First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

This week’s edition will focus on the top three tactical allocation funds. This type of mutual fund changes its asset allocation in accordance with market conditions. Risk mitigation is one of the main goals in this type of fund, allowing them to alternate between asset classes (i.e. stocks, bonds, and cash, among others) as needed.

Our breakdown of each fund includes key aspects such as 1-year performance, fund expenses, investment style, and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the Tactical Allocation Funds page to find out more about the other funds in this category as well.

Trending Funds

1. Goldman Sachs Growth and Income Strategy Portfolio (GOIIX)

As one of the most prestigious Wall Street institutions, it comes as no surprise that the top fund on our list this week is offered by Goldman Sachs. GOIIX delivered a solid 1-year trailing total return of 7.28%. The gross expense ratio of 0.73% puts it on the lower-average range compared to other similar fund types.

The fund’s investment strategy is to utilize a basket of other mutual funds to achieve long-term capital appreciation and minimize risk exposure. The stated weight allocations for the fund are to hold 55% in equity funds, 15% in dynamic (mixed-asset) funds, and 30% in fixed-income funds. Weight allocations may change by 25% to 30% for each category. It is benchmarked to the MSCI ACWI (60%) and the Barclays Global Aggregate Index (40%).

Christopher Lvoff, CFA, is a managing director in the Global Portfolio Solution Group (GPS) in Goldman Sachs Asset Management LP and a senior portfolio manager. He has been managing this fund since April 2017. Neill Nuttall, a Managing Director and the Co-Chief Investment Officer in the GPS Group, joined the team in February 2019.

As a fund of funds, it invests in a basket of other mutual funds in order to accomplish its stated goals. Assets held in the fund’s portfolio breakdown as follows: domestic equity (25.6%), global equity (21.1%), global bonds (15.5%), domestic bonds (11.4%), and international equity (7.8%)

Learn more about different Portfolio Management concepts here.

The number two pick for our list this week is another one offered through Goldman Sachs. GIPIX generated a 1-year trailing total return of 7.24%. It comes with a gross expense ratio of 0.81%, making it competitive with similar fund types.

The investment strategy of the fund is to seek long-term capital appreciation while minimizing risk by investing in a basket of other mutual funds. The stated weight allocations for the fund are to hold 50% in fixed-income funds, 15% in dynamic (mixed-asset) funds, and 35% in equity funds. Weight allocations may change by 25% to 35% for each category. The fund splits its benchmark indexes against the MSCI ACWI (40%) and the Barclays Global Aggregate Index (60%). Note how this fund contrasts to the GS Growth and Income Strategy Portfolio.

Just like the previously mentioned GOIIX, this fund is managed by Neill Nuttall and Christopher Lvoff, CFA.

The top 5 asset allocation weights in the fund are global bonds (33.7%), global equity (15.4%), domestic bonds (15.3%), domestic equity (14.3%), and tactical strategies (5%).

Find out the funds suitable for your portfolio by using our free Screener.

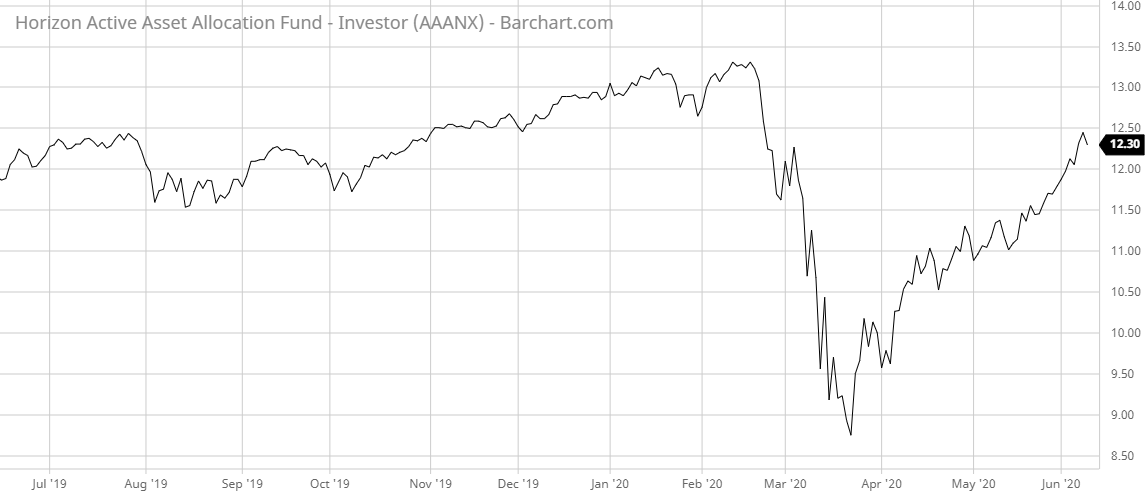

Rounding out our top three list is Horizon’s Active Asset Allocation Fund (AAANX). It delivered a 1-year trailing total return of 4.93%. The relatively high 1.45% expense ratio puts it at the top end of the fee range compared to its peers.

The fund uses ETFs in its investment strategy in order to select an allocation mix that achieves positive returns while minimizing risk exposure. Management focuses on three key principles: economic, quantitative, and fundamental analysis. It uses the S&P Global BMI Ex-U.S. Index as its benchmark portfolio.

The fund is co-managed by Scott Ladner, Chief Investment Officer and Chair of the Investment Committee for Horizon, Mike Dickson, PhD., Head of Portfolio Management at Horizon, and Zachary Hill, CFA, who all share day-to-day responsibilities for fund management.

The portfolio contains a basket of ETF holdings, classifying it as a “fund of funds.” Asset classes that are considered include U.S. stocks, foreign developed market stocks, emerging market stocks, REITs, government bonds, corporate bonds, international bonds, municipal bonds, and high-yield bonds.

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

Our expert analysis of the top three will give you insight so you know what the best tactical allocation fund is to fit your portfolio needs.

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of June 4, 2020