By nature, bonds aren’t very exciting. Steadily paying their coupons and principals back at maturity, they tend to play second fiddle to stocks when it comes to total returns. So when the market environment has plenty of potential to light a fire under bonds to deliver stellar results on both fronts, investors need to pay attention.

Today, that signal is flashing brightly.

We could be entering the next Golden Age for fixed income assets. Thanks to several tailwinds and factors, fixed income assets are poised to deliver strong total returns. High current yields coupled with capital gains could lift the sector and make it one of the best performers in the medium to long term. With that, investors may want to answer the call and buy bonds.

A Wonderful Setup

It’s no secret that income has once again returned to fixed income investments. As inflation raged and the economy grew too hot, the Federal Reserve and other central banks acted quickly. In the case of the Fed, they increased rates from zero to 5.5%, a level not seen in decades.

For fixed income assets, this increase in rates meant their prices fell, while new bonds coming to market reflected the higher yields. Today, various bond categories are paying yields not seen since the Great Recession, with T-bills paying close to 5.5% and investment-grade corporate bonds paying 6%. Even junk bonds are yielding north of 8%.

The whole point of raising rates is to cool off the economy by making saving more advantageous and borrowing more expensive. And it looks like the Fed has started to accomplish that goal. A variety of economic data has started to slip. The U.S. GDP growth rate has fallen, measures of manufacturing and services activity have dipped, and the housing market has begun to cool.

This has given rise to the idea the Fed will have to cut rates sooner rather than later to support the economy. This idea has been supported by the central bank with statements indicating this rate tightening cycle has seen its peak and it expects at least two cuts this year.

Welcome to the Golden Age

This setup has investors entering what could only be described as the Golden Age for bonds. The reason? Investors have a great opportunity to score not only strong yields but also the potential for capital gains.

As the Fed starts to cut rates, new bonds coming to market will yield less to reflect the changes in interest rate policy. However, already-issued bonds continue to yield high amounts. This makes them desirable for investors. As such, their prices would rise to match the new lower-yielding bonds now coming to market. This allows investors to see capital gains on their bonds if they purchase them before the Fed starts cutting rates.

The proof is in the pudding.

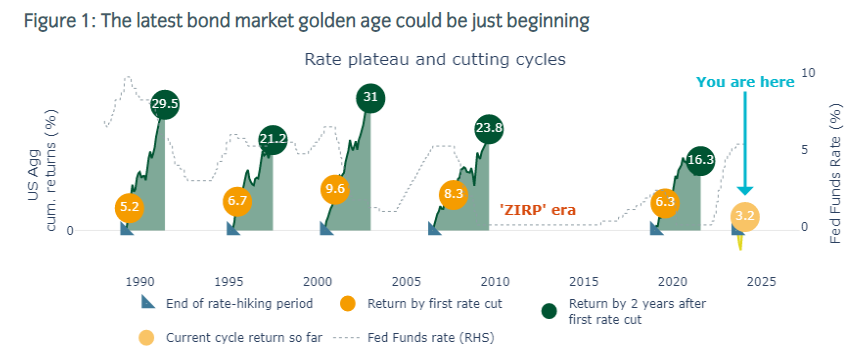

Looking at the last five rate tightening-to-cutting cycles, Insight Investment highlights the return potential. After the first rate cut through two years later, the Bloomberg U.S. Aggregate Index managed to return between 16% and 31%, while the Bloomberg U.S. Corporate Investment Grade Index managed to produce returns of 21% to 32%. 1

This chart from the asset manager highlights the return potential.

Source: Insight Invetsment

The best part is the tail end of the graph. Bonds have only managed to produce a 3.2% total return today. This implies that the Golden Age is in its infancy. The Fed has continued to keep rates high to tackle inflation, implying that yields are still juicy and investors have time to lock in those high yields.

Moreover, bonds may be a better buy than stocks these days. According to Insight Investment, since 2000, 102% of U.S. investment-grade bonds’ total returns can be attributed to yield. Because of the current higher starting yields, investors are already able to lock in better returns. This is before any capital gains. For stocks, only about 45% of the return has historically come from dividend payments. Because we are entering a period of potential economic duress—in which the Fed would have to cut rates—stock returns are less ‘“guaranteed’ due to lower contribution of income in their returns.

Playing the Golden Age

Given that bonds offer a heck of a deal in terms of current yield and have the potential to perform well—and even outperform equities—investors should consider adding a hefty dose of bonds to their portfolios.

Insight Investment recognizes the road to the Golden Age may not be a straight line. However, investors should use those bumps to lower the dollar-cost average of owning bonds by either using new money or using the proceeds from selling equity holdings. The investment manager also suggests thinking of going global as this approach has added value. Other ideas include adding duration—via long-term bonds—and stepping out of cash into short-term bonds.

Luckily, all of these fixed income themes can be quickly added via ETFs for a low cost.

Popular Bond ETFs

These ETFs were selected based on their ability to provide access to investment-grade bonds at a low cost. They are sorted by their YTD total return, which ranges from -3.4% to 1.4%. They have assets under management of $3.77B to $316B and expenses of 0.03% to 0.40%. They are currently yielding between 2.9% and 7.6%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SJNK | SPDR Bloomberg Short Term High Yield Bond ETF | $3.77B | 1.4% | 7.6% | 0.40% | ETF | No |

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $8.99B | 1.3% | 7.2% | 0.08% | ETF | No |

| VCSH | Vanguard Short-Term Corporate Bond Index Fund | $42.6B | 0.4% | 3.6% | 0.04% | ETF | No |

| BSV | Vanguard Short-Term Bond Index Fund | $58.8B | 0.1% | 2.9% | 0.04% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26.3B | 0.1% | 3.5% | 0.15% | ETF | No |

| VCIT | Vanguard Intermediate-Term Corporate Bond Index Fund | $39.6B | -0.2% | 4.1% | 0.04% | ETF | No |

| BND | Vanguard Total Bond Market Index Fund | $316B | -0.4% | 3.3% | 0.03% | ETF | No |

| AGG | iShares Core U.S. Aggregate Bond ETF | $90.4B | -0.8% | 3.5% | 0.03% | ETF | No |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | $27.9B | -1.1% | 4.3% | 0.14% | ETF | No |

| TLT | iShares 20+ Year Treasury Bond ETF | $49.8B | -3.4% | 3.7% | 0.15% | ETF | No |

In the end, bonds are currently set up to succeed. High current yields coupled with the potential for capital gains only come around once in a blue moon. Today, investors have that chance to score both. That means buying bonds is a necessity for portfolios.

The Bottom Line

Thanks to high yields and the potential for capital appreciation, fixed income assets may have entered a Golden Age. For investors, that means buying bonds with both hands today. Locking in today’s high yields while waiting for capital gains is a smart strategy.

1 Insight Investment (February 2024). The fixed income party is just getting started