In this article, we’ll look at what risks remain for junk bonds over the coming months and why some asset managers are eager to buy.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

Junk Bonds Remain a Risky Bet

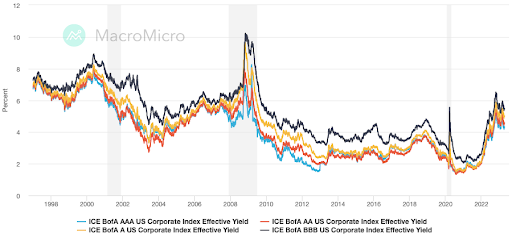

Currently, AAA-rated corporate bonds are yielding 4.34%, whereas B-rated bonds trade at 8.47%, and CCC and lower-rated bonds trade at 14.70%. While the spreads between these bonds and Treasuries are widening quickly, the spreads between AAA and junk bonds remain historically tight (see the chart below).

AAA vs. BBB-rated corporate bond spreads remain historically tight. Source: MacroMicro

The consensus is that credit spreads must widen further, given the lower credit availability and risk of a recession. If a recession occurs, many smaller borrowers could see less cash flow and may have trouble servicing their debt. CCC-rated and lower debt in particular could see a jump in defaults if a recession materializes.

Don’t forget to explore all High Yield Bonds to see if they suit your portfolio needs.

But a Recovery Could Pay Off

In particular, JPMorgan’s asset managers suggested they would buy mining and autos in the BB-rated high-yield space. However, they quickly noted that spreads need to widen, and there needs to be more decompression of spreads between investment-grade and high-yield before they make any significant moves.

Investors who wish to start building exposure to junk bonds earlier can also consider actively managed ETFs rather than passive funds. For example, the Invesco High Yield Bond Factor ETF (IHYF) uses a factor-based strategy to outperform market-weighted indexes, incorporating fundamental and technical factors into its decisions.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.