The next consumer price index (CPI) reading on July 13 will provide an early indication of the effectiveness of these measures, but higher bond yields are almost certainly having an effect. In fact, some experts believe that bond prices may be exceptionally attractive at current levels, generating attractive yields with limited downside.

Let’s take a look at what bonds investors may want to consider and what products they should continue to avoid.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

What to Buy

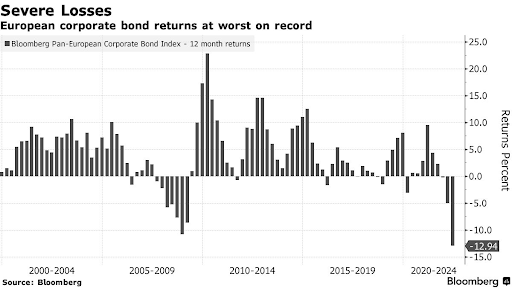

European bonds fall more sharply than during the 2008 financial crisis. Source: Bloomberg

Meanwhile, the European Central Bank is walking a fine line between raising interest rates to combat inflation, avoiding a potential recession, and managing costs for indebted economies. If the economy slows too quickly, the central bank could pause its interest rate hikes or even reverse them, providing a boost to bond markets.

Individual investors seeking exposure to the European bond market may want to consider the EuroPac International Bond Fund (EPIBX), which offers targeted exposure with a 1.15% expense ratio.

What to Avoid

Italy-Germany bond spreads widened to 2.18%. Source: YCharts

Periphery European bonds could also prove risky. For instance, the gap between 10-year Italian bonds and their German peers widened to 2.18%—their highest level since May 2020. These higher borrowing costs could become unsustainable for debt-laden economies, resulting in higher credit risks for bondholders and headaches for the ECB.

Other Takes

Another area to consider is contingent convertibles and corporate hybrids. In particular, convertible bonds issued by tech companies have fallen sharply lower, creating opportunities. For instance, Beyond Meat had a $1.15 billion, zero-coupon convertible bond issue due in 2027, offering a 19.5% yield and trading for 41 cents on the dollar.

Individual investors seeking exposure to convertible bonds may want to consider the Columbia Convertible Securities Fund (PACIX), which offers a 0.78% yield with a 1.12% expense ratio.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about income investing.