In 2020, the mass cancellation of events in sporting arenas and convention centers due to social distancing guidelines and the public fear of gathering was detrimental for their revenue streams, adding to the insurmountable pressure that already existed for local and state economies.

In this article, we will take a closer look at how publicly funded sporting areas and convention centers, once considered to have been the cash cows for local economies, are adding to the fiscal strain with no clear solution in sight.

Be sure to check out our Education section to learn more about municipal bonds.

Local Economies and Funding of Large Crowd Arenas

With these assumptions in mind, local economies will often pledge their general fund revenues, in addition to the revenues generated from the events held at their respective establishments, to fund the construction of these large crowd spaces. Now, these assumptions may be true and help justify the construction projects for local governments; however, what happens if these arenas aren’t able to host the games and other events for various reasons like low disposable income or COVID-19? Then, the local economies are still on the hook to not only fund the administrative costs to run these establishments but also make the debt service payments on the bonds issued for their construction – adding pressure to the already impaired revenue sources.

Some have also argued about the opportunity cost that existed with funding for these large sporting arenas or convention centers. The argument talks about the use of public funds that builds these establishments takes these funds away from other projects like construction of a public school, library, public park or spending on the construction of new roadways – all of which provide a larger public good.

Want to learn more about the potential impact of COVID-19 on local and state governments? Click here to know more.

The Future of Large Gathering and Credit Rating Downgrades

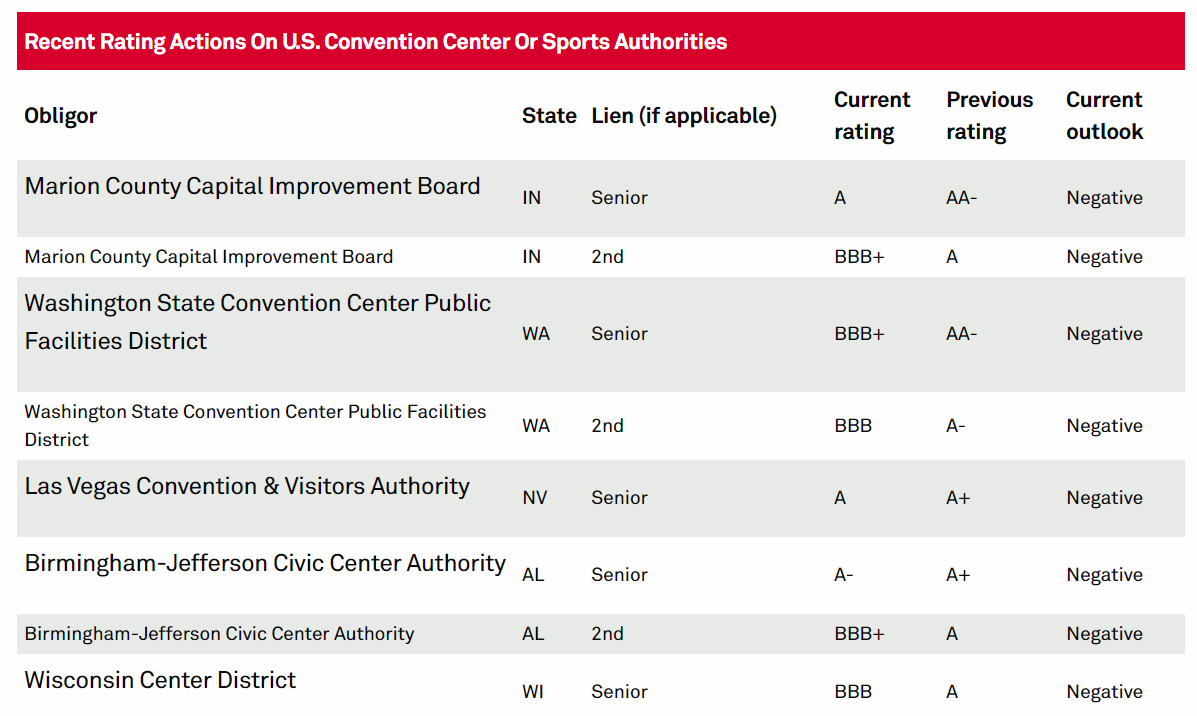

These impacts are also evident in the credit monitoring approaches of several credit rating agencies that show either a downgrade or a negative outlook for public debt issued to fund the sporting arenas or various convention centers. In the chart below, the S&P ratings report shows the credit rating downgrades or negative outlooks that are consistent with the impacts of COVID-19 restrictions on local economies:

Source: Standard & Poor’s Financial Services LLC

Use our Screener to find the right municipal bonds for your portfolio.

The Bottom Line

Until these establishments are able to generate some revenues, we will continue to see an increased financial strain on other revenue sources pledged for the debt service, continued credit rating downgrades, and deterioration of budgets for local economies.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.