Let’s take a look at how COVID-19 has impacted the mortgage-backed securities market and where investors can look for opportunities.

Don’t forget to check out our Fixed Income Channel to learn more about fixed income concepts and trends.

Impact of COVID-19 on MBS

For instance, the AlphaCentric Income Opportunities Fund (IOFIX), which focuses on lower-rated mortgage-backed securities, fell by more than 30% in just a week and was forced to put up $1 billion worth of securities for sale. Commercial real estate operators, such as WeWork, also had their credit ratings cut due to an anticipated shortfall in cash flow.

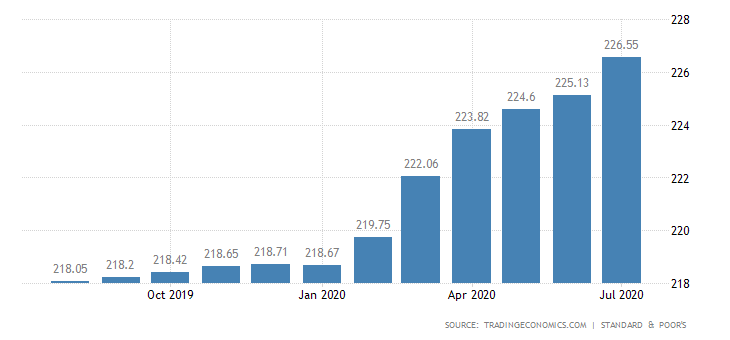

Of course, the Federal Reserve stepped in with a pledge to provide up to $2.3 trillion in loans to support the economy in April and continues to purchase about $120 billion per month of Treasury and mortgage-backed securities in the open market. These efforts – combined with robust fiscal support – helped stabilize the markets and return them to an upward trajectory.

Be sure to check bond funds section to explore various funds from the fixed income space.

Robust Fundamentals

That said, these fundamentals are dependent on continued fiscal support. Mortgage delinquencies rose during the second quarter to a seasonally adjusted rate of 8.22% of all loans outstanding, according to the Mortgage Bankers Association’s National Delinquency Survey, suggesting that the expiration of fiscal stimulus and protections could impact the market.

Sorting Risks From Opportunity

Commercial MBS has a bit more uncertainty. While Class A properties with well-capitalized sponsors may be able to cope with the pandemic, hotels, retail properties and Class B/C properties are a lot riskier. Actively managed funds are well-suited to analyze these risk factors and optimize a portfolio to minimize default risks over time.

Despite concerns over prepayments or fundamentals, many analysts expect the MBS market to continue to outperform Treasuries into the third quarter. Strong demand from investors seeking high-quality yield, ongoing support from the Federal Reserve and ongoing strength in home prices are likely to offset delinquencies and any increases in supply in the near term.

The Bottom Line

Over the long term, investors should keep a close eye on ongoing fiscal support for homeowners to avoid delinquencies and ongoing improvements in the job markets. With net supply growth remaining slow, the underlying housing market could continue to see strength over the intermediate term given the low interest-rate environment.

Be sure to check out our News section to be up-to date with trending funds and market updates.