Historically, investors have purchased bonds for their steady coupon payments. This relationship was thrown on its head as the Fed cut rates in the wake of the Great Crisis. Price appreciation as rates fell became the name of the game. That is, until last year when the broader bond market fell.

However, according to investment manager Thornburg, that may not be such a bad thing for the municipal bond market.

Thanks to a variety of factors, price appreciation in the muni bond market may be hard to come by. But with such ample tax-equivalent yields, that might not be an issue for investors. Income will drive the bus and that will still lead to great returns.

Breaking the Trend

With interest rates hitting highs not seen in about a decade, it’s easy to forget that just a year or two ago, investors were scrambling for yield. Overall, rates have been falling since the 1980s. Then an unprecedented zero rate interest policy started at the end of the Great Recession. The severity of the recession required the Fed to drop interest rates to zero to jumpstart the economy. And with slow growth and low inflation, the central bank kept them there for roughly a decade.

Bonds have an inverse relationship with rates. So, when rates drop, investors flock to older, higher yielding bonds for income. This creates price appreciation.

For the municipal bond market, that price appreciation was pretty good. The Bloomberg Municipal Bond Index managed to have a streak of eight consecutive years of positive total returns – aka yield plus price appreciation. Even when the Fed raised rates by 0.25% in 2015, munis still managed to produce a slight gain. You have to go back to the so-called ‘Taper Tantrum’ of 2013 for the sector to show a loss.

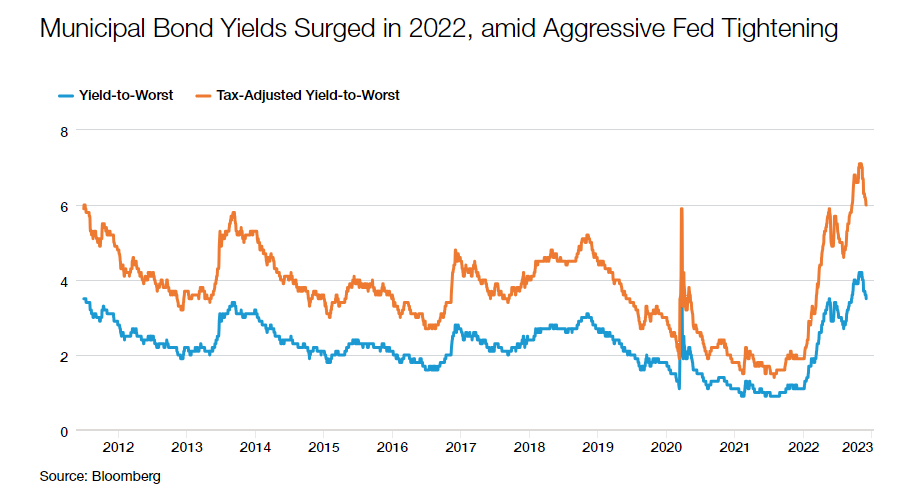

However, the good times ended last year. As the Fed raised rates to combat surging inflation, bonds of all sorts had their worst years in a long time. That included munis. In 2022, the Bloomberg Municipal Bond Index posted its worst total return in more than 30 years: a negative 8.8%.

A Strong 2023 & Beyond

But that poor performance in 2022 may lead to a strong positive one for muni bonds going forward. According to analysis from investment manager Thornburg, muni bonds’ juicy after-tax yields will help these bonds perform well this year and beyond.

According to the investment manager, many investors who bought bonds over the last few years did so in a weird period as falling rates drove up prices. That’s not normal for the sleepy muni market. Looking at data for the last 30 years, just over 90% of the total return of the Bloomberg Municipal Bond Index comes from income and less than 10% has been driven by price gains. 1

And right now, yields are at some of their largest points in 12 years. Just take a look at this chart from Thornburg. Right now, investors in the highest tax brackets can score tax-equivalent yields of 6%, while those in the median 24% can still earn roughly 4% on their money. This doesn’t even include the effect of state and local taxes on that yield.

Source: Thornburg Investments

According to Thornburg, that sets up a very good position for munis to deliver positive and strong returns going forward. That high starting yield provides enough of a ‘cushion’ that munis shouldn’t sell off in price by too much if there is a downturn. Better still is that high yield is tax-free for most investors. Price appreciation is not.

Moreover, Thornburg suggests the nature of muni buyers will help as well. Historically, munis have been a place for wealthy individuals to buy and hold. These days, municipal bonds are now finding their ways into a variety of professionally managed and institutional investor portfolios. For example, insurance and pension funds are now some of the biggest buyers of muni bonds. This has created another buyer price floor for the asset class. Last year’s buyers were mostly the so-called yield tourists. Now a steadier buyer base is here, ready to sop up supplies amid those high yields.

At the same time, municipal credit quality should not be ignored. State’s rainy day funds are at their fattest amounts on record, while the vast bulk of the sector trades at high credit ratings. This puts it on par with U.S. government debt. When factoring in the tax advantages of the sector, it becomes even more advantageous.

So, while munis may not see huge price gains over the few years, returns will be strong, driven by their hefty coupon payments.

Buying Some Muni Income

With munis offering strong yields and the potential for that yield to drive returns, investors may want to follow Thornburg’s advice and start aggressively adding munis to their portfolios. Buying them individually is still a hard field to play on, with many munis trading on the OTC exchanges and new issues being oversubscribed. But given the size of the muni market, there are numerous ways to get your hands on the bonds.

Munis are one of the few asset classes that benefit from active management, with the bulk of managers beating their benchmarks over the long haul. Top funds like the PIMCO Intermediate Municipal Bond Active ETF or Thornburg’s own Intermediate Municipal Fund make fine portfolio additions to play the income potential in municipal bonds.

However, the question is whether or not active management will make a difference in the current environment. After all, yield and the income that these bonds throw off will drive returns going forward. To that end, investors may only need to index to get juicy returns.

At $32 billion in assets, the iShares National Muni Bond ETF is the largest ETF in the sector and offers a low-cost way to add muni bonds to a portfolio. Not to be outdone, the Vanguard Tax-Exempt Bond Index Fund and SPDR Nuveen Bloomberg Municipal Bond ETF can also be used for cheap beta exposure to the asset class. With the ETFs, manager skill is put on hold and they can coupon clip to get the returns. For example, the iShares’ fund is yielding a tax-equivalent 6.4% for an investor in the top tax bracket.

Municipal Bond Mutual Funds & ETFs

These funds were selected based on their YTD total return, which range from -3.2% to 2.4%. They have expenses between 0.05% to 0.91% and have assets under management between $40 million to $33 billion. Their yields are between 1.4% to 3.6%, which works out to be a tax-equivalent range of 1.82% to 4.37% for someone in the 24% median tax bracket.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| MEAR | BlackRock Short Maturity Municipal Bond ETF | $509M | 2.4% | 3.6% | 0.25% | ETF | Yes |

| PVI | Invesco VRDO Tax-Free ETF | $41M | 2.1% | 3.6% | 0.25% | ETF | No |

| FGNSX | Strategic Advisers Tax-Sensitive Short Duration Fund | $4.19B | 1.8% | 3.1% | 0.37% | MF | Yes |

| PSMEX | Putnam Short-Term Municipal Income Fund | $52.1M | 1% | 2.9% | 0.91% | MF | Yes |

| THIMX | Thornburg Intermediate Municipal Fund | $899M | 0.1% | 3.3% | 0.91% | MF | Yes |

| SUB | iShares Short-Term National Muni Bond ETF | $9.59B | -0.3% | 2% | 0.07% | ETF | No |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | -0.4% | 3.5% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $32.8B | -1.8% | 2.9% | 0.07% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Mun Bond ETF | $4.06B | -1.0% | 1.4% | 0.20% | ETF | No |

| PZA | Invesco National AMT-Free Municipal Bond ETF | $2.33B | -1.8% | 2.9% | 0.28% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond Index Fund | $30.6B | -1.8% | 3.1% | 0.05% | ETF | No |

| ITM | VanEck Intermediate Muni ETF | $1.81B | -2.2% | 2.4% | 0.24% | ETF | No |

| TFI | SPDR Nuveen Bloomberg Municipal Bond ETF | $3.8B | -3.2% | 2.7% | 0.23% | ETF | No |

Perhaps the best play could be to pair a passive ETF for broad muni exposure and an active fund. Ultimately, the combination could prove to be the best fruitful outcome for investors.

Either way, municipal bond yields are at some of their highest points in years. That suggests the bonds will provide strong returns going forward with that yield providing most of the gains. That’s not necessarily too shabby.

The Bottom Line

After last year’s rout, municipal bonds are offering tax-equivalent yields north of 6%. According to investment manager Thornburg, that’s a huge win for investors, with that yield driving much of the sector’s potential return. Under that guise, muni bonds are a big buy. Pairing a passive ETF with an active fund could provide the best combination of returns for the sector.

1 Thornburg (Jan 2023). Income Will Once Again be the Primary Driver of Municipal Bond Returns