Over the past 40 years, bond prices have risen sharply higher and yields have fallen to previously unthinkable lows, including negative yields in some cases. The vast amount of spending in response to the COVID-19 pandemic has consumers and investors concerned about inflation for the first time in more than a decade.

Let’s take a look at Warren Buffett’s opinion on bonds and other fixed income investments as discussed in Berkshire Hathaway’s highly anticipated annual letter to shareholders.

Don’t forget to explore our Fixed Income Channel to learn more about fixed income investment concepts and trends.

Bonds Face a “Bleak Future”

The Oracle of Omaha has always been a fan of equities and did not mince words about fixed income in Berkshire Hathaway’s annual letter.

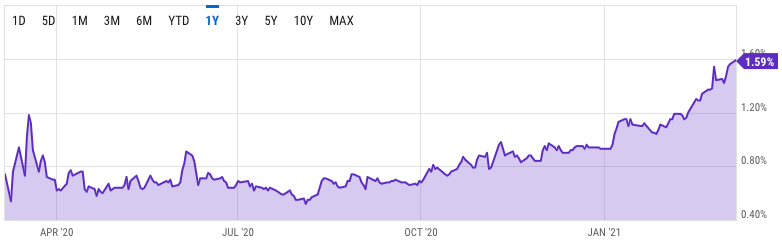

In the letter, Buffett notes that the 10-year Treasury bond has fallen 94% to yield just 0.93% at year end, which is a sharp decline from the 15.8% in September 1981. He also notes that investors in German, Japanese, and other bonds earn a negative return on trillions of dollars worth of sovereign debt, pointing to a “bleak future” for bond fixed income investors.

When looking at pockets of higher income opportunities, Buffett warns that shifting purchases to obligations backed by shaky borrows is reminiscent of the savings and loan crisis three decades ago and isn’t the answer to inadequate interest rates.

The Central Bank’s Response

The Central Bank is likely to hold off on any action until there is an established economic recovery. Right now, Treasury bonds are trading at their lowest yields since 2013 and well below 0.3% yields at the beginning of 2010. The correction in bond and equity markets in the meantime will likely be just that—a correction.

“Right now, with interest rates at historic lows, the smartest thing we can do is act big,” Yellen said in January. “In the long run, I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.”

Check out this article to see if you even need bonds these days.

Alternatives to Fixed Income

Aside from Buffett’s preference for equities, investors may also want to consider blue-chip, high dividend paying stocks as an alternative way to generate income from a portfolio. These companies typically include utilities, pipeline operators, financial institutions, REITs or others that have a strong balance sheet and robust free cash flow generation.

International bonds may be another area to consider. In particular, investors may want to look at countries that don’t have the same inflationary concerns as the United States and Europe, where low interest rates persist. A diversified basket of emerging market bonds, for example, may be a way to increase yield and diversify risk.

The Bottom Line

Be sure to check out MutualFund.com’s News section here.