First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529 accounts.

In this edition, we take a closer look at trending U.S. Large-Cap Growth Equity Funds for investors.

Large-cap growth funds have been strong performers over the past year, especially for actively managed funds. Over the past five years, Wilshire’s index of large-cap stocks rose 134% compared to 96% for mid-cap stocks and 94% for small-cap stocks.

Our breakdown of each fund includes vital aspects, such as one-year performance, performance from inception, fund expenses, investment strategy, and management team’s profile, to give you an overview of how these funds hold up against their peers.

Be sure to check out the U.S. Large-Cap Growth Equity Funds page to find out more about the other funds in this category as well.

Trending Funds

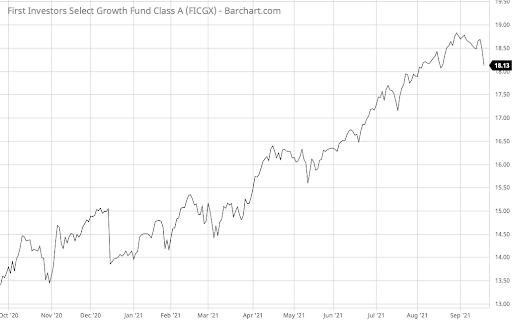

The number one mutual fund on this week’s list is the Delaware Growth Equity Fund (FICGX). It provided an exceptional trailing one-year total return of 51.29% with a 1.14% expense ratio, putting it in the middle of the pack in terms of expenses.

With a focus on fundamental analysis, the fund invests in a concentrated group of high-quality companies that the managers believe have undiscovered growth potential. The fund holds companies with a high level of momentum and less volatility than the category average, making it a good option for risk-averse investors.

The fund is managed by Steven S. Smith, CFA, John D. Brim, CFA, and Eivind Olsen, CFA, who all have more than 25 years of industry experience. The team’s average tenure amounts to 13.8 years, although Mr. Brim and Mr. Smith have 14.4 years of experience.

The fund’s portfolio consists of 36 holdings concentrated in information technology (38.2%), consumer discretionary (17.1%), healthcare (12.4%), and industrials (12.1%). Interestingly, the company’s portfolio has an average price-to-earnings ratio of 22.29x—lower than the 30.73x category average—and consists of smaller companies than the category average.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com

2. Edgewood Retail Growth Fund (EGFFX)

The Edgewood Retail Growth Fund (EGFFX) comes in second place. It generated a one-year trailing return of 44.99% with a 1.4% expense ratio, making it the most expensive fund on the list.

The fund’s strategy is to pursue long-term capital growth through a portfolio of mid-to-large size companies. These companies are distinguished by their financial strength, levels of profitability, strong management, and ability to deliver long-term earnings power. The goal is to provide investors with superior long-term performance with low risk.

The fund is managed by a team of seven long-term managers with a tenure of 15.6 years. All of the managers have been with the fund since its inception in 2006.

The fund’s portfolio consists of 22 equities concentrated in medical technology (17.6%), information technology (16.6%), financials (13.3%), media and advertising (11.2%), and consumer discretionary (11%). Unlike the Delaware Growth Equity Fund, the portfolio’s average price-to-earnings ratio comes in at 45.04x—higher than the 30.73x category average—with larger companies among its holdings.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com

3. Brown Advisory Sustainable Growth Investment Fund (BIAWX)

The Brown Advisory Sustainable Growth Investment Fund (BIAWX) rounds out the list. It has a trailing one-year trailing return of 43.17% with a 0.86% expense ratio, making it the lowest cost fund on the list.

The fund seeks long-term capital appreciation by investing in mid- and large-cap stocks that the managers believe effectively implement sustainable business strategies to drive their prospects for future earnings growth. The fund may also invest up to 15% of its net assets in non-U.S. and emerging market securities, typically through ADRs.

The fund is managed by Karina Funk, CFA, and David Powell, CFA, who have an average tenure of 9.3 years. Karina has extensive investment experience spanning early-stage ventures to debt and public equities. She and co-portfolio manager, David, have developed a distinctive fundamental research methodology focused on finding companies at the intersection of positive fundamental and sustainable business drivers.

The fund’s portfolio holds 33 equities concentrated in information technology (43.7%), healthcare (23.4%), and consumer discretionary (15.1%). Notably, the fund holds smaller companies than the category average, but these companies have an average price-to-earnings ratio that comes in above the category average at 42.90×. The company’s holdings also have higher growth rates than the average fund in the space.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.

Note: Data as of September 16, 2021.