Income is easy to find these days. Thanks to last year’s rout and decline in bond prices, as well as the Fed’s path of interest rate hikes, bonds are back to producing some serious coupon payments. Yields today are as high as they were before the financial crisis. Income is finally back in fixed income. That’s making those near or in retirement certainly happy.

The question is, should they be?

Maybe not. That’s according to asset manager MFS’s recent research. When it comes to corporate and high-yield bonds, investors may not be taking all the considerations into view. Recession risks and other factors could mean those yields have plenty of room to rise. That certainly throws cold water on the sector.

There’s Plenty of ‘Yield’ to Be Had

Just a few years ago, it was hard for investors to find income. With the Federal Reserve keeping rates at roughly zero for the better part of a decade, many traditional sources of income produced next to nothing. However, as inflation surged and the Fed raised rates to combat the hot economy, income has now become easy to find these days. Yields on cash are as high as 5%, while a variety of bond sectors are paying yields not seen since the Great Recession.

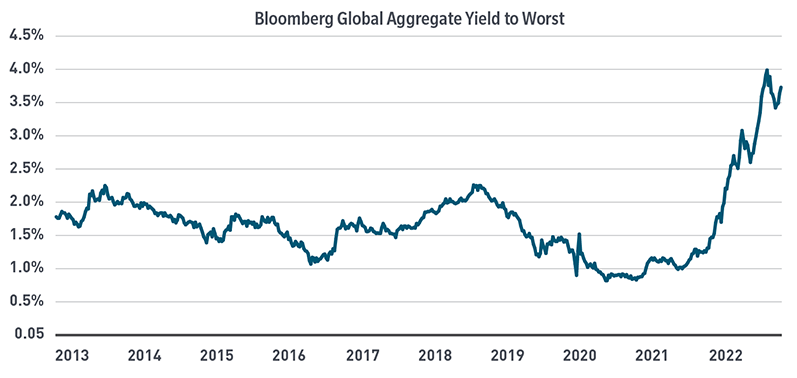

You can see from this chart just how dramatically yields have risen over the last decade.

Source: MFS.

The Bloomberg Global Aggregate—which is a measure of all bonds across the world—is currently paying around 3.75%. That’s a huge increase of 1.75% just a decade ago.

Investors have been quick to gobble up these higher rates. And corporate bonds—both investment-grade and junk—have been touted and tapped as prime ways to get just the right amount of risk and yield. Inflows show that investors have taken the advice, putting billions into short-term and intermediate corporate bond vehicles like the iShares iBoxx $ Investment Grade Corporate Bond ETF.

Higher Yields Doesn’t Mean Lower Risk

But investors may want to rethink that position. That’s the latest stance of investment manager MFS. Just because yields are higher doesn’t mean that risks have been reduced. In fact, the higher yields may be masking some issues.

For starters, recessionary risks are still growing. Data across a wide range of channels is still weakening. From industrial production and durable goods orders to home sales and consumer spending, economic data has been in a downtrend. All in all, the U.S. economy grew by just 2% annualized for the first quarter of the year. The latest estimates from the Conference Board show real GDP growth will slow to 1.3% in 2023 and then fall to 0.1% in 2024. 1 This will put pressure on corporate earnings, revenues, and cash flows, making bond payments difficult to complete.

The next piece of the puzzle predicted by MFS involves a shift in spending.

According to the asset manager, the last decade was a period of corporate savings that exceeded investments. Thanks to the generalized low growth in the period after the Great Recession, many firms stepped back from corporate spending and diverted those funds in so-called ‘financialization’ efforts. This included increasing dividend payouts above long-term historical norms, record stock repurchases, and increased mergers & acquisitions activity.

However, the lack of CAPEX spending is coming back to roost. MFS predicts that many firms will have to spend massively over the next decade to make up for shifts in customer tastes and supply chain fixes. Governments and consumers are demanding newer environmental and ethical standards from firms. Onshoring will result in billions of spending or new factories, warehouses, and other facilities. Utilities will be forced to upgrade their operations to lower carbon sources of energy. MFS predicts all this required spending will hit profit margins and investors aren’t giving this fact enough credit.

MFS predicts that this “environment of weakening demand, materially higher-operating costs, and increasing CAPEX” will ultimately put pressure on corporations’ ability to make payments on their bonds, particularly with rates higher. While the effect will hit investment-grade bonds as well, MFS’s Global Investment Strategist, Robert M. Almeida, predicts that high-yield bonds could be very much at risk. Highly leveraged borrowers will be hard pressed to find products/projects that generate 10%+ in the new environment. 2

Taking a Step Back

For investors, MFS’s thought-piece shines the light on some risks they may not have considered. Certainly, going forward the combination of trends—higher interest expenses, increasing required CAPEX—will put pressure on corporate bonds. Without the ability to raise funds (i.e., via increasing taxes), the sector’s high yields may not be all that great in context.

So, what to do?

The easy answer may be to pull back on corporate bonds and focus on those with the ability to raise funds indefinitely, aka Treasuries and munis. With the U.S. government and many states’ ability to raise taxes to pay for their bonds, investing here may not be such a bad idea. The iShares U.S. Treasury Bond ETF and Vanguard Intermediate-Term Treasury Index Fund are two low-cost options in the Treasury space, while the Schwab Municipal Bond ETF offers a dirt-cheap muni bond option.

Treasury & Municipal Bond ETFs

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| TFI | SPDR Nuveen Bloomberg Municipal Bond ETF | $3.824B | 1.6% | 0.23% | ETF | No |

| SCMB | Schwab Municipal Bond ETF | $139.7M | 1.1% | 0.03% | ETF | No |

| VGIT | Vanguard Intermediate-Term Treasury Index Fd ETF | $13.805B | 0% | 0.04% | ETF | No |

| SPTI | SPDR Portfolio Intermediate Term Treasury ETF | $4.177B | -0.1% | 0.06% | ETF | No |

| GOVT | iShares $ Treasury Bond ETF USD Dist | $27.419B | -0.2% | 0.05% | ETF | No |

The other choice is to get active with your corporate bond exposure. MFS suggests investors look at balance sheet health and leverage ratios when choosing bond investments. The firm’s MFS Corporate Bond Fund uses this framework to buy corporate bonds, as does the SPDR Blackstone High Income ETF for junk debt. Ultimately, the point is to be active in the space. Finding those low leveraged and strong firms will be the key to winning going forward.

Active Corporate & High-Yield ETFs & Mutual Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| PHYL | PGIM Active High Yield Bond ETF | $93.3M | 1.4% | 0.53% | ETF | Yes |

| HYBL | Spdr Blackstone High Income ETF | $125.7M | 1.4% | 0.70% | ETF | Yes |

| MBDIX | MFS Corporate Bond Fund Class I | $945.6M | 1.3% | 0.52% | MF | Yes |

| FCBFX | Fidelity® Corporate Bond Fund | $871.1M | 1.3% | 0.44% | MF | Yes |

The Bottom Line

These days, finding high yields is easy in the fixed income sector. However, investors may still need to be cautious, particularly when it comes to corporate bonds.

MFS’s latest report shows that current high yields doesn’t mean risk is gone from the sector. Conversely, risks may be growing. That means investors should focus on other bond sectors like Treasury and municipal bonds to get yield.

1 Conference Board (July 2023). The Conference Board Economic Forecast for the US Economy

2 MFS (February 2023). Fixed Income is Attractive, but Beware of “Fake” Yield