First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

In this edition, we look closely at trending Short-term U.S. Treasury Funds for investors.

The U.S. Treasury market is the deepest and most liquid market in the world and a central part of U.S. and global financial systems. Backed by the full faith and credit of the U.S. government, they are also one of the safest places to park an unlimited amount of money. Investors can choose between T-bills, T-notes, and T-bonds, depending on their desired length of maturity and interest rate.

Short-term U.S. Treasury funds have become a popular way for investors to de-risk their portfolios while taking advantage of rising interest rates. With shorter maturities, investors can roll over their capital into higher-rate investments faster than longer-dated bonds.

Be sure to check out the Short-term U.S. Treasury Funds page to find out more about the other funds in this category as well.

Trending Funds

The GMO U.S. Treasury Fund (GUSTX) comes first on this week’s list, with a 0.21% loss over the past 12 months. The fund offers a 0.09% expense ratio and a 0.57% yield, making it the least expensive option on our list.

The fund seeks liquidity and safety of principal by investing in securities secured or backed by the full faith and credit of the U.S. government. In particular, the fund aims to take advantage of and dynamically allocate opportunities in the market not accessible to the money market industry. And the fund managers look for relative value opportunities in the U.S. while prioritizing capital preservation and liquidity.

The fund’s portfolio consists of about 60% bonds and 40% cash, with most holdings concentrated in 1.1% U.S. Treasury Notes. In addition to T-Notes, the fund holds positions in Federal Home Loan Banks, a series of government-sponsored banks offering liquidity to members of financial institutions to support housing finance and community investment.

Want to know more about portfolio rebalancing? Click here.

Source: BarChart.com.

2. American Century Short-Term Government Fund (TWUSX)

The American Century Short-Term Government Fund (TWUSX) comes in second place, with a 5.02% loss over the trailing 12-month period. With its 0.54% expense ratio and 0.89% yield, the fund is the highest-yielding option on our list.

The fund seeks high current income while safeguarding principal by investing in U.S. government securities, including U.S. Treasuries and other securities issued or guaranteed by the U.S. government and its agencies.

The fund’s portfolio holds T-Notes primarily, with an 11% allocation to those yielding 1.5%. Like the GMO U.S. Treasury Fund, the American Century Fund also has Federal Home Loan Banks notes. But like the GMO U.S. Treasury Fund, it holds only a 3% cash position.

Find funds suitable for your portfolio using our free Fund Screener.

Source: BarChart.com.

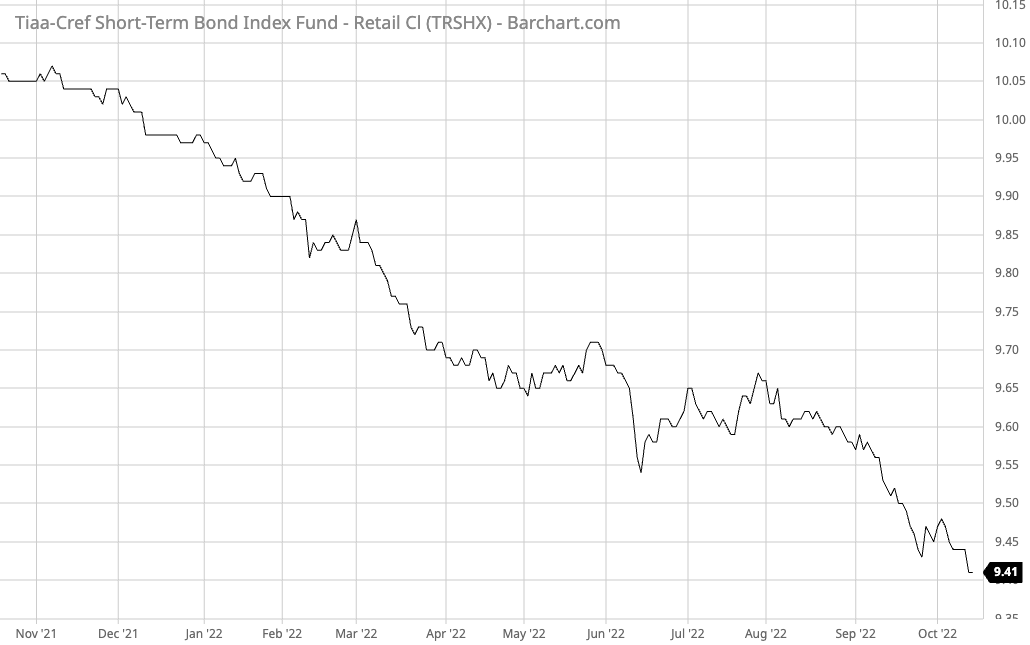

3. TIAA-CREF Short-Term Bond Index Fund (TRSHX)

The TIAA-CREF Short-Term Bond Index Fund (TRSHX) comes in third place with a 5.63% loss over the past 12 months. The fund’s 0.45% expense ratio and 0.55% yield puts it in the middle of the road among the funds on today’s list.

The fund seeks total return by investing in short-term investment-grade debt based on a short-term bond index. Using a quantitative model and a passive approach, the fund minimizes trading costs while providing broad market exposure and maintaining an average maturity of no more than three years.

Like the other funds on our list, T-Notes comprise most of the fund’s portfolio. However, the fund includes 0.5% or fewer allocations to corporate issuers, foreign government debt, and other securities.

Source: BarChart.com.

Learn more about different Portfolio Management concepts here.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

NOTE: Trailing one-year total returns as of October 13, 2022.