While no agreement has been made, lawmakers in Washington and President Biden reported that they were confident that a deal could be reached and the U.S. would not default on its debt. House Speaker Kevin McCarthy told reporters that the House of Representatives could vote on a debt ceiling deal as soon as next week. With that, stocks moved higher towards the tail end of the week. However, the mood was still mixed on Wall Street. Amid a solid jobs market and slowing inflationary pressures, retail sales rebounded from two consecutive months of declines, with a 0.4% increase for April. Nonetheless, the increase was less than the 0.8% analysts were looking for. As expected, building permits declined by 1.5%, while housing starts unexpectedly increased 2.2% month-over-month. Meanwhile, energy storage information was also released by EIA, which showed build-ups in key energy commodities. Finally, a speech by Fed chairman Jerome Powell reiterated much of the central bank’s recent take on rates and inflation, offering no new clues as to its plans.

This week, all eyes will be on the Fed, with the release of the latest FOMC meeting minutes on Wednesday. The central bank has continued to signal that it plans to keep raising rates until inflation is down to its target 2% annual rate. However, growing speculation and changes to Fed speak have hinted that the bank may pause to see if its aggressive stance on rates is working. Investors will look for clues in the meeting minutes to see if that is happening. On the consumer front, personal income data for April will be released on Friday, with analysts expecting the metric to rise by 0.3% following two consecutive months of similar increases. Personal spending, which remained unchanged in March, is expected to post a 0.3% uptick for April. We’ll also get to see the latest durable goods report on Friday. While the metric surged 3.2% in March on a month-over-month basis, analysts now predict a 1.1% decline in April, highlighting recessionary pressures felt by manufacturers.

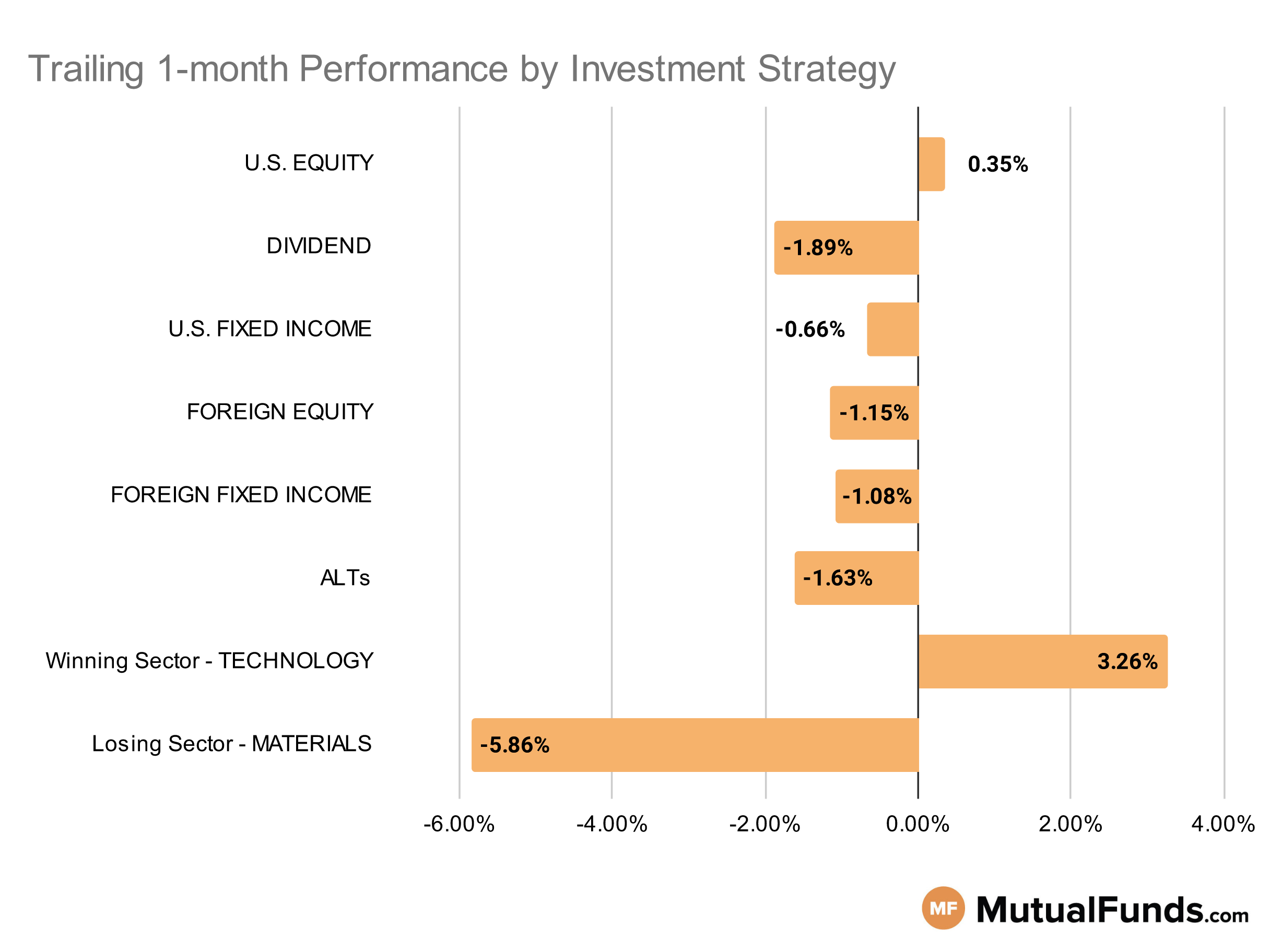

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

U.S Equity Strategies

In U.S. equities, growth strategies including those focused on large-cap equities outperformed others over the last trailing month. On the other hand, just like last week, small and mid cap strategies continued their struggle.

Winning

- Virtus AllianzGI Focused Growth Fund (PGWAX) , up 7.32%

- T. Rowe Price Institutional Large Cap Core Growth Fund (TPLGX), up 6.57%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , up 5.2%

- Fidelity® Nasdaq Composite Index® ETF (ONEQ), up 4.42%

Losing

- iShares Russell Mid-Cap Value ETF (IWS) , down -1.96%

- Schwab U.S. Large-Cap Value ETF™ (SCHV), down -2.38%

- Voya Russell Small Cap Index Portfolio (IRSIX) , down -6.57%

- Voya Russell Mid Cap Index Portfolio (IRMCX), down -13.03%

Dividend Strategies

When it comes to dividend income, sector and quality oriented dividend strategies won while larg cap dividend strategies lost over the trailing one month period.

Winning

- HCM Dividend Sector Plus Fund (HCMNX) , up 1.82%

- Amana Mutual Funds Trust Income Fund (AMANX), up 1.67%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW) , up 0.35%

- FlexShares Quality Dividend Index Fund (QDF), up 0.04%

Losing

- Columbia Dividend Opportunity Fund (RSDFX) , down -3.79%

- Federated Hermes Strategic Value Dividend Fund (SVAIX), down -5.75%

- First Trust Morningstar Dividend Leaders Index Fund (FDL) , down -6.57%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV), down -7.63%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on shorting longer duration US treasuries along with strategies focused on finding unique income opportunities benefited over the last trailing one month, while long-only strategies focused on longer duration corporate and government bonds continued to lose.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 2.41%

- AlphaCentric Income Opportunities Fund (IOFCX), up 0.82%

- GMO Opportunistic Income Fund (GMOLX) , up 0.82%

- iShares Floating Rate Bond ETF (FLOT), up 0.79%

Losing

- Templeton Global Bond Fund (TGBAX) , down -3.15%

- iShares 10+ Year Investment Grade Corporate Bond ETF (IGLB), down -3.34%

- PIMCO Extended Duration Fund (PEDPX) , down -3.37%

- SPDR® Portfolio Long Term Corporate Bond ETF (SPLB), down -3.41%

Foreign Equity Strategies

Among foreign equity strategies, small cap and Mexican and Japanese equities came out as the top performing strategies, while Chinese equities continued to remain on the losing end.

Winning

- iShares MSCI Mexico ETF (EWW) , up 4.1%

- JPMorgan BetaBuilders Japan ETF (BBJP), up 3.4%

- Matthews Japan Fund (MJFOX) , up 2.34%

- Frontier MFG Global Equity Fund (FMGEX), up 2.33%

Losing

- Voya International Index Portfolio (IIIAX) , down -5.09%

- Fidelity® China Region Fund (FHKCX), down -5.36%

- KraneShares Bosera MSCI China A ETF (KBA) , down -7.81%

- WisdomTree China ex-State-Owned Enterprises Fund (CXSE), down -8.65%

Foreign Fixed Income Strategies

Among foreign debt, while emerging market local currency based debt strategies continue to post marginal gains, some high yielding strategies from emerging markets lost.

Winning

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC) , up 0.6%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), up 0.52%

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX) , flat 0%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), down -0.4%

Losing

- PIMCO Emerging Markets Bond Fund (PEBCX) , down -1.5%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -1.83%

- Ashmore Emerging Markets Total Return Fund (EMKIX) , down -2.07%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), down -3.75%

Alternatives

Among alternative strategies, Japanese equity strategies continued to win. On the other end, gold and natural resource based strategies struggled.

Winning

- iShares Currency Hedged MSCI Japan ETF (HEWJ) , up 7.01%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 6.18%

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX) , up 4.18%

- Fidelity® Contrafund® Fund (FCNKX), up 3.24%

Losing

- PIMCO CommoditiesPLUS® Strategy Fund (PCLAX) , down -7.48%

- SPDR® S&P Global Natural Resources ETF (GNR), down -7.82%

- FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR) , down -8.2%

- Fidelity® Select Gold Portfolio (FSAGX), down -9.6%

Sectors

Among the various sectors,technology strategies continued to win over the last trailing month. However, precious metal strategies lost.

Winning

- Virtus AllianzGI Technology Fund (DRGTX) , up 7.29%

- iShares U.S. Technology ETF (IYW), up 7.13%

- iShares U.S. Home Construction ETF (ITB) , up 6.83%

- T. Rowe Price Global Technology Fund (PRGTX), up 6.81%

Losing

- Fidelity® Select Energy Portfolio (FSENX) , down -8.43%

- Franklin Gold and Precious Metals Fund (FGPMX), down -9.84%

- ETFMG Prime Junior Silver Miners ETF (SILJ) , down -12.58%

- Global X Copper Miners ETF (COPX), down -12.59%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietory system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and adequate track record, the system places a minimum threshold on net assets of $500 million. Fund performance data is calculated for the trailing one month, based on change in NAV.

Here is a summary of different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.