Let’s take a closer look at why municipal bond-focused closed-end funds are attractive and whether you should invest.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Why Muni Bonds?

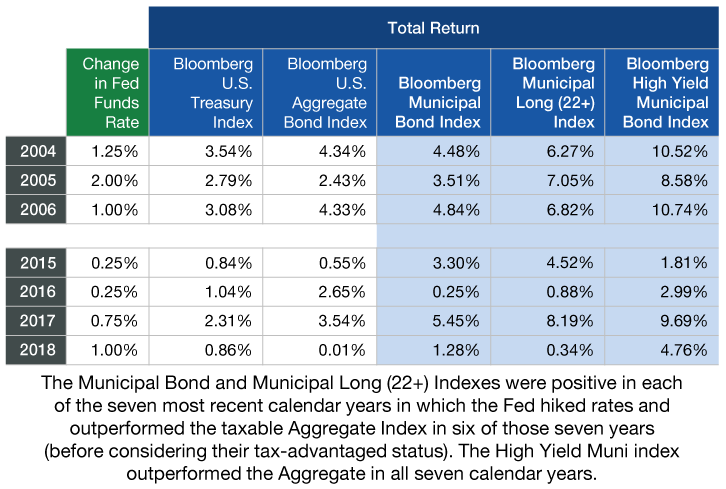

Source: Lord Abbett

In addition to their tax benefits, muni bonds tend to perform well during rising interest rate environments. According to Lord Abbett, muni bonds posted positive returns in the seven most recent interest rate hike periods. They also outperformed taxable aggregate bond indexes in six of those seven years before considering the impact of their tax benefits.

Finally, while individual muni bonds have a $25,000+ minimum investment, muni bond funds provide a cheap and easy way for any investor to build exposure to the asset class. Exchange-traded funds (ETFs) and mutual funds are the two most common investment vehicles for investing in municipal bonds via a conventional brokerage.

Buying at a Discount

Muni CEFs sold off over the past few months as investors sought to position their portfolios for rising yields. While muni yields have risen faster than comparable Treasuries over the past few months, investors can generate a return as the current discount aligns with historic NAV discounts or premiums.

For example, Nuveen Municipal Value Fund Inc. (NUV) has a net asset value of $1.94 billion, or $9.51 per share, but trades at just $9.08 per share, as of July 22, 2022. In addition to a modest 3.69% yield, investors could realize a significant capital gain if the fund’s 4.52% discount reverts to its 3-year average premium of 0.41%.

| Name | Ticker | Market Value | Discount/Premium |

| Nuveen Municipal Value | NUV | $1.9 Billion | -4.52% |

| Nuveen CA Quality Muni Income | NAC | $1.8 Billion | -9.10% |

| BlackRock Municipal 2030 Target Term | BTT | $1.6 Billion | -5.84% |

| Nuveen NY AMT Quality Muni Income | NRK | $983 Million | -10.56% |

| BlackRock Muni Yield Quality III | MYI | $812 Million | -7.17% |

Data as of July 22, 2022.

Here are some of the highest-yielding muni CEFs

| Name | Ticker | Yield | Discount/Premium |

| MainStay MacKay Defined Term Muni Opportunities | MMD | 5.43% | 4.62% |

| PIMCO Municipal Income II | PML | 6.27% | 14.72% |

| BlackRock Municipal Income | BFK | 5.07% | -7.86% |

| BlackRock Municipal Income II | BLE | 5.49% | -8.16% |

| Neuberger Berman Municipal | NBH | 5.29% | -7.60% |

Data as of July 22, 2022.

Don’t forget to check our Muni Bond Screener.

The Bottom Line

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.