First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. From the top trending category, we select the top three funds with the highest one-year trailing total returns. To ensure the quality and staying power of funds, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds that are closed to new investors and are not available for investment outside registered accounts such as retirement or 529 accounts.

In this week’s edition, we analyze the top three Monthly Dividend Income Funds. As the name suggests, these funds invest in stocks that produce income through dividend distributions.

The increased volatility in the stock market and uncertainty regarding the direction of the economy heading into 2021 has resulted in a popularity boost for dividend paying stocks. Mutual funds that invest in income-oriented portfolios are more risk averse and offer stability to any portfolio in which they are held. These funds prioritize investments in stocks that have a dividend yield – generally around 2% or higher. Market capitalization is generally mixed with funds holding varying weights of each but may be specialized to focus on particular sectors of the market.

Our breakdown of each fund includes key aspects such as one-year performance, fund expenses, investment style, and management teams to give you an overview of how these funds hold up against their peers.

Be sure to check out the Monthly Dividend Income Funds page to find out more about the other funds in this category as well.

Trending Funds

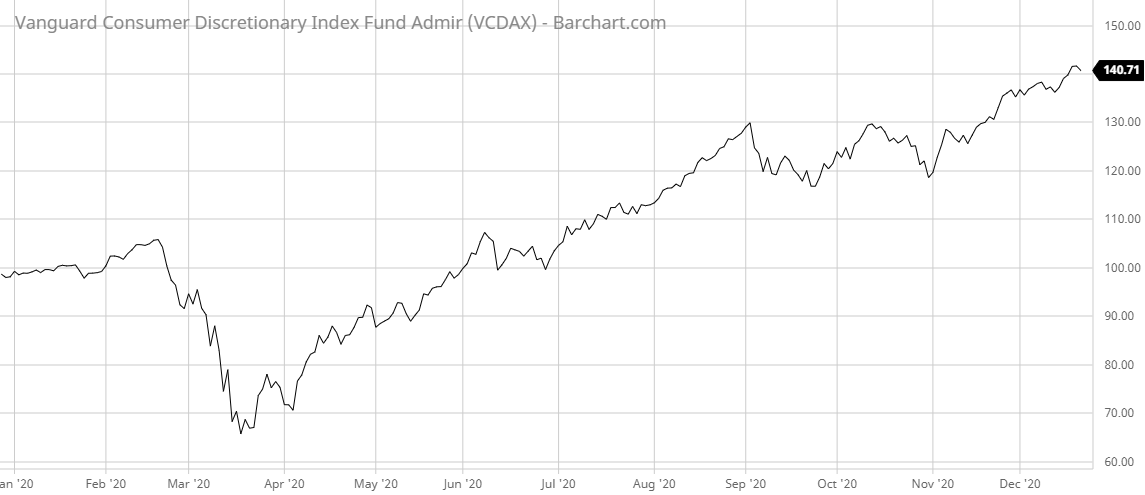

1. Vanguard Consumer Discretionary Index Adm (VCDAX)

The top fund in our list this week is from a familiar name in the industry – Vanguard. The Consumer Discretionary Index Adm (VCDAX) boasts an impressive one-year performance of 49.45% and a 10-year annualized performance of 17.9%. Like most index funds, it carries an extremely low expense ratio of just 0.10%.

The investment strategy of the fund is to mimic the performance of the MSCI US Investable Market Index/Consumer Discretionary 25/50. It attempts to invest in most, if not all, stocks listed in the index and may be composed of large-cap, mid-cap, and small-cap stocks in the consumer cyclical sector. Its benchmark portfolio is the same as the index it seeks to track.

Michael Johnson, Portfolio Manager at Vanguard, has been managing the fund since December 2010. He is assisted by Awais Khan, CFA, Portfolio Manager at Vanguard, who joined the team in November 2017.

The fund’s portfolio currently holds 300 assets with 93.18% of its weight in consumer cyclical stocks. The top five holdings are Amazon.com Inc 22.14%, Tesla Inc 8.84%, Home Depot Inc 6.54%, *Nike Inc B 3.68%, and McDonald’s Corp 3.56%.

Learn more about different Portfolio Management concepts here.

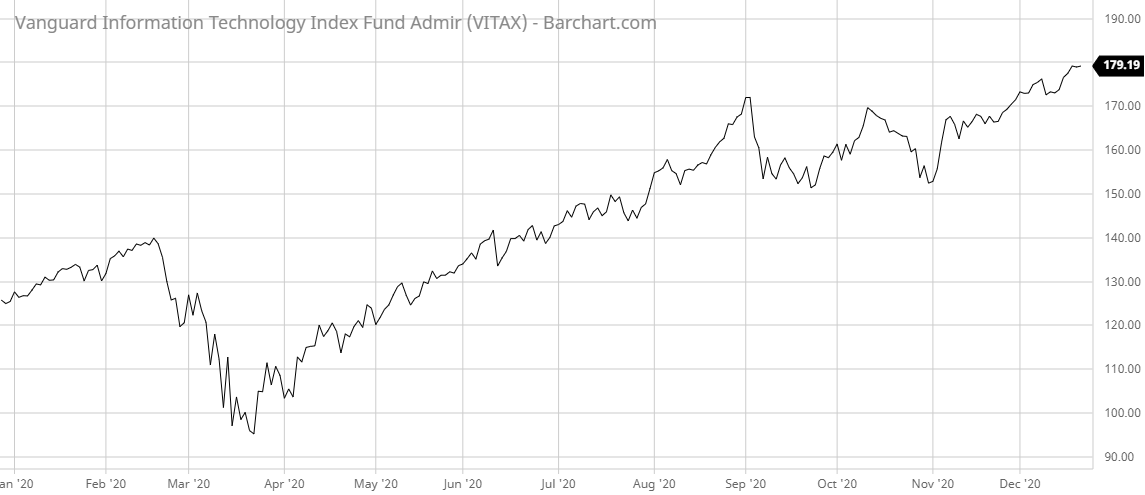

2. Vanguard Information Technology Index Adm (VITAX)

Another fund from Vanguard takes our second place spot this week with its Information Technology Index Adm (VITAX). It has an outstanding one-year performance of 47.35% and a 10-year annualized performance of 20.5%. Like the previous index fund, it comes with a low 0.10% expense ratio.

The investment strategy of the fund is to invest in many, if not all, of the stocks listed in the MSCI US Investable Market Index (IMI)/Information Technology 25/50 to mimic its performance. The portfolio may contain a mixture of large-cap, mid-cap, and small-cap stocks in the technology sector. Its benchmark portfolio is the same as the index it seeks to track.

The fund’s primary portfolio manager is Walter Nejman, Portfolio Manager at Vanguard, who has been managing the fund since December 2015. Michael Johnson, Portfolio Manager at Vanguard, joined the team in November 2017.

The portfolio of the fund currently contains 345 assets with 87.65% of the weight held in the technology sector. Its top five holdings include Apple Inc 20.70%, Microsoft Corp 15.64%, Visa Inc Class A 3.37%, NVIDIA Corp 3.36%, and Mastercard Inc A 3.06%.

Find out the funds suitable for your portfolio by using our free Screener.

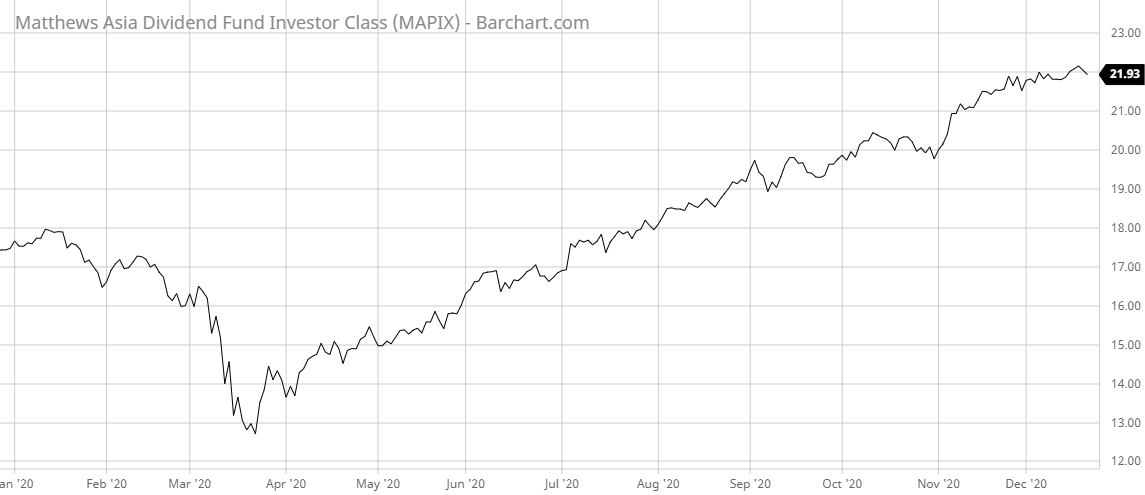

3. Matthews Asia Dividend Investor Fund (MAPIX)

The last fund on this week’s list is the Matthews Asia Dividend Investor fund (MAPIX). It has a respectable one-year performance of 28.83% and a 10-year annualized performance of 8.4%. Unlike the first two funds listed, the Matthews fund is not an index fund and comes with a relatively higher expense ratio of 1.03%.

The fund’s investment strategy is listed as providing a level of income that is higher than the current yields available from assets in Asian markets. To achieve this, it selects dividend paying stocks irrespective of market sector or capitalization to hold in its portfolio. The benchmark for the fund is the MSCI All Country Asia Pacific Index.

The fund’s primary portfolio manager is Yu Zhang, Portfolio Manager at Matthews, who has been managing the fund since March 2011. Yu is supported by Robert J. Horrocks, Chief Investment Officer and Portfolio Manager at Matthews, Sherwood Zhang, Portfolio Manager at Matthews, and S. Joyce Li, CFA, Portfolio Manager at Matthews Asia.

The portfolio of the fund currently lists 58 assets. The top five holdings and their respective economic region and sector are Minth Group, Ltd. in China/Hong Kong 6.2%, Taiwan Semiconductor Manufacturing Co., Ltd. in Taiwan 4.5%, LG Chem, Ltd.* in South Korea 3.4%, Chongqing Brewery Co., Ltd. in China/Hong Kong 3.1%, and Breville Group, Ltd. in Australia 2.7%.

Want to know more about portfolio rebalancing? Click here.

The Bottom Line

Make sure to visit our News section to catch up with the latest news about mutual fund performance.

Note: Data as of December 17, 2020.