This week’s edition will focus on global allocation funds. These funds seek capital appreciation by investing in a variety of asset classes including equities and bonds from emerging and developed markets across the globe. These funds typically come with a basket of mixed market cap equities across different sectors.

One thing to note while considering these funds is that foreign currency risk might lower overall returns relative to the value of the U.S. dollar. In addition, one must be aware of various geopolitical risks that might affect overseas markets.

Our breakdown of each fund includes key aspects such as one-year performance, performance from inception, fund expenses, investment strategy, and management team to give you an overview of how these funds hold up against their peers.

Be sure to check out the Global Allocation Funds page to find out more about the other funds in this category.

Trending Funds

1. Baron Global Advantage Fund Retail Shares (BGAFX)

The top fund on our list is BGAFX, which is offered through Baron. It holds a phenomenal trailing one-year total return of 32.86%. The seemingly high expense ratio of 1.15% is actually low compared to its peers, making it a bargain for value-minded investors.

The investment objective of this fund is to invest in established and emerging market common stock shares. At least 40% of its assets will be held in non-U.S. stocks but can be as little as 30% if foreign market conditions are not favorable. It is benchmarked to the MSCI All Country World Index.

Portfolio fund manager Alex Umansky has been manager of the fund since its inception in April 2012.

The top five countries the fund invests in are listed as follows: the United States (62%), China (15%), Brazil (8%), the Netherlands (7%), and Canada (3%). The portfolio breaks down asset classes as domestic stock (55%), foreign stock (34%), and remaining as cash.

Learn more about different Portfolio Management concepts here.

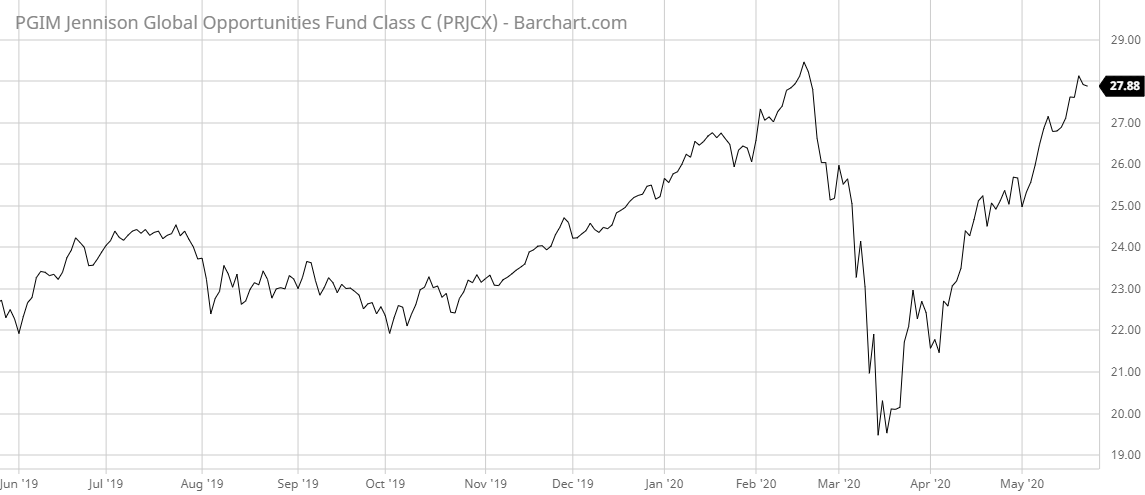

Next up on our list this week is PRJCX. It has a trailing one-year total return of 22.13%. The expense ratio of 1.94% makes it somewhat expensive compared to other mutual funds, but on par with similar fund types. It also comes with a deferred load of 1.00% for early withdrawal.

The objective of the fund is to seek long-term capital appreciation through developed and emerging market investments. Management favors a growth style of equity management and selects stocks that have long-term growth potential. The fund is benchmarked to the MSCI All Country World Index.

Mark Baribeau, CFA, a managing director and head of global equity, and Thomas Davis, a managing director and global equity portfolio manager, have been managing the fund since its inception in March 2012.

The regional weight breakdown of the fund’s portfolio is the United States (54%), China (14%), France (11%), the Netherlands (6%), and Switzerland (5%). Asset classes held in the portfolio include domestic stocks (54%), foreign stocks (45%), and the remaining in cash.

Find out the funds suitable for your portfolio by using our free Screener.

The final fund, MSOPX , on our list is offered by Morgan Stanley, a staple in the mutual fund industry. The Global Opportunity Fund has a trailing one-year total return of 16.60%. It comes with a 1.95% expense ratio, placing it in the middle range among other similar mutual fund types.

Like other global allocation funds, it invests in developed and emerging market economies seeking long-term capital appreciation. Management approaches investments with a value-oriented style, seeking equities whose prices are undervalued relative to their intrinsic value. It uses the MCSI All Country World Index as its benchmark.

Kristian Heugh, CFA, is the portfolio manager of the fund with 19 years’ experience in the investment industry. He is the head of the Global Opportunity team at Morgan Stanley.

Regional holdings of the fund include North America (60%), Pacific Basin (16%), Euro-Europe (6%), Non-Euro Europe (5%), and India (3%). Top equity holdings include Amazon (AMZN), MasterCard (MA), TAL Education Group (TAL), ServiceNow (NOW), and Alphabet (GOOG).

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of May 21, 2020