Let’s take a closer look at ESG-focused muni bonds and how you can add them to your portfolio.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

What Are ESG Muni Bonds?

They may carry a green bond, climate bond, social bond, sustainability bond, or other labels depending on their use of proceeds. And to complicate matters further, many muni bonds finance environmental or social causes without an official ESG label, given the costs associated with having an independent third party verify and certify the bonds.

Many municipal bonds finance things that fall under ESG-like categories. Source: Refinitiv via MSRB

The three most popular ESG-like categorizations include:

- Green Bond Principles (GBP) – The proceeds from green bonds typically finance clean transportation, climate change adaptation, circular economy products, energy efficiency, green buildings, renewable energy, pollution control, wastewater management, or other categories that promote environmental causes.

- Social Bond Principles (SBP) – The proceeds from social bonds typically finance affordable housing, affordable basic infrastructure, access to essential services, employment generation, sustainable food systems, or socioeconomic advancement and empowerment causes.

- Sustainable Bond Guidelines (SBG) – The sustainable bond label typically applies to bonds that finance or refinance projects that support green and social causes.

Muni issuers may self-designate bonds under these labels (or others), but many investors look toward third-party validation to ensure the bonds align with their ESG goals. For instance, the Climate Bond Initiative is a non-profit that oversees the Climate Bond Standard, a verification and certification process for ESG-like bond initiatives.

Where to Find ESG Muni Bonds

Another popular ESG muni ETF is the VanEck HIP Sustainable Muni ETF (SMI), which invests in bonds that support sustainable development. Like the MBNE ETF, the fund managers look at HIP (Human Impact + Profit) ratings to select bonds that align with the UN SDGs and promote positive social and environmental outcomes.

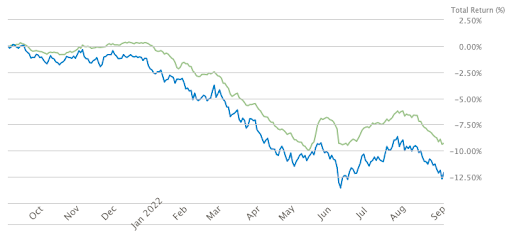

SMI (green) vs. AGG (blue) performance comparison. Source: ETF.com

In addition to ETFs, many mutual funds provide exposure to ESG-focused muni bonds. For instance, the Hartford Sustainable Municipal Bond Fund (HMKAX) invests in muni bonds within a sustainability framework. The fund focuses on healthcare, housing, transportation, and education by holding revenue bonds in these areas.

Of course, investors in any muni bond fund should be aware of the expense ratio, default risk, interest rate risk, and other fund characteristics. These factors are critical to determining if a fund is a good fit for a person’s financial goals and risk tolerance. For example, these funds often hold fewer general obligation (GO) bonds than more generic muni funds.

Don’t forget to check our Muni Bond Screener.

The Bottom Line

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.