With the economy heading into a recession, the central bank’s interest rate hikes could slow over the coming quarters. The slowdown in interest rate hikes could help stabilize interest rates, making the bond market more attractive, particularly as a safe haven. And, thanks to its unique characteristics, the municipal bond market looks especially attractive.

Let’s examine why the muni bond market looks so inviting and where investors can seek out the best opportunities.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

Stabilizing Prices With Attractive Yields

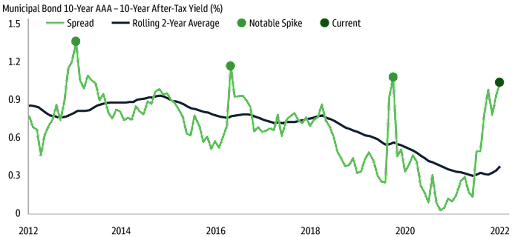

Past spikes in the spreads between 10-year AAA muni yields and after-tax 10-year Treasury yields were followed by quick retrenchments (higher prices). Source: Goldman Sachs

At the same time, U.S. Treasury yields are higher than they’ve been in years, with the 10-year peaking at around 4%. The municipal-to-Treasury yield ratio is also much higher than historical averages at about 86%, indicating an attractive relative yield. Tax-exempt income compensation for investors willing to buy now is at historic highs.

Well-Positioned for an Economic Downturn

Meanwhile, state and local tax revenues continue to rise, thanks to positive economic growth. More than 30 states reported higher-than-expected revenue in 2021, according to the National Association of State Budget Officers, with overall state revenue (including federal funds) increasing by more than 12% last year.

Demand Outstrips Supply

While the overall muni market has seen net outflows this year, municipal ETF flows came in at a positive $13.7 billion through September. High after-tax yields could draw in more investors early next year when rates stabilize. And the potential for a U.S. recession could also sharply increase demand as investors seek safe-haven investments for their capital.

Muni Bond Opportunities

| Name | Ticker | AUM | Expense Ratio |

| iShares National Muni Bond ETF | MUB | $28.9 Billion | 0.07% |

| Vanguard Tax-Exempt Bond ETF | VTEB | $20.8 Billion | 0.05% |

| iShares Short-Term National Muni Bond ETF | SUB | $9.1 Billion | 0.07% |

| SPDR Nuveen Bloomberg ST Muni Bond ETF | SHM | $4.6 Billion | 0.20% |

| SPDR Nuveen Bloomberg Muni Bond ETF | TFI | $3.3 Billion | 0.23% |

Data as of November 1, 2022

The Bottom Line

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.