First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we analyze the top three Municipal Bond Funds. These funds invest in local, state, and other government bond issuance. Taxes on returns from these types of securities are exempt from federal taxation and can be exempt from state and local taxes depending on where the investor’s primary residence is located.

The uncertainty of the current political climate means investors are looking ahead to what tax changes the next administration might bring about. For investors in higher tax brackets, these funds are popular because profits are exempt from federal taxes and may be exempt from state and local taxation as well.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, investment style, and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the Municipal Bond Funds page to find out more about the other funds in this category as well.

Trending Funds

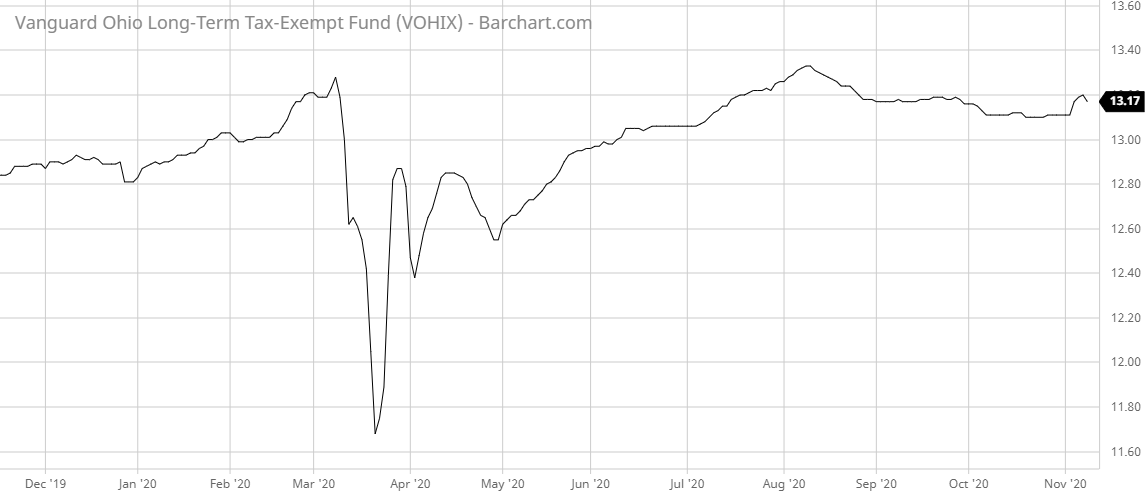

1. Vanguard Ohio Long-Term Tax-Exempt Fund (VOHIX)

The number one fund on our list this week comes from a familiar name in the mutual fund industry. The Vanguard Ohio Long-Term Tax-Exempt Fund (VOHIX) generated a trailing one-year total return of 5.22%. The extremely low 0.13% expense ratio makes it the least expensive fund on our list this week.

The stated investment strategy of the fund is to invest primarily in high-quality municipal bonds issued by the State of Ohio and local governments. At least 80% of its assets are invested in securities with tax-exempt income with a dollar-weighted average maturity between 10 and 25 years. The portfolio is benchmarked to the Bloomberg Barclays Municipal Bond Index.

Stephen M. McFee, CFA, is the portfolio manager and the co-lead of the municipal revenue team at Vanguard’s fixed income group. He has been managing the fund since February 2020.

The fund’s portfolio currently holds 732 bonds with an average duration of 6.6 years. Weight by bond maturity is listed as: less than 1 year, 1–3 years, 3–5 years, 5–10 years, 10–20 years, 20–30 years, and over 30 years.

Learn more about different Portfolio Management concepts in our channel here.

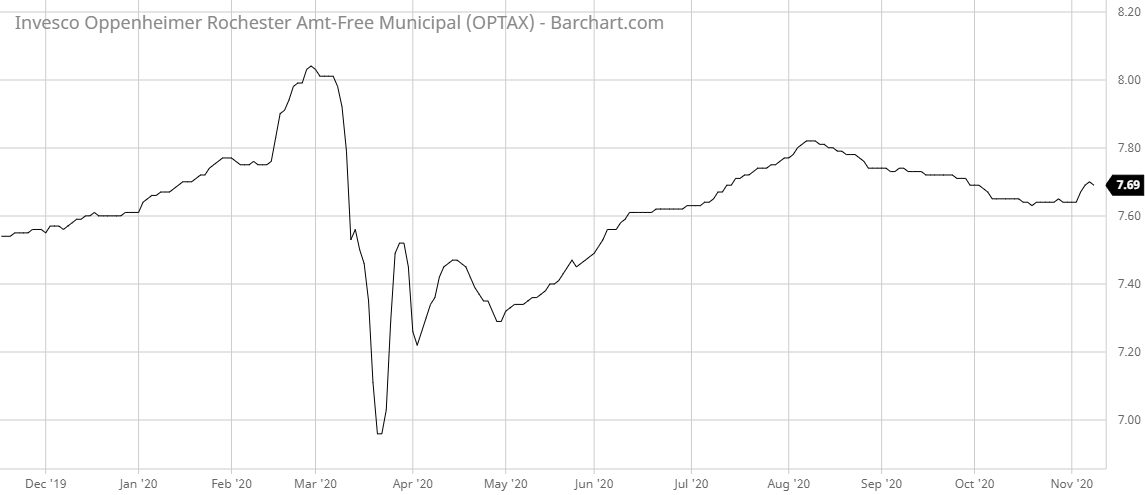

2. Invesco AMT-Free Municipal Income Fund (OPTAX)

Invesco’s AMT-Free Municipal Income Fund (OPTAX) comes in at number two this week with a solid trailing one-year total return of 4.62%. However, the expense ratio of 0.86% makes it the most expensive fund on this week’s list.

The primary investment objective of the fund is to invest in municipal bonds (long-term obligations), municipal notes (short-term obligations), municipal leases, and tax-exempt commercial paper. The fund uses the Bloomberg Barclays Municipal Bond Index as its benchmark portfolio.

Mark Paris, Chief Investment Officer and Head of Municipal Strategies at Invesco, has been managing the fund since June 2019. He is supported by Joshua Cooney, Elizabeth S. Mossow, Tim O’Reilly, and Julius Williams.

The portfolio of the fund currently holds 776 assets. The top five bond assets by weight include: Michigan Tobacco Settlement Finance Authority, Buckeye Tobacco Settlement Financing Authority, New York State Dormitory Authority, County of Miami-Dade FL Water & Sewer System Revenue, and Birmingham Commercial Development Authority.

Find the funds suitable for your portfolio by using our free Screener.

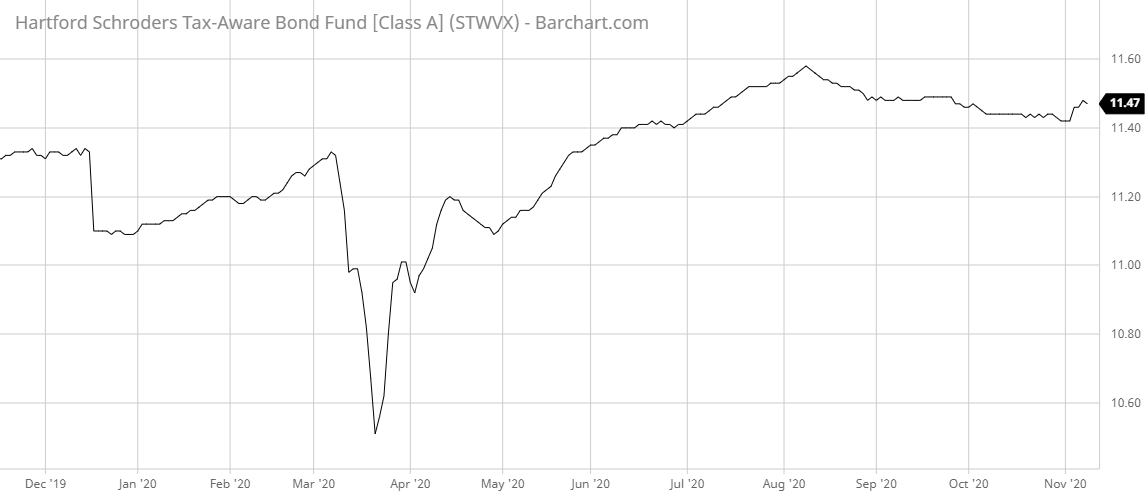

3. Hartford Schroders Tax-Aware Bond Fund (STWVX)

The last fund to make our list this week comes from a name that most investors probably aren’t familiar with. Hartford Schroders Tax-Aware Bond Fund (STWVX) generated a trailing one-year total return of 4.60%. It comes with an expense ratio of 0.71%.

The investment strategy of the fund is to invest at least 80% of its assets in U.S. dollar-denominated, investment-grade fixed income debt instruments. The fund uses a combination of short and long positions to maximize returns and does not consider the duration of the bonds selected. The portfolio is benchmarked to the Bloomberg Barclays Municipal Bond Index.

Andrew B.J. Chorlton, CFA – Head of U.S. Multi-Sector, Fixed Income at Schroders, Julio Bonilla, CFA, and Neil G. Sutherland, CFA have been managing the fund since October 2011. Lisa Hornby, CFA and David P. May joined the team later.

The top five holdings in the fund’s portfolio are listed as: U.S. 10yr Note, U.S. 5yr Note, Morgan Stanley Institutional Liquidity ESG, Pennsylvania State Government Bonds 4%, and Federal National Mortgage Association 2%.

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

Our expert analysis of the top three will give you insight so you know the best municipal bond fund that fits your portfolio needs. And don’t forget to sign up for our free newsletter to get the latest insights on mutual funds.

Make sure to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of November 9, 2020.