Amid all this, the economic conditions and various government interventions have been conducive to strong consumer health; the recent unemployment numbers show a decline in U.S. unemployment rate to 5.2% (August 2021), and federal stimulus funds with the ability to work from home have led to a significant increase in disposable income. This has translated into rapid growth of the housing market, generally away from the larger cities, and a spike in used car prices/sales.

In this article, we will take a look at a few of the indices to analyze consumer health trends and what it entails for the future.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Understanding Key Economic Indices and Trends

- Unemployment trends

- Consumer sentiment

- Inflation outlook

- Overall national GDP

At the beginning of the pandemic, economic uncertainty and the sudden halt of economic output led to a spike in areas like national unemployment and a drastic fall in national GDP numbers.

However, these indices normalized after the reopening of the economy; in some cases we are seeing robust growth, including the housing market boom and an increase in discretionary income for individuals due to either a decrease in certain expenditures, working from home, or funds from government interventions.

Unemployment Trends

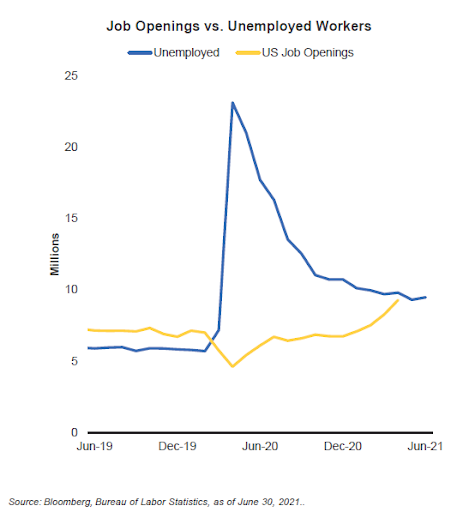

As shown in the graph above, as the unemployment numbers have been coming down, we are seeing a direct increase in job openings; however, the labor participation rate has been relatively stagnant—in August, 2021 the labor participation rate was 61.4%.

Consumer Spending Trends

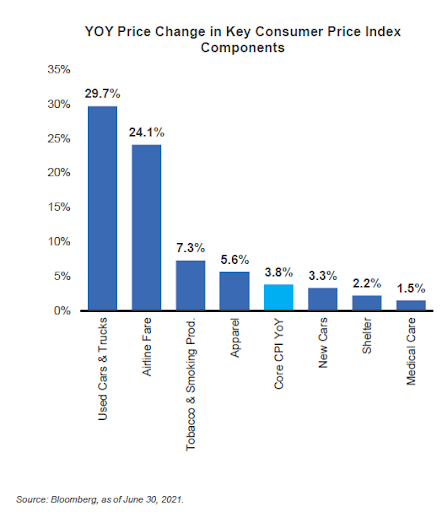

There are some sectors of consumer spending that will benefit more with the rising vaccination rates and consumers becoming more comfortable meeting and visiting their loved ones, including bars, restaurants, and local travel destinations. However, public transportation may take a long time to recover, and it may not fully recover to its pre-pandemic levels due to remote work becoming the new reality and more companies adopting hybrid work schedules. In 2020, people generally avoided public transportation and shifted to either purchasing new/used vehicles (explaining the surge in both new and used car sales) to get around and/or getting out of large cities and making small, yet accessible, towns their long-term residence,which reflects the jump in the housing market.

Another sector that’s poised for significant growth is travel, but it may take some time. As consumer confidence is building and vaccinations have proven to be effective, more and more people will take a chance to travel domestically and internationally. However, this sector will continue to face headwinds with new virus variants, the unvaccinated masses, and various regional and international requirements for travel. Although the graph above shows that people are becoming more comfortable with travel, travel destinations have not all been open or prepared to handle travelers due to their own struggles with controlling the virus.

Explore all municipal bonds and ETFs here.

The Bottom Line

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.