The reality is international bonds can offer a whole host of benefits, including inflation protection, higher yields, and reduced risk/diversification factors.

The best part is adding a slice of international bonds is quite easy. Thanks to the exchange traded fund (ETF) boom, there are now numerous ways for investors to get their international bond fix for low costs.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

Woefully Under-diversified

The shame is that investors who focus so little on international bonds are limiting themselves.

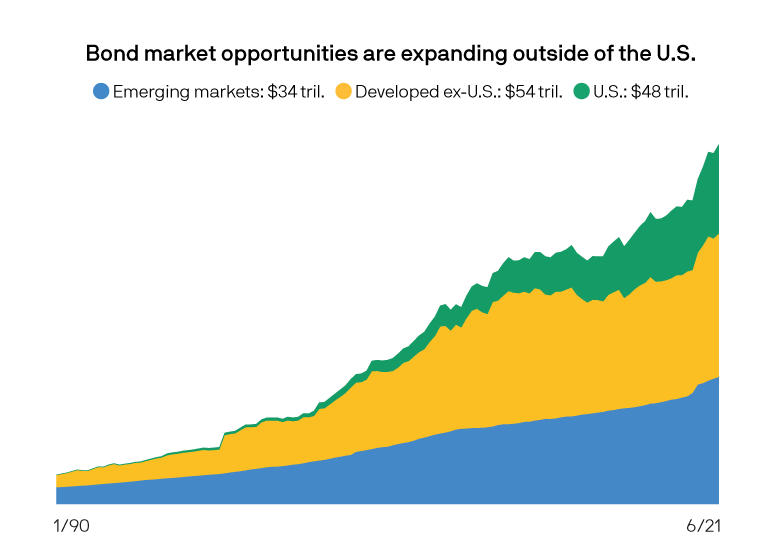

For one thing, non-U. S. bonds account for roughly 57% of the world bond market. That means there are more opportunities overseas than there are at home. This chart from J.P. Morgan underscores the sheer size of the global bond market outside the U.S.

Source: J.P. Morgan Asset Management

Moreover, those opportunities are not as risky as we may think. Part of hometown bias is believing that firms domiciled in your home country are somehow safer. Nothing could be further from the truth. An investment-grade bond from Germany is just as safe as one from Kansas.

At the same time, thanks to the global economy and rise of multinational brands, revenues are not directly tied to a single nation. You’re just as likely to have a Honda in your driveway and have Unilever-owned mayo in your fridge as you are a Ford or Kraft. In fact, the vast bulk of the world’s largest companies by revenue are located outside the U.S.

Currency & Yield Benefits

When we buy an international bond mutual fund or ETF, we are doing so with dollars. However, the fund managers must convert those dollars into Euros, Loonies or Yen to make the purchases. The exchange rate can help investors during periods of dollar weakness or strength. During periods of dollar strength, fund managers can buy ‘more’ international bonds and get them for less. The reverse is that during periods of dollar weakness, the interest payments from international bonds—in Euros, Kiwis, etc.—get translated into more greenbacks. This helps boost yields.

And while the dollar has been surging in recent quarters thanks to the Fed’s interest rate increases and perceived safety, that hasn’t always been the case. Analysts at Capital Group now predict the dollar is about 20% overvalued. A declining dollar would help swing the pendulum the other way and boost returns for international bonds.

Secondly, interest rates overseas and rates of inflation are different than they are here. For example, Europe is experiencing lower inflation than the United States in the current environment. This difference helps produce lower correlated returns versus U.S. bonds and helps lead or lag during various periods.

Ultimately, international bonds have the ability to add additional yield and protect portfolios versus inflation when U.S. bonds are, perhaps, not doing so.

Making an International Bond Play

So, how to do it? Unlike the ease of buying a Treasury from your brokerage account or directly from Uncle Sam, individual international bond investing is a bit harder. This means the bulk of us will be drawn to the numerous mutual funds and ETFs that cover the space.

A broad and easy choice could be the Vanguard Total International Bond Index Fund Admiral Shares (VTABX) or its ETF sister (BNDX). The fund covers more than 6,000 investment-grade international bonds issued by corporations and governments. Holdings include both developed market and emerging market nations. For a low cost, the fund offers instant and broad exposure. The iShares Core International Aggregate Bond ETF (IAGG) offers similar, broad exposure, with more of a focus on developed market nations.

Once investors have their core down, they can add some spice. Just like U.S. bonds, there are a variety of flavors to be had overseas. For example, the VanEck Emerging Markets High Yield Bond ETF (HYEM) can be used to add emerging market junk bonds, while the JPMorgan International Bond Opportunities ETF (JPIB) can be used to add active management to a bond portfolio.

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.