020. These funds supported 2.8 million affordable mortgages and nearly 90,000 affordable housing units.

Other mutual funds and ETFs with exposure to affordable housing include:

| Name | Ticker | Type | Yield | Expense Ratio |

| TIAA-CREF Core Impact Bond Fund | TSBHX | Mutual Fund | 1.70% | 0.43% |

| TIAA-CREF Short Duration Impact Bond Fund | TSDHX | Mutual Fund | 1.49% | 0.45% |

| Community Development Fund | CDCDX | Mutual Fund | 1.18% | 1.00% |

| Access Capital Community Investment Fund | ACASX | Mutual Fund | 1.57% | 0.80% |

| ImpactShares Affordable Housing MBS ETF | OWNS | ETF | 1.95% | 0.30% |

Data as of March 22, 2022.

There are also several private investment opportunities:

- The Capital Impact Investment Note supports affordable housing and other programs for underserved communities. Since its inception, it has deployed more than $400 million toward financing more than 4,000 affordable units nationwide.

- Small Change provides crowdfunded (Regulation CF) real estate investments focused on affordability, green energy, and other objectives. These projects include both debt and equity investment opportunities throughout the country.

Of course, investors should ensure these funds fit within their overall risk and return objectives. These funds also have higher expense ratios due to their active management approach, which could reduce long-term returns compared to passively managed funds. And private investments may have little-to-no liquidity and a higher risk of losses.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.