When investors think of bonds, their minds immediately go toward U.S. Treasuries or other IOUs issued by corporations. Maybe municipal securities enter their minds. But these are just the tip of the iceberg with regard to fixed income. There are a lot of other bonds and fixed income assets on the market. Some can provide plenty of extra yield and capital gains potential.

One of the fastest growing and highest yielding could be in opportunistic credit.

Leveraged loans, collateralized loan obligations (CLOs), asset-backed securities (ABS), and private credit securities have quickly become top spots for investors to find additional yield in their portfolios. And while riskier than bread & butter bonds, they can offer plenty of extra benefits for portfolios. For investors building their fixed income toolboxes, opportunistic credit could be a wonderful addition.

When Opportunity Knocks

Bonds are essentially loans. When you buy a U.S. Treasury bond, you’re lending Uncle Sam money. In exchange for that, he’ll pay you some interest and your principal back at a later date. The same can be said for when you buy a bond from Coca-Cola or the State of Ohio. But as the world has grown more complex, so has the world’s lending and borrowing needs. In that, a variety of bonds and fixed income assets have begun to take form.

It’s here that opportunistic credit has begun to take hold.

Opportunistic credit basically looks at all these other asset classes and seeks to capitalize on the dislocation between them and traditional bread & butter bonds. This includes private credit assets made by non-bank lenders, such as small business loans, venture debt, consumer loans, accounts receivable loans, law financing, fleet financing, etc. It can also include pools of bank-issued loans such as senior or leverage loans, which are often tied to a specific asset like a pipeline or manufacturing equipment.

The complexity, and sometimes the lack of liquidity, of these bonds often causes most investors to ignore them in favor of more traditional bonds.

Benefits of Going Non-traditional

However, there are benefits in ignoring the herd and focusing on some of these non-traditional bond types. For one thing, there is income potential.

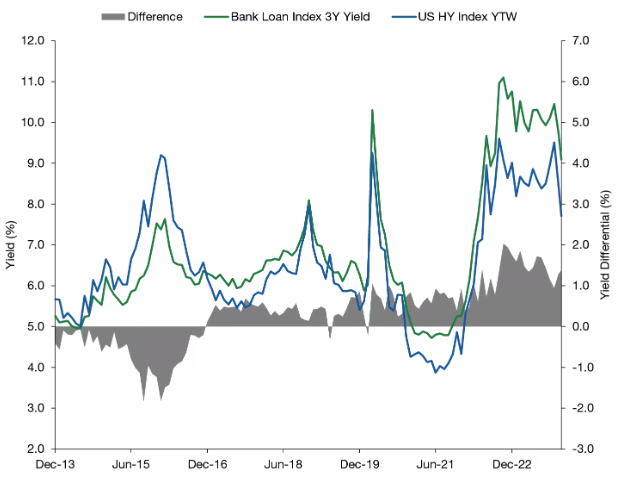

Because of the lack of liquidity and potential risk with regard to many of these bonds, opportunistic credit could offer higher yields than similar risk profiles. For example, this chart from Lord Abbett shows the yield difference between bank loans and more traditional high yield bonds. Investors can pick up an extra percentage point or two by selecting bank loans over junk bonds. 1

Source: Lord Abbett

But this is just one example. CLOs yield more than traditional corporate bonds, while ABS can pay more than traditional mortgage bonds.

The structure of those yields can be different too. While the vast bulk of traditional bonds such as Treasuries and corporate bonds feature fixed yields, many opportunistic credit types feature floating yields that are tied to interest rate policies. This can prove advantageous during a rising rate environment or a ‘higher for longer’ scenario such as the one we have now.

In addition, investors looking at the opportunistic credit space can profit from capital gains as well. Limited liquidity, as well as overall perceived riskiness, has many assets within the opportunistic credit definition trade at discounts to their par values. That can drive gains when loans are paid back or refinanced.

Plenty of Access

For investors, access to these loans and other fixed income types has only grown exponentially. Since the Great Recession and Credit Crisis, banks have stepped off the gas. But private lenders have added nitrous to the tank. Over the last decade, assets in private credit and other non-traditional bonds have compounded at a growth rate of 10%. To date, more than $1.4 trillion sits in these types of non-traditional bonds.

And the market continues to get bigger.

For example, Blackstone recently announced plans for a new $10 billion private credit fund, while pension and endowment fund operators have pledged more than $100 billion into such bonds.

This is all well and good for private equity groups and big institutional investors. But what about the retail investor set? Are there opportunities in opportunistic credit? The answer is a resounding yes.

Thanks to the growth of ETFs and other funds, investors have access to some of these non-traditional bonds in the opportunistic credit markets. This includes bond index and active ETFs that cover these bonds.

Investors can choose a fund to directly bet on and own leverage loans, CLOs or ABS bonds. Here, they can customize their allocations and bond-types. At the same time, many new opportunistic bond ETFs that are run by active management have begun to sprout up. Here, a fund can own a swath of different bond types and enhance yields with capital gains.

Either way, adding a dose of these non-traditional bonds can provide extra income and opportunities for a portfolio.

Opportunistic Credit ETFs

These funds were selected based on their ability to tap into non-traditional bonds and the opportunistic credit asset classes. They are sorted by their YTD total return, which ranges from 0.10% to 2.20%. They have expense ratios between 0.19% to 2.65% and have assets under management between $9.5M to $6.8B. They are currently yielding between 3.8% and 9.2%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| LONZ | PIMCO Senior Loan Active Exchange-Traded Fund | $303.44M | 2.20% | 8.3% | 0.72% | ETF | Yes |

| VABS | Virtus Newfleet ABS/MBS ETF | $9.53M | 1.60% | 3.8% | 0.49% | ETF | Yes |

| PAAA | PGIM AAA CLO ETF | $157.94M | 1.50% | 6.3% | 0.19% | ETF | Yes |

| CLOA | BlackRock AAA CLO ETF | $103.34M | 1.50% | 6.29% | 0.20% | ETF | Yes |

| JAAA | Janus Henderson AAA CLO ETF | $6.78B | 1.40% | 6.2% | 0.22% | ETF | Yes |

| SRLN | SPDR Blackstone Senior Loan ETF | $5.38B | 1.40% | 9.2% | 0.70% | ETF | Yes |

| BKLN | Invesco Senior Loan ETF | $6.8B | 1.10% | 7.8% | 0.67% | ETF | No |

| CRDT | Simplify Opportunistic Income ETF | $76.51M | 0.50% | 7.1% | 0.95% | ETF | Yes |

| DBL | DoubleLine Opportunistic Credit Fund | $261M | 0.30% | 9.2% | 2.65% | CEF | Yes |

| OBND | SPDR Loomis Sayles Opportunistic Bond ETF | $37.46M | 0.10% | 6.8% | 0.55% | ETF | Yes |

The Bottom Line

There are plenty of bonds beyond the world of Treasuries and corporate bonds. Opportunistic credit seeks to tap into these issues. Extra yield and potential for capital gains await investors in the sector.

1 Lord Abbett (January 2024). Leveraged Loans: Looking Ahead