First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529.

In this edition, we look closely at trending Inverse Equity Funds. As the name implies, these funds aim to provide a total return that’s the inverse of a benchmark equity index. These funds became popular after a brutal September wiped out the S&P 500 index’s impressive gains between July and mid-August. While the market improved in October, investors are hardly out of the woods yet, and inverse equity funds could offer some downside protection.

Be sure to check out the Inverse Equity Funds page to find out more about the other funds in this category as well.

Trending Funds

The Grizzly Short Fund (GRZZX) took first place with a 30.25% trailing 12-month total return. With its 2.98% expense ratio, the fund comes close to being the most expensive on today’s list.

The fund seeks capital appreciation by identifying stocks the fund managers expect will decline in price and shorting them. With its active approach, the fund managers carefully select sectors and companies they believe will underperform. While they seek to be 100% short at all times, they don’t use futures, options, or other leverage instruments.

Currently, the fund’s most prominent short positions focus on consumer discretionary (13%), industrials (12%), financials (10%), and healthcare (10%). But when comparing its short positions versus the S&P 500’s long positions, the fund’s most contrarian plays are in application software (8% vs. 2%) and healthcare equipment (7% vs. 3%).

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Federated Hermes Prudent Bear Fund (BEARX)

The Federated Hermes Prudent Bear Fund (BEARX) comes in second place with a 12.12% trailing 12-month total return. With a 3.01% expense ratio, it’s the most expensive fund on this week’s list, although closely matched with GRZZX.

The fund seeks capital appreciation primarily through short positions in domestically-traded equity securities and indices. In particular, the fund managers employ strategic short selling supported by an intensive security-by-security research process. The fund further aims to limit losses in bull markets using defined risk management strategies.

Currently, 96.7% of fund assets are short the S&P 500 index, and a further 4% are short individual equities, including mainly information technology and healthcare stocks. Meanwhile, the portfolio also includes 6.4% long equities, with overweight holdings in materials and consumer staples, which could help if October’s bull market continues.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

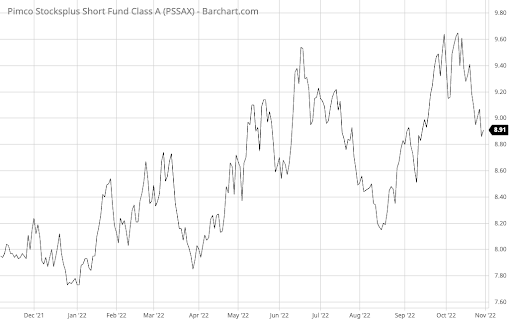

3. PIMCO StocksPLUS Short Fund (PSSAX)

The PIMCO StocksPLUS Short Fund (PSSAX) takes third place with a 10.62% trailing 12-month return. But with a 1.04% expense ratio, it’s the cheapest fund on this week’s list.

The fund provides passive short exposure to the S&P 500 index, along with an additional source of return potential. By selling forward contracts, the fund earns a financing rate in exchange for selling the index returns short. The strategy differs from the other two funds on today’s list that may incur borrowing costs when selling short.

The fund’s trailing 12-month yield is about 0.55%, which partially offsets the 1.04% expense ratio, making it a compelling option for investors who want to short the S&P 500 index. But, of course, these benefits may disappear when the S&P 500 index rises.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.