Smart money is defined as the capital that is being controlled by institutional investors, gurus, and other financial professionals. Often these investors are the first to find trends and the first to profit before anyone else. Following the so-called smart money can be advantageous.

And right now, the smart money is making some big bets on fixed income.

That’s the gist of a new UBS survey of family offices. It turns out CIOs and other investment professionals for high and ultra-high-net-worth families are buying bonds in spades. They are taking advantage of high yields and locking in income. For regular joes, it could be worth following their example.

Big Inflows into Bonds

When you are wealthy, you generally have a private banker and work with an investment firm to run your finances. When you are very wealthy, you start your own firm. Family offices are the current trend these days, offering custom and tailored solutions for a specific family or individual. And a lot can be gleaned from their moves in the market.

Swiss-investment bank UBS has been tracking the moves of family offices and other institutional investors for years. Its latest survey of family offices shows a distinct pattern. It turns out they are loving bonds in a big way.

The latest UBS Global Family Office Report surveyed 230 single family offices around the world that managed an average $2.2 billion each. The report showed a big switch in current asset allocations and planned future allocation decisions. The biggest winner is bonds.

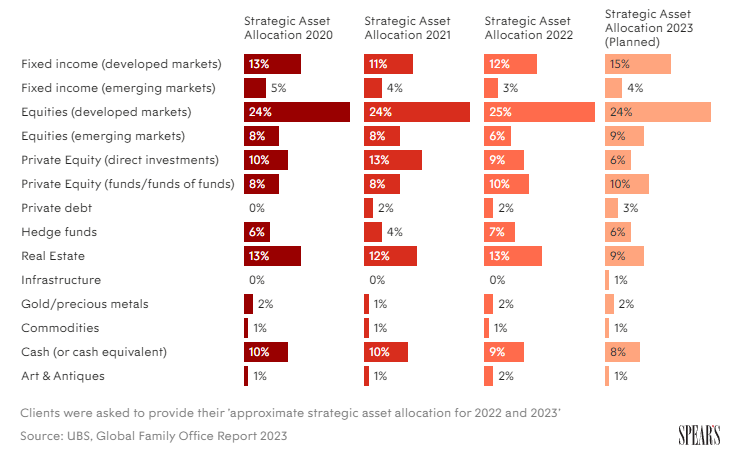

The report showed that after three years’ worth of cutting exposure to developed market fixed income assets, family offices are now loading up on bonds. Fixed income is quickly becoming a major source of diversification and returns. Allocations to developed fixed income rose to 15% of assets, while emerging market bonds now sit at 4%. More than one third—37%—of family offices have shifted a fair bit of assets into short-duration bonds. Private credit allocations have gone from effectively zero just three years ago to more than 3% this year. [1,2]

Looking ahead, 38% of family offices surveyed plan on increasing their allocations to fixed income further over the next five years.

To make room for the increases in various credit and fixed income allocations, family offices have sold real estate holdings—both public and private—and have significantly reduced exposure to hedge funds, private equity, and developed market stocks.

This chart from Spears shows the change in allocations since the UBS survey began in 2020.

Source: Spears.

The Reasons for the Shift Toward Fixed Income

For family offices and high-net-worth investors, the shift toward fixed income underscores the overall feeling of uncertainty and wonderful income opportunities that bonds currently provide.

After years of zero and even negative interest rate policies, the current path of tightening by the world’s central banks has made bonds a top choice to find actual yields. These days, Bloomberg U.S. Aggregate Bond Index is now paying 4.22%, while Bloomberg Global ex-U.S. Aggregate is paying 3.45%.

UBS Global Family and Institutional Wealth head, George Athanasopoulos, mentions that “this year’s report comes at a defining moment in time. It’s the end of an era for low or negative nominal interest rates and the ample liquidity that followed the global financial crisis. Against that backdrop, our research shows that family offices are making major changes to ensure they’re positioned for growth and success.”

Additionally, family offices are switching their allocations to fixed income due to geopolitical tensions and uncertainty. They are less concerned with inflation and recession potential than they are with continued conflicts.

Taking a Page From the Smart Money’s Playbook

For regular retail investors, the advice in the UBS survey and family offices’ allocation decisions could serve as a basis for their portfolios. The reasons for high-net-worth investors and families for loading up on bonds are certainly valid for us as well.

Yields are at highs not seen in about a decade, while the potential for conflict and recession is growing. This makes the case for the safety of bonds that much stronger. UBS’ survey doesn’t indicate what vehicle family offices and high-net-worth investors are using to get increased bond exposure. Nor does it break out what kind of bonds aside from three broad types: short term, emerging market, and private credit exposure. However, it does mention that active management is being preferred.

For regular joes, the trio of the BlackRock Short Maturity Bond ETF, Vanguard Emerging Markets Government Bond Index Fund, and SPDR Blackstone Senior Loan ETF could be all you need. These three ETFs provide exposure—including active management in the case of short-term and senior loans—to the major allocation shifts from the survey.

However, a variety of bond types are currently offering compelling yields and discounts, from Munis to junk debt. The overall play is that bonds could be the top choice for portfolios these days, offering “potential wealth protection, yield, and capital appreciation” according to Athanasopoulos.

Emerging Market & Short-term Debt Funds

| Ticker | Name | AUM | YTD Price Ret (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|

| EMDZX | PGIM Emerging Markets Debt Local Currency Fund-Class Z | $48.4M | 4.8% | 0.73% | MF | Yes |

| JPST | JPMorgan Ultra-Short Income ETF | $23.911B | -0.3% | 0.17% | ETF | Yes |

| SRLN | SPDR Blackstone Senior Loan ETF | $4.555B | 1.1% | 0.7% | ETF | Yes |

| BKLN | Invesco Senior Loan ETF | $3.848B | 1.8% | 0.65% | ETF | No |

| NEAR | BlackRock Short Maturity Bond ETF | $3.705B | 0.7% | 0.25% | ETF | Yes |

| VWOB | Vanguard Emerging Markets Govt Bd Idx ETF | $3.45B | -0.7% | 0.2% | ETF | No |

| PCY | Invesco Emerging Markets Sovereign Debt ETF | $1.605B | 1% | 0.5% | ETF | No |

The Bottom Line

Following the smart money can pay off for regular investors. In the case of family offices and the ultra-rich, that means buying a hefty dose of bonds. According to UBS’ latest survey, allocations of fixed income and private credit are rising, taking advantage of the opportunities. Accordingly, regular investors may want to follow their advice.

1 UBS (May 2023). UBS Global Family Office Report 2023: Family offices planning the biggest shift in strategic asset allocation for several years

2 Spears (June 2023). Family offices shift to fixed income and alternatives amid high inflation and interest rates