First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $250 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and not available for investment outside registered accounts such as retirement or 529.

In this edition, we take a closer look at trending Floating Rate Corporate Bond Funds for investors.

Most analysts and economists believe the Federal Reserve will raise interest rates in 2022. Of course, higher interest rates are bearish for fixed-income securities that lock investors into lower rates. However, floating-rate securities are an exception with rates that periodically adjust to current interest rates, making them less sensitive to interest rate volatility and a good option for income investors.

Our breakdown of each fund includes vital aspects, such as one-year performance, performance from inception, fund expenses, investment strategy, and management team’s profile, to give you an overview of how these funds hold up against their peers.

Be sure to check out the Floating Rate Corporate Bond Funds page to find out more about the other funds in this category as well.

Trending Funds

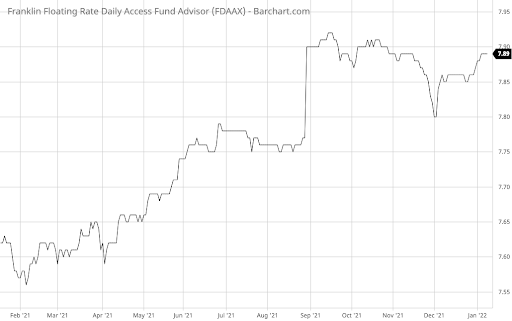

The Franklin Floating Rate Daily Access Fund (FDAAX) comes first on this week’s list. It provided an exceptional trailing one-year total return of 8.47% with a 0.71% expense ratio and a 3.7% TTM yield, putting it in the middle of the road regarding expense ratios and yield.

The fund seeks a high level of current income and capital preservation, by investing predominantly in floating interest rate senior-secured corporate loans (floating-rate loans) and corporate debt securities. These bonds have less interest rate sensitivity than conventional corporate or government bonds.

A team of four portfolio managers runs the fund with an average tenure of four years. Justin Ma, CFA, is the most senior team member with more than eight years at the helm. He’s joined by Reema Agarwal, CFA, Margaret Chiu, CFA, and Judy Sher, who co-manage the portfolio.

The fund’s portfolio consists of about 280 B-rated corporate bonds with an effective duration of 1.18 years and a 4.39% yield to maturity, making it the highest-duration fund on the list. The portfolio is concentrated in the technology (15.29%) and healthcare (13.06%) industries, with the largest holding accounting for just under 5% of the fund’s total assets.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

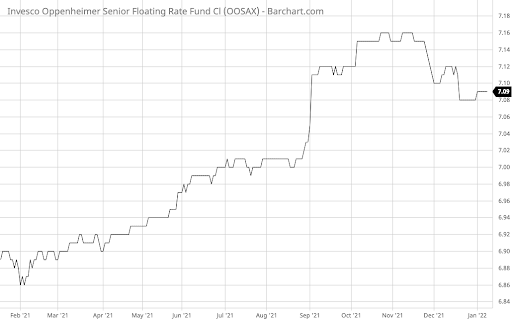

2. Invesco Senior Floating Rate Fund (OOSAX)

The Invesco Senior Floating Rate Fund (OOSAX) comes in second place. It offered an 8.30% trailing one-year return, 1.08% expense ratio, and 4.38% TTM yield, making it the highest yielding fund on the list.

The fund seeks income by investing in senior floating-rate loans. In particular, the fund invests at least 80% of its net assets in senior loans and derivatives that have similar characteristics. The fund may invest in senior loans directly, as an original lender, by assignment from a lender, or through loan participation agreements.

The fund is managed by David Lukkes, CFA, Thomas Ewald, and Philip Yarrow, CFA, who have an average tenure of about three years. Mr. Lukkes is the most senior member of the team, with six years of experience managing the fund.

The fund’s portfolio consists of about 520 BB or lower-rated bonds with an effective duration of 0.13 years and a weighted coupon of 4.88%, giving it the lowest duration of the funds on our list. The portfolio is most concentrated in telecom (2.23%), application software (1.66%), hotels, resorts, and cruise lines (1.5%), and casino and gambling (0.88%) industries.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

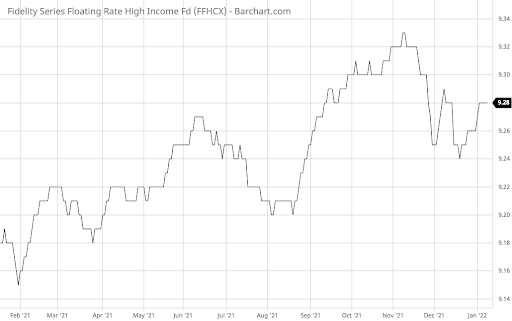

3. Fidelity Series Floating Rate High Income Fund (FFHCX)

The Fidelity Series Floating Rate High Income Fund (FFHCX) rounds out the list. It provided a 6.09% trailing one-year return with a 0% net expense ratio and a 4.29% yield, making it the lowest cost fund on the list.

The fund seeks a high level of current income by investing at least 80% of its assets in floating-rate loans and other floating-rate securities from both domestic and foreign issuers.

The fund is managed by Eric Mollenhauer and Kevin Nielsen, who have an average tenure of about seven years. Mr. Mollenhauer has the longest tenure at about 10 years.

The fund’s portfolio holds about 515 bonds with a duration of 0.20 years and a weighted coupon of 4.16%. These bonds are concentrated in business equipment and service (11%), telecom (8%), healthcare (7%), and electronics (7%). As with the other funds on the list, the bonds are primarily BB-rated or lower credit quality.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete list of Best High Yield Stocks.

Note: Data as of January 6, 2022.