Phishing for Phools

All of these excuses are easily shown to be nothing more than what economists George Akerlof and Robert Shiller would call an exercise in “phishing for phools.” The “phish” is a way to get someone to make a decision that’s to the benefit of the phisher, but not to the benefit of the phool. They explain that if you can divert a story someone is telling himself in your favor but not in his, you have ripened him up to be phished for a phool.

Active managers need investors to accept they will outperform, so they create supporting stories to earn your belief. Often, they will even sound plausible. However, like in The Wizard of Oz—when Toto pulls back the curtain exposing the Wizard as a fraud—once you dig under the surface, the story is exposed as nothing more than another fairy tale.

Pulling Back the Curtain

Thanks to Cliff Asness, managing and founding principal of AQR, we can show that this excuse is simply a phish, or more plainly a fraud, because 2015 wasn’t very much different from any other year.

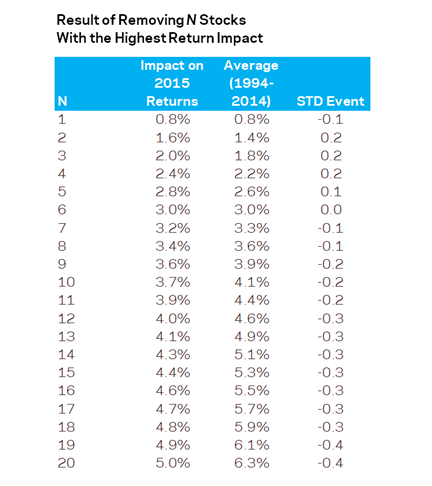

Asness performed the following exercise. Beginning in 1995, he removed the N number of stocks with the biggest positive impact on the S&P 500 each year (and re-weighted the index over the remaining 500 minus N stocks). Doing so will always get a lower return. The following table shows the impact in 2015 of removing the N largest-contributing stocks, the average impact of doing this same exercise each year over the period from 1995 through 2014, and the “standard deviation event” of the 2015 result (the impact in 2015 minus the average impact over the period from 1995 through 2014, divided by the volatility of the annual impacts).

While the S&P 500 Index returned just 1.4% in 2015, active managers had great opportunity to generate alpha as there was a very large dispersion in returns between the best and worst performers—not the narrow market claimed by phishers.

For example, there were 10 stocks in the index that returned at least 46.6% and 25 that returned at least 34.2%. All an active manager had to do to outperform was overweight these superperformers. On the flip side of the coin, there were 10 stocks in the index that lost at least 55.6% and 25 stocks that lost at least 45.8%. To outperform, active managers simply had to underweight, or simply avoid, these dogs. And yet very few did.

| The 10 Best S&P 500 Performers in 2015 | Percent Return (%) | The 10 Worst S&P 500 Performers in 2015 | Percent Return (%) |

|---|---|---|---|

| Netflix Inc. | 134.4 | Chesapeake Energy | -77 |

| Amazon | 117.8 | CONSOL Energy | -76.6 |

| Activision Blizzard | 92.1 | Southwestern Energy | -74 |

| NVIDIA Corp. | 64.4 | Freeport-McMoRan Copper & Gold B | -71 |

| Cablevision Systems | 54.6 | HP Inc. | -70.5 |

| VeriSign Inc. | 53.3 | Fossil Group | -67 |

| Hormel Foods | 51.8 | Kinder Morgan | -64.7 |

| First Solar | 48 | Micron Technology | -59.6 |

| Total System Services | 46.6 | NRG Energy | -56.3 |

| 46.6 | Murphy Oil | -55.6 |