Let’s look at how corporate bonds performed in 2022 and whether they will likely make a comeback in 2023.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

A Terrible 2022 Performance

While corporate bankruptcies remain historically low thus far, companies could struggle to pay or refinance their debts next year. For example, Carvana’s revenues fell sharply in 2022 while spending on interest payments soared. With its stock down 90%, it’s easy to see why its bonds are trading at less than 50 cents on the dollar.

A More Bullish Outlook for 2023?

At the same time, Moody’s expects the lackluster economy to send default rates among non-IG corporate bonds from 2.3% in September 2022 to 7.9% by September 2023. Some recent casualties falling into these categories are companies like Revlon, which filed for bankruptcy in June 2022 after failing to pay interest on its $3.8 billion debt load.

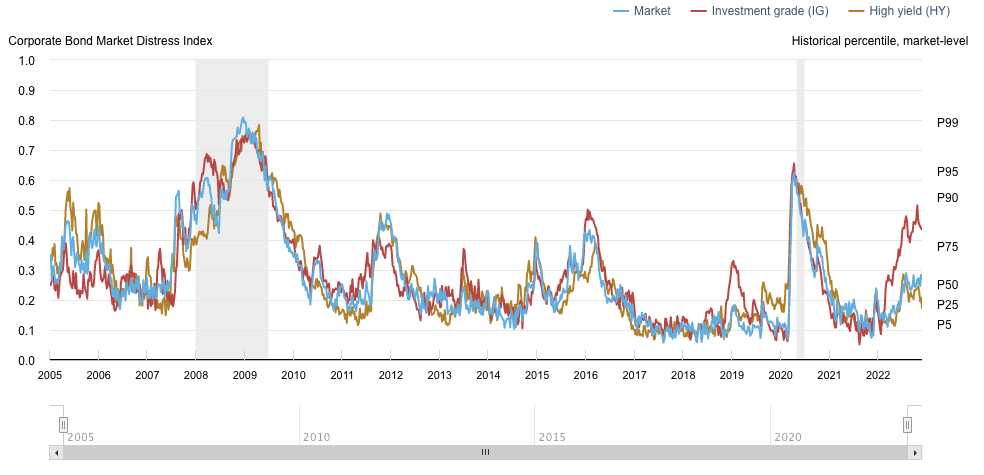

On the other hand, IG corporate bonds are relatively strong. The New York Federal Reserve’s Corporate Bond Market Distress Index is below its historical 65th percentile, while IG corporate bonds remain closer to the 25th percentile. After all, many of these higher-rated issuers have ample cash on hand with no need for near-term refinancing.

Finding Opportunities in the Market

The high and flat yield curve also means investors can find attractive yields in short-term bonds. But, with the Fed’s narrative changing, longer-duration bonds could see the most significant price increase if the central bank pauses or reverses its interest rate hikes. So, investors should consider their income versus capital gains priorities.

Some IG corporate bond ETFs to consider include:

| Name | Ticker | Expense Ratio |

| Vanguard Short-Term Corporate Bond ETF | VCSH | 0.04% |

| Vanguard Intermediate-Term Corporate Bond ETF | VCIT | 0.04% |

| iShares iBox Investment Grade Corporate Bond ETF | LQD | 0.14% |

| iShares 1-5 Year Investment Grade Corporate Bond ETF | IGSB | 0.06% |

| iShares 5-10 Year Investment Grade Corporate Bond ETF | IGIB | 0.06% |

| iShares Broad Investment Grade Corporate Bond ETF | USIG | 0.04% |

The Bottom Line

Take a look at our recently launched Model Portfolios to see how you can rebalance your portfolio.