First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we take a closer look at floating rate bond funds. This type of mutual fund invests in bonds and other fixed-income securities with payments that fluctuate as interest rates change. These funds are designed as wealth preservation vehicles rather than chasers of growth or high dividends. Fixed-income durations are kept low – usually 1 year or less – in order to maintain a quick portfolio turnover and take advantage of changes in interest rates.

Our breakdown of each fund includes key aspects such as 1-year performance, fund expenses, SEC yields, portfolio duration, and management profile, to give you an overview of how these funds hold up against their peers.

Be sure to check out the Floating Rate Bond Funds category to find out more about the other floating rate funds.

Trending Funds

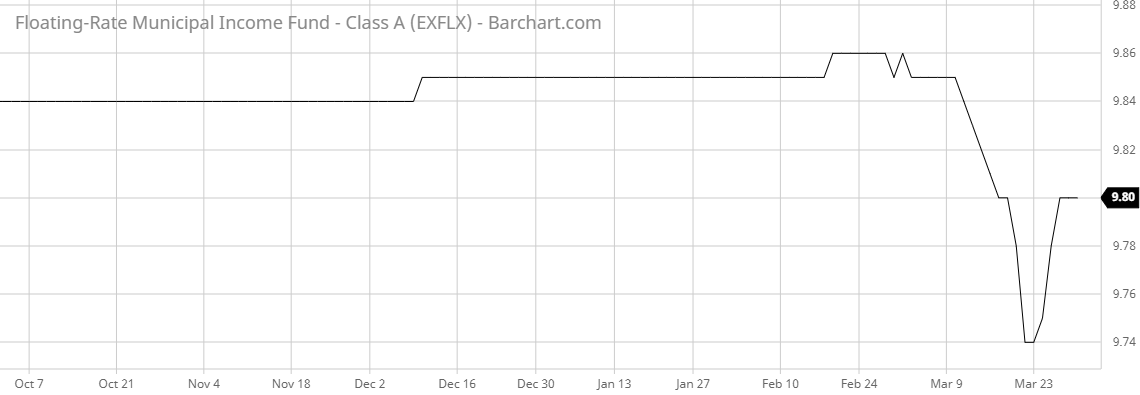

1. Eaton Vance Floating Rate Municipal Income Fund (EXFLX)

The fund is specifically focused on seeking out tax-exempt income with a low portfolio duration in order to hedge against rising municipal interest rates. It is benchmarked to the Bloomberg Barclays 1-Year Municipal Bond Index.

The fund’s manager is Craig Robert Brandon, CFA, who has been managing the fund since 2004. He is a vice president of Eaton Vance Management and co-director of municipal investments and portfolio manager on Eaton Vance’s municipal bond team. Adam A. Weigold, vice president at Eaton Vance, later joined the team in 2014.

The portfolio is made up of municipal bonds across a variety of sectors. The top 3 sectors by weight include hospitals (22.87%), transportation (15.76%), and education (14.70%) while 97.93% of its holdings are rated A, AA, or AAA. The average duration of the portfolio is just 0.06 years making it a very short-term bond portfolio.

Learn more about different Portfolio Management concepts here.

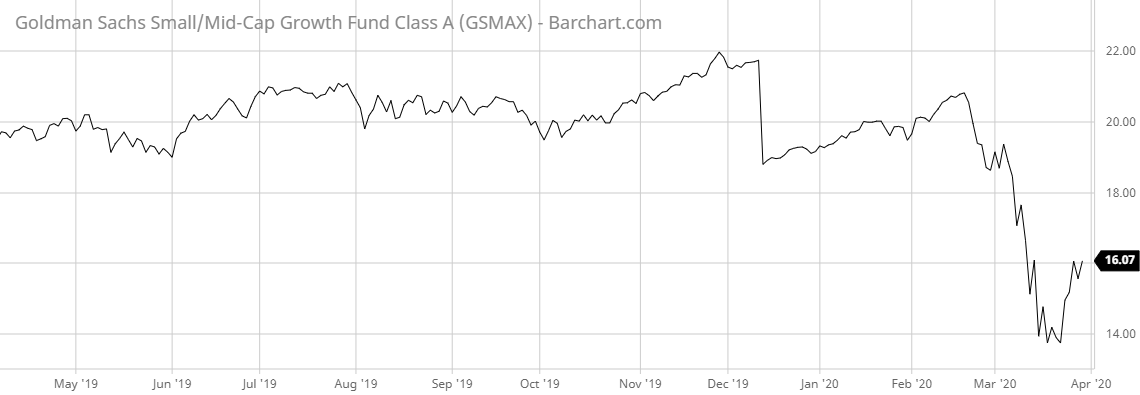

2. Goldman Sachs High Quality Float Rate Fund (GSAMX)

Under normal circumstances, the fund invests 80% of its net assets in high quality i.e. instruments with AAA or similar credit rating, and US government or agency backed debt securities. The fund also uses derivatives to manage duration. The fund might invest in eligible foreign securities, including sovereign debt, however almost 100% of the fund’s holdings are mandated to hold securities denominated in U.S. dollars. The fund’s benchmark index is ICE BofAML Three-Month U.S. Treasury Bill Index.

The Portfolio Manager, Dave Fishman, is a managing director at Goldman Sachs and co-head of the Goldman Sachs global liquidity management team, and has been managing the fund since 2008. Since 2016, Mr. Fishman has been assisted by Matthew T. Kaiser, managing director at Goldman Sachs, and John Olivo, Goldman’s global head of short-duration fixed-income strategies.

The fund’s portfolio primarily consists of asset-backed bonds (50.38%) and agency mortgage-backed bonds (29.74%). It has an extremely low effective portfolio duration of just 0.01 years making it one of the shortest-duration bond funds available to investors.

Find out the funds suitable for your portfolio by using our free Screener.

3. PIMCO Senior Floating Rate Fund A (PSRZX)

The investment strategy of the fund is to select floating rate bank loans that are made to below-investment-grade companies in order to take advantage of higher return potential. Its primary benchmark is the J.P. Morgan BB/B Leveraged Loan Index.

Elizabeth O. MacLean is the fund manager and an executive vice president and bank loan portfolio manager at PIMCO. With an extensive knowledge in managing bank loan portfolios, she has been managing the fund since its inception in 2011.

The fund’s portfolio consists mostly of bank loans which make up 89.66% of its investment weight; bonds account for 5.13% while 1.38% are placed in other short duration instruments. The fund’s portfolio carries an effective duration of 0.61 years, making it one of the longer-term options, but still well under 1-year.

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of March 26, 2020