ESG investing has become increasingly popular over the past decade. While millennials and women are driving a lot of growth in the market, ESG equity benchmarks have also outperformed their traditional peers between 2012 and 2018, suggesting that sustainable investments may offer better opportunities, regardless of values.

Let’s examine six core themes from BlackRock’s 2020 ESG survey and what they mean for your portfolio.

Explore our ESG channel to know more about ESG strategies and trends.

1. Sustainability Isn't a Fad

More than half of the respondents consider sustainable investing a fundamental part of the investment process and its outcomes. Meanwhile, only 5% of respondents believe that sustainable investing is a short-term trend that will not develop further.

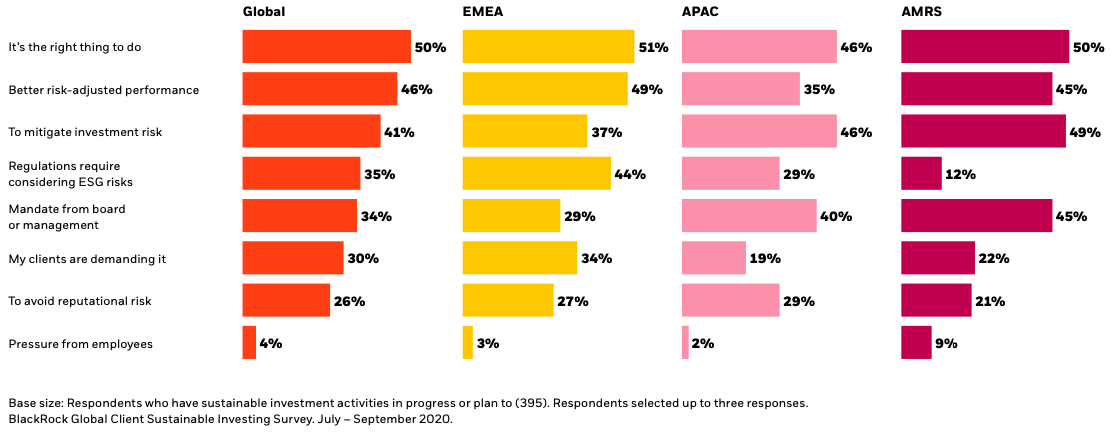

Top drivers of sustainable investing – Source: BlackRock

While values-based drivers are essential, a growing number of investors recognize that sustainable investing offers the dual benefit of better risk-adjusted returns and less investment risk. Regulations requiring the consideration of ESG risks are also driving these trends.

2. Allocations Keep Growing

Sustainable strategies experienced record growth in 2020, with $230 billion in ESG fund inflows and $1.83 trillion in AUM. Respondents plan to double their sustainable assets under management over the next five years, moving from 18% to 37% of AUM by 2025.

The EMEA represents the largest market for sustainable investments. In 2020, the region had a 21% allocation to ESG funds, compared to 12% for APAC and 13% for AMRS. Goldman Sachs expects EMEA allocations to reach 47% by 2025 versus 22% for APAC and 20% for AMRS.

Use the Dividend Screener to find the securities that meet your investment criteria.

3. Data Remains a Key Challenge

The number of companies reporting ESG data has risen from 20% of S&P components in 2011 to 90% by the end of 2019. Still, more than half of respondents cited a lack of ESG data and analytics as a significant barrier to deeper or broader implementation of sustainable investing.

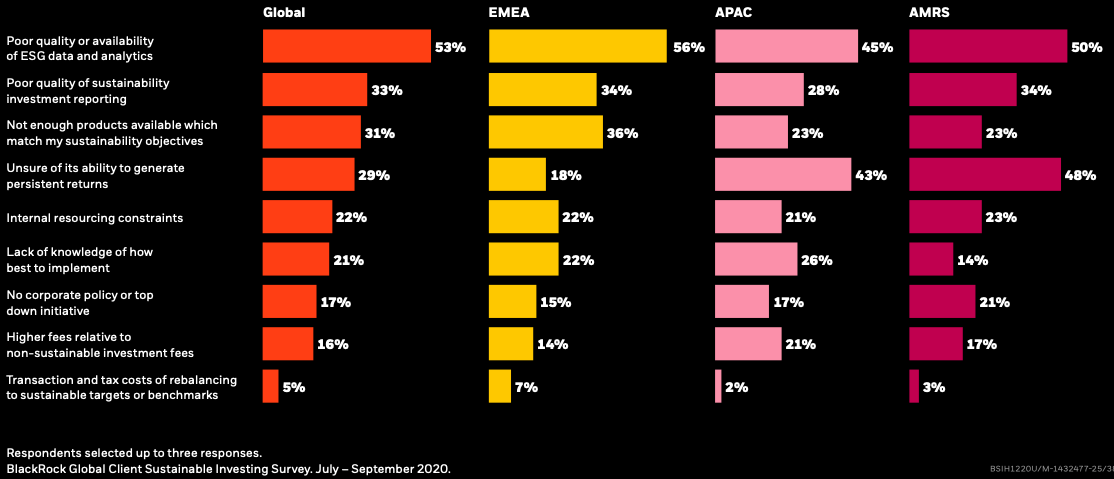

Challenges in adopting ESG principles – Source: BlackRock

Aside from data challenges, nearly one-third of respondents cited a lack of investment options matching their sustainability objectives as a top barrier. In contrast, only 16% cited higher fees than non-sustainable products, suggesting that there could be room for expansion.

4. Climate is the Primary Focus

ESG investments cover Environment, Social, and Governance issues, but nearly 90% of respondents ranked Environment as the essential ESG factor. About half of respondents allocate funds to Climate Action and Affordable Clean Energy in their portfolios.

In the U.S., climate-related investments could also benefit from the Biden administration’s investments—and potential investments—in renewable energies. For example, expanded tax credits for renewable energy companies could accelerate their growth and profitability.

5. Different Strategies Persist

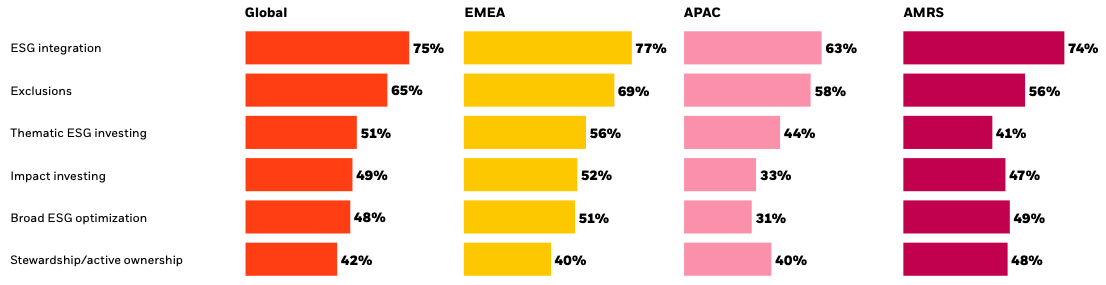

Three-quarters of respondents currently use or are considering integrating ESG into their investment decisions. Meanwhile, 65% of respondents utilize or consider utilizing exclusionary screens as a critical mechanism for expressing their sustainability principles.

Different ESG approaches – Source: BlackRock

Aside from ESG integration and exclusion, the report found that EMEA investors preferred outcome-oriented approaches, like impact investing. In contrast, AMRS investors chose active ownership as a preferred sustainable investing approach in their portfolios.

Click here to explore the portfolio management channel and learn more about different concepts.

6. Fixed Income and Alternatives

Equity allocations remain the most popular way to gain ESG exposure, but there’s a growing interest in sustainable fixed income and alternative asset classes. More than 40% of respondents allocate to sustainable fixed income strategies today, while over 60% plan on considering it in the future.

In the U.S., the municipal bond market has become an essential source of fixed income ESG investments. For example, so-called “green bonds” help fund environmentally-focused projects on a municipal level, and the growing interest in them has made such projects even more compelling.

The Bottom Line

ESG investing has become increasingly popular over the past decade as investors seek to align their portfolios with their values and maximize risk-adjusted returns. In its survey of more than 400 asset managers, BlackRock found that these trends are only accelerating.

Investors may want to consider accelerating their implementation of ESG into their portfolios to realize these benefits and stay ahead of these trends. At the same time, asset managers should continue to look for ways to meet the growing demand for ESG-focused portfolios.

Be sure to check our News section to keep track of the latest updates around income investing.