Bonds have suddenly become a hot topic after decades of near-zero interest rates. Currently, many money market accounts pay more than 5%, making them competitive with historical stock market returns. But, as inflation continues to trend lower, these high interest rates may not last very long into the new year. And you may need to readjust your portfolio.

In this article, we’ll look at where bond yields are likely headed in 2024, what risks to watch out for, and some tips for adjusting your portfolio.

Lower Yield Expectations

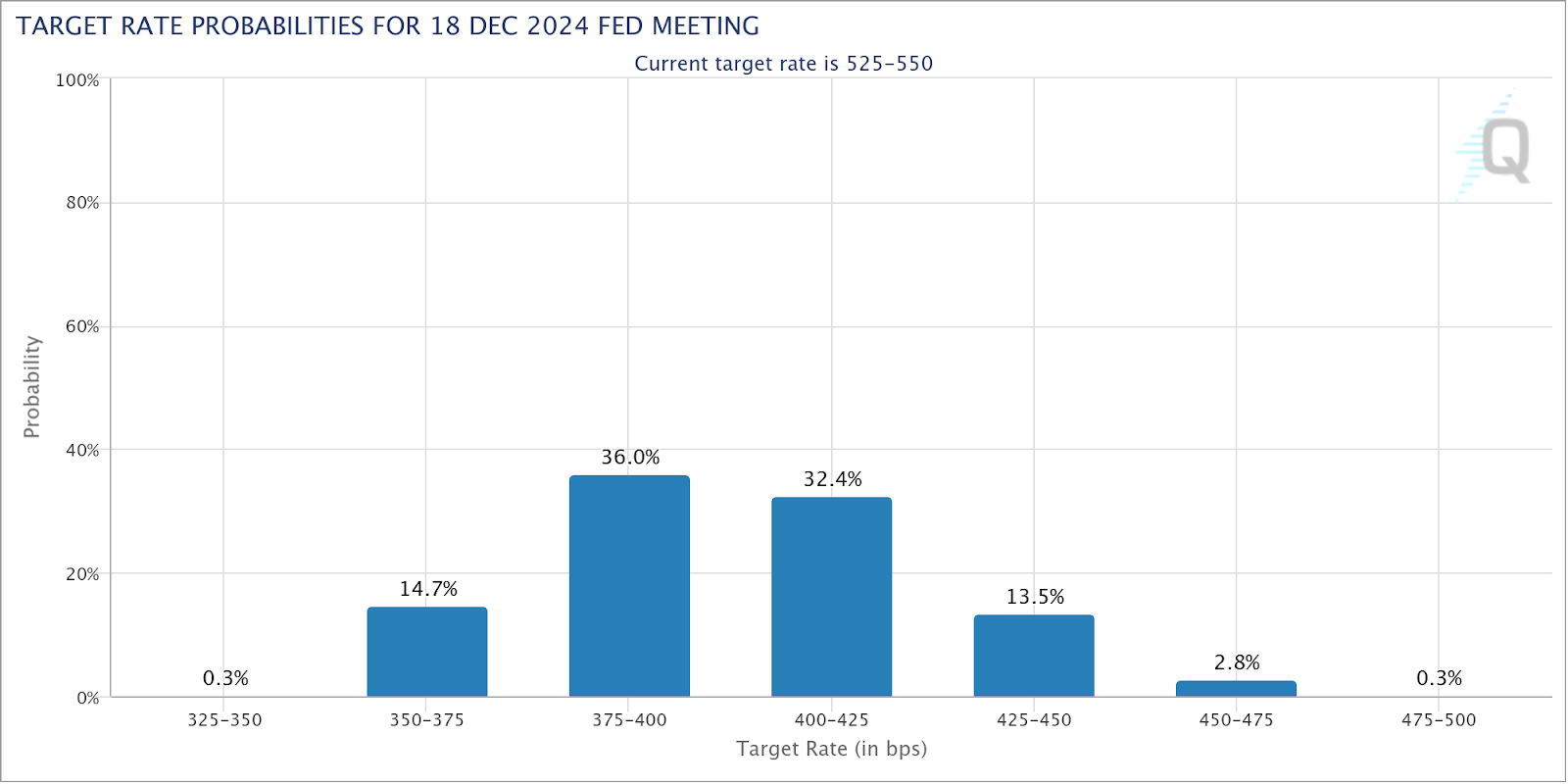

The CME FedWatch – a tool measuring interest rate expectations based on futures contracts – suggests that interest rates will fall from 525 to 500 basis points today to somewhere between 375 and 425 basis points by the end of the year (68.4%). And a minority are betting on even lower interest rates of between 350 and 375 basis points (14.7%).

Source: CME FedWatch

There are several factors supporting these bets on lower rates ahead.

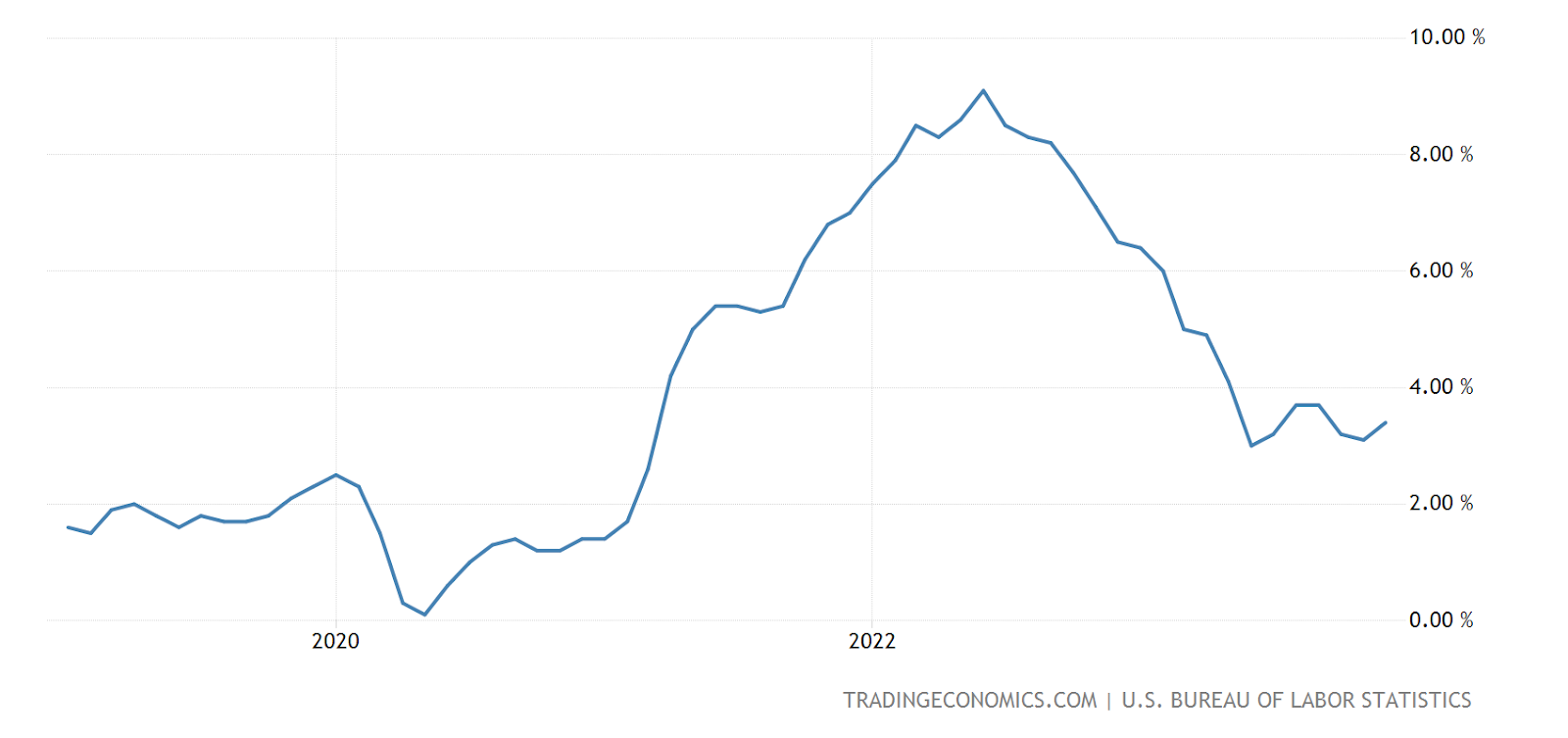

First, inflation has fallen from its peak of 9.1% in June 2022 to 3.4% in December 2023. While these numbers remain above the Fed’s 2% target rate, the central bank’s goal is to pursue a “soft landing,” so it may stop hiking rates as it nears the target rate. In other words, it’s clear that the Fed’s interest rate hikes have been effective at taming inflation thus far.

Second, banks have begun tightening lending standards, which will put the brakes on the economy. In particular, the combination of higher interest rates and reduced lending activity could have a noticeable impact over the coming months. And that’s why the Fed is likely to start proactively lowering rates this year to prevent these dynamics from causing a recession.

The Fed’s Balancing Act

The Fed’s challenge will be balancing the need to tame inflation with avoiding a recession. Thus far, rising interest rates have successfully tamed inflation without negatively impacting the economy. However, raising rates or tightening lending too quickly could push the economy into a recession, forcing the Fed to cut rates more aggressively in order to soften the blow.

Annual Inflation Rate in U.S. (Source:TradingEconomics)

On the other hand, if inflation reignites due to other economic factors, the Fed could hike rates by another 25 basis points before starting its move to lower rates long-term. This could become an issue if inflation continues to stabilize above the Fed’s 2% target rate, as it has recently with rising food and shelter costs offsetting significant decreases in energy costs.

Ultimately, the central bank’s decisions to cut or raise interest rates will be data-driven, focusing on a broad range of economic indicators. Most experts agree that the Fed won’t rush into policy changes in either direction and instead opt to maintain higher interest rates for an extended period to be sure inflationary pressures are gone before stimulating growth.

Impact on Investor Portfolios

Interest rates have a knock-on effect on a broad range of investments. While bonds are directly impacted by any sudden changes, the downstream impact on the economy can result in changes to stocks and other securities. As a result, it’s a good idea to reassess your current portfolio allocations and risk tolerance levels moving into the new year.

If the Fed maintains the expected course, investors can expect the economy to slow down without a recession. Meanwhile, the yield curve will likely remain inverted with 10-year Treasuries falling below 4% and the federal funds rate remaining elevated. Ultimately, this is a best-case scenario with stocks seeing a soft landing and bonds experiencing a price increase.

If inflation rears its head, the Fed could increase interest rates by another 25 basis points, sending bonds (higher yields) and stocks (slower growth) lower. The yield curve would likely remain inverted due to tighter monetary policy, but yields could stay elevated for all maturities. And finally, a recession could lead to a steeper yield curve and a bigger drop in stock prices.

The Bottom Line

The bond market remains in a state of flux, but all signs point to a soft landing. As the Fed looks to cut rates, bond prices could rise as yields move lower. However, if inflation reignites or a recession takes hold, investors should brace for very different outcomes.