Furthermore, 2023 will likely be a relatively tumultuous year for issuers, investors and the capital markets in general due to economic uncertainties, the Fed’s aggressive take on interest rates and political shifts ahead. With the rapid rate of interest rate hikes, many fixed income investors are sitting on hefty unrealized capital losses in their portfolio. For both issuers and investors, it’s paramount to gauge the Fed’s stance on the U.S. economy and whether we will see a downward shift in the short-term interest rates stimulating municipal debt issuances and helping investors with their unrealized losses.

In this article, we will take a closer look at what CY2023 has in store for the capital market and the U.S. economy in general.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Gauging the Monetary Policy into 2023

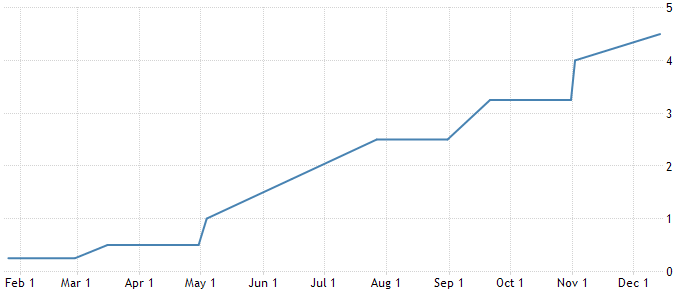

We are clear on where the Federal Reserve Chair, Jerome Powell, stands on the U.S. economy when he mentioned that we have tools to fix the broken economy, but not runaway inflation – indicating that rate hikes will likely continue until either inflation gets under control or an economic recession occurs. The chart below shows the pace of interest rate hikes in CY2022.

Source: Federal Reserve

In terms of the municipal debt markets, there has been a large influx of capital through federal and state governments through initiatives like American Rescue plan (ARPA), which has diminished the need for funding that could’ve been raised through issuing municipal debt. In addition, with the higher interest rates to raise capital, more governments are choosing to focus on capital projects that have some form of a funding plan tied – for example, capital projects funded through APRA federal funds. When looking at the accumulated issuances for CY2022, the markets registered a downward trend, which will likely continue into the new year unless of course the rates come down, fostering an environment for cost-effective capital issuance for local and state governments. Along the same lines, investors may also be skeptical with the recessionary talks, as they may jeopardize the underlying credit quality of their holdings and/or affect the revenue sources for local governments that could be pledged for future debt issuances.

For investors, until the rates come down, this could be a great opportunity to put their liquid capital to use and lock in very attractive returns for a longer duration. This could also be a way to generate additional premiums, as it’s a given that when the rates come down and the current investments are selling at much higher than their face value the inverse relationship between interest rates and bond prices rises.

Check out this article to see if it makes sense to buy closed-end municipal bond funds.

Reasons for Cautious Optimism

With the choppy 2022 behind us, many of the economic shifts are already in place that will likely result in the positive shift in the economies, whether it’s an intended slowdown of the economy to tame inflationary pressures or some other bellwether. Nuveen Investments, in its annual publication, also stated that “The course for municipal bonds in 2023 will likely depend on inflation levelling off or declining.” However, for investors who can look past the wider economic trends and focus on the fundamental strength of the municipal market, we believe taxable municipal bonds can be an important component in well-diversified, long-term portfolios. In terms of the credit strength, municipal credit fundamentals are particularly strong relative to corporate credit. Inflationary pressures are less impactful to municipal credit as higher costs can be pushed through to customers. Year-over-year revenues have increased in both 2021 and 2022 as inflation has bolstered municipal revenues while impacting the cost-side much less.

The Bottom Line

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.