Let’s take a closer look at green bonds and how you can incorporate them into your portfolio with green bond ETFs.

Be sure to check out our ESG Channel to learn more.

What Are Green Bonds?

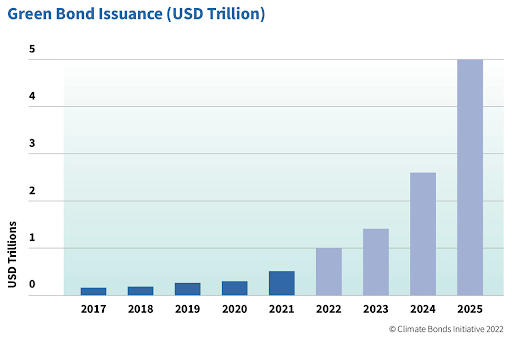

Green bond issuances will accelerate in 2022 and beyond. Source: Climate Bond Initiative

A key advantage of green bonds is that each dollar you put in directly goes toward environmental causes. That’s very different from ESG stocks and funds, where investors are simply buying shares of a company that uses only a portion of its resources to make a positive impact. As a result, green bonds have become popular among impact investors.

The use of proceeds for green bonds is surprisingly diverse. While renewable energy was the largest category at 35% of the market, energy-efficient buildings (30%), green transportation (18%), and water management (6%) accounted for a meaningful part of the market. In addition, investors will find a mix of sovereign and corporate issuers.

Unfortunately, green bonds are similar to other bonds with high minimum investments and limited liquidity, making them ill-suited for individual portfolios. The good news is that green bond ETFs solve these problems by aggregating many green bonds into a single, diverse portfolio that anyone can purchase through their conventional brokerage account.

Investing With Green Bond ETFs

The iShares Global Green Bond ETF (BGRN) is the largest green bond ETF with more than $250 million in net assets. With more than 750 green bonds, it also has the most diverse bond portfolio. In addition, the fund charges a 0.2% expense ratio and offers a 0.81% trailing 12-month yield paid annually, making it an excellent option for investors.

The VanEck Vectors Green Bond ETF (GRNB) holds over 300 green bonds with a 0.2% expense ratio and a 2% trailing 12-month yield paid out in monthly distributions. Unlike BRGN, the fund focuses on U.S.-dollar denominated bonds certified by the Climate Bonds Initiative, meaning the portfolio may adhere to higher standards.

When investing in these ETFs, remember that green bond funds have many of the same risks as other fixed-income ETFs. For example, you may want to evaluate the bond portfolio’s duration for interest rate exposure and credit ratings for default risk while being mindful of each fund’s expense ratio and liquidity levels.

Alternatives to Green Bonds

Green bonds have become extremely popular, but they come with limitations for issuers. Since green bonds can only finance green projects, they’re off-limits for issuers that don’t have enough green projects for an entire bond issuance. Fortunately, sustainability-linked bonds (SLBs) provide an alternative with more flexibility to fill the gap.

Issuers of SLBs don’t have to use all the proceeds for green projects, but they must still adhere to some standards. For example, many SLBs must measure the use of proceeds to ensure a percentage reach of green projects. Some bonds also provide external verification to reassure bondholders further.

Of course, the same flexibility means that investors must take a more active approach to avoid ‘green washing’ or ‘sustainability washing’ risks. Unscrupulous issuers may use the ‘sustainability’ moniker to lower their cost of capital while financing non-sustainable projects. As a result, investors may also want to look for third-party certifications.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.