I-Bonds vs. Inflation-Protected Bonds

While there are no funds composed of I-Bonds, there are a number of funds that focus on inflation-protected bonds.

- Vanguard Inflation-Protected Securities (VIPSX): A plain-vanilla TIPS exposure fund with very low fees.

- PIMCO Real Return Fund (PRTNX): A PIMCO-managed fund that is exposed to U.S. TIPS and invests 20% outside of the U.S. in international TIPS.

- Harbor Real Return (HARRX): A PIMCO-managed fund that employs a broader toolkit for investors. HARRX encompasses non-U.S. inflation-protected bonds and the use of forward contracts to obtain TIPS exposure.

- Principal Inflation Protection Fund (PITAX): The fund provides exposure to TIPS of varying maturities issued by the U.S. and foreign nations. Also, this fund invests in corporate TIPS issued by U.S. and non-U.S. companies.

When to Buy TIPS

According to the BLS report, the August 2015 weights of the major goods are:

- Food: 14%

- Energy: 8%

- Commodities less food and energy: 19%

- Apparel: 3%

- New Vehicles: 3%

- Shelter: 32%

- Medical Care: 6%

- Transportation: 6%

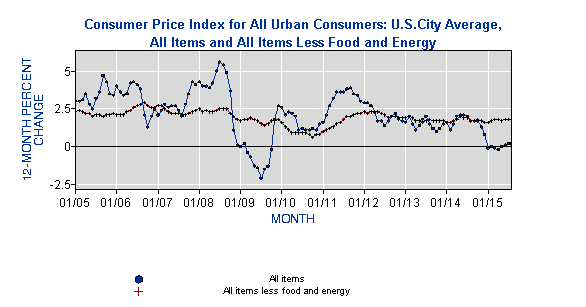

As you can see, goods related to commodities (e.g. energy, agricultural, softs) and real estate are the major influences on the CPI. Recently, commodities have hit 40-year lows which have driven the value of the CPI down.

The Bottom Line

Investors should rotate into TIPS and other inflation-hedged assets when quantitative easing occurs and when inflation shows potential to get out of hand. Investors should also be aware that quantitative easing inflates the stock market, but that the stock market is subject to inflationary value pressures, which reduce real returns.