First, we select the top trending category from more than 200 categories listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending category. To ensure funds’ quality and staying power, we only look at those mutual funds with a minimum of $100 million in assets and a track record of at least three years. We also remove those mutual funds closed to new investors and unavailable for investment outside registered accounts such as retirement or 529. Fund performances are reported based on trailing 12-month total returns.

High interest rates have made bonds more attractive for new buyers, but the risk of an economic slowdown could jeopardize returns. For example, the recent move into investment-grade corporate bonds has some concerned that investors aren’t being compensated enough for the risk of a slowdown, which could lead to downgrades.

Short-term Treasuries could offer a near-term safe haven, protecting investors from recession-related risks while offering a reasonable yield. That said, short-term Treasury yields plummeted by more than onehalf percentage point earlier this month after the collapse of SVB and Signature Bank, a significant move by government standards.

Nevertheless, in this edition, we look closely at trending Government Bond Funds investors may want to consider for their fixed-income allocations.

Be sure to check out the Government Bond Funds page to learn more about the other funds in this category as well.

Trending Funds

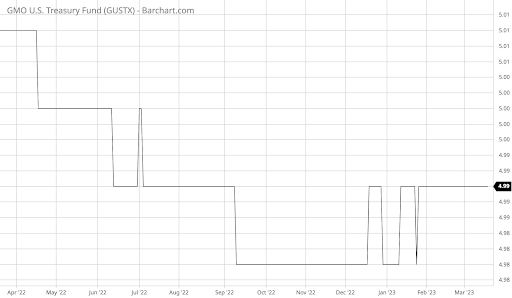

The GMO U.S. Treasury Fund (GUSTX) comes in first place with a 0.64% return over the past 12 months. With a 0.09% expense ratio and a 0.80% TTM yield, the fund is the top performing but lowest yielding fund on today’s list.

The ~$400 million fund seeks liquidity and safety of principal by investing in securities secured or backed by the full faith and credit of the U.S. government. Unlike money market securities, the fund aims to take advantage of and dynamically allocate between opportunities in the market with a focus on short-duration strategies.

Currently, the portfolio’s most significant holdings include 2.83% U.S. Treasury Notes (18.13%), 0.25% U.S. Treasury Notes (14.46%), and 0.13% U.S. Treasury Notes (13.30%). These bonds have a maturity date of fewer than three years into the future, limiting their exposure to potential rising interest rates over the coming months.

Want to know more about portfolio rebalancing? Click here.

Source: Barchart.com.

2. Vanguard Short-Term Treasury Index Fund (VSBSX)

The Vanguard Short-Term Treasury Index Fund (VSBSX) comes in second place with a -0.55% return over the past 12 months. With a 0.07% expense ratio and a 1.49% TTM yield, the fund is the cheapest and highest yielding option on our list.

The $20 billion fund invests in U.S. Treasuries (not including inflation-protected securities) with maturities between one and three years. As with the previous mutual fund, the fund has limited exposure to potential rising interest rates than longer duration funds. And the fund offers a compelling alternative to money market funds.

Currently, the fund has 94 bonds in its portfolio with a 4.8% yield to maturity, a 2.0% average coupon, and a 1.9-year average duration. The most significant holdings include Treasury Bonds and Treasury Notes, with coupon rates between 0.25% and 4.5%.

Find funds suitable for your portfolio using our free Fund Screener.

Source: Barchart.com.

3. TIAA-CREF Short-Term Bond Index Fund (TRSHX)

The TIAA-CREF Short-Term Bond Index Fund (TRSHX) comes in third place with a -0.67% trailing 12-month return. With a 0.45% expense ratio and a 1.21% yield, the fund is the most expensive option on today’s list.

Unlike the other funds on our list, TRSHX invests in more than 750 government and corporate bonds. While government bonds are AAA-rated, short-term corporate bonds have ratings as low as BBB. As a result, the portfolio may have higher credit risk than other funds on the list, although the low duration still limits interest rate risk.

Currently, the fund’s portfolio includes 76% government bonds and 23% corporate bonds. Within these segments, the fund holds 71% AAA-rated bonds, 13% A-rated bonds, and 11% BBB-rated bonds. And with more than 750 issuers, the portfolio has much more diversification than the other funds on today’s list.

Learn more about different Portfolio Management concepts here.

Source: Barchart.com.

The Bottom Line

Want to generate high income without undertaking too much risk? Check out our complete Best High Dividend Model Portfolio.

All data as of March 15, 2023.