Conflicting news on a potential compromise sent a mixed message and helped stocks move lower four out of the five trading sessions in the week. However, towards the end of the week stocks jumped as investors became more hopeful of a deal. Investors were also paying attention to ongoing volatility in the market, with NVIDIA beating its latest earnings estimates and recording a jump of more than 20%. On the flips side, helping create a pessimistic mood on the street was the latest FOMC meeting minutes. Fed officials pointed towards uncertainty, with several governors expressing that the economy was moving in-line with their expectations. That view was countered by others, who pointed to the need for further rate hikes.

Next week, thanks to the Memorial Day holiday, the markets will feature a shortened trading period. Aside from any continued debt ceiling drama, labor and employment trends will be on investors’ minds. Several pieces of key labor data will be released, starting with the latest JOLTs report on Wednesday. The number of available jobs has slipped in recent weeks, but still sits north of 9 million, suggesting a robust labor market. The number for April is also expected to remain above the 9 million mark. The most recent official unemployment data highlights the strong momentum in the labor market, clocking in at 3.4% in April and matching a 50-year low. On Friday, analysts expect May’s rate to slightly tick up to 3.5%. The labor participation rate also has continued to grow, with May’s figure expected to be still below pre-pandemic figures. Also on Friday, we’ll get to see the official non-farm payrolls number. While April’s number showed a big upswing, whereby private companies added 230,000 jobs, May’s number is expected to come in around 170,000.

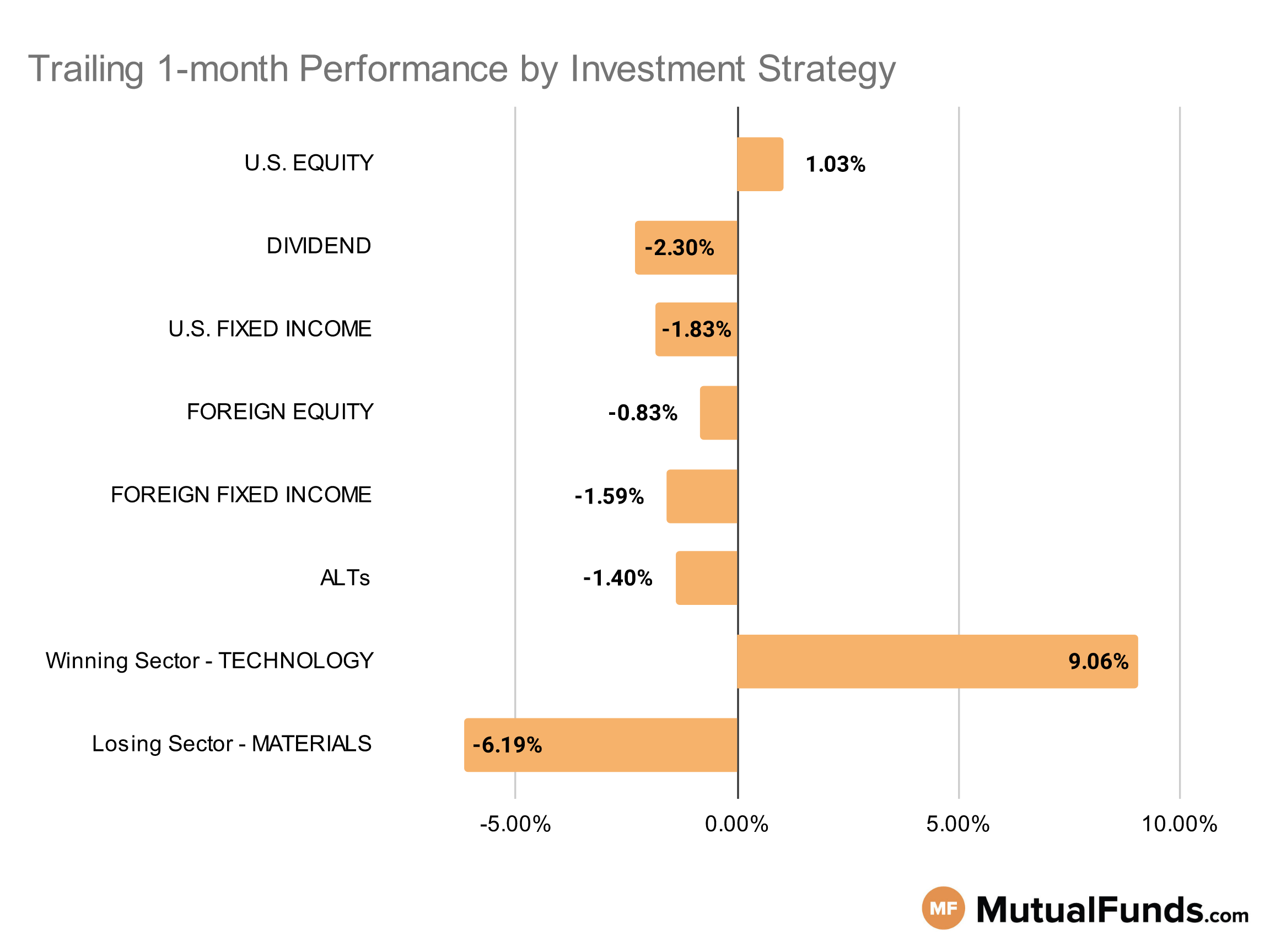

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

U.S Equity Strategies

In U.S. equities, growth strategies outperformed others over the last trailing month. On the other hand, just like last week, small and mid cap strategies continued their struggle.

Winning

- Fidelity Advisor® Growth Opportunities Fund (FAGAX) , up 10.05%

- Virtus Zevenbergen Innovative Growth Stock Fund (SCATX), up 9.99%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , up 8.51%

- Fidelity® Nasdaq Composite Index® ETF (ONEQ), up 7.6%

Losing

- iShares Russell Mid-Cap Value ETF (IWS) , down -2.44%

- Schwab U.S. Large-Cap Value ETF™ (SCHV), down -3.49%

- Voya Russell Small Cap Index Portfolio (IRSIX) , down -5.51%

- Voya Russell Mid Cap Index Portfolio (IRMCX), down -12.99%

Dividend Strategies

When it comes to dividend income, sector and quality oriented dividend strategies won while high dividend strategies lost over the trailing one month period.

Winning

- HCM Dividend Sector Plus Fund (HCMNX) , up 4.01%

- Vanguard Diversified Equity Fund (VDEQX), up 2.5%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW) , up 0.35%

- FlexShares Quality Dividend Index Fund (QDF), up 0.32%

Losing

- Neuberger Berman Equity Income Fund (NBHAX) , down -4.24%

- WisdomTree U.S. High Dividend Fund (DHS), down -6.32%

- Federated Hermes Strategic Value Dividend Fund (SVAIX) , down -6.55%

- Invesco S&P Ultra Dividend Revenue ETF (RDIV), down -6.96%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on shorting longer duration US treasuries along with strategies focused on finding unique income opportunities benefited over the last trailing one month, while high yield muni bond and long-only bond strategies continued to lose.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 6.7%

- iShares Convertible Bond ETF (ICVT), up 1.15%

- AlphaCentric Income Opportunities Fund (IOFCX) , up 1.05%

- Calamos Market Neutral Income (CVSIX), up 0.7%

Losing

- iShares 20+ Year Treasury Bond ETF (TLT) , down -6.25%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -7.9%

- PIMCO Extended Duration Fund (PEDPX) , down -8.11%

- VanEck Vectors High Yield Muni ETF (HYD), down -25%

Foreign Equity Strategies

Among foreign equity strategies, Brazilian and Taiwanese equity strategies came out as the top performing strategies, while international real estate and Chinese equities struggled.

Winning

- iShares MSCI Brazil ETF (EWZ) , up 6.63%

- iShares MSCI Taiwan ETF (EWT), up 6.5%

- PGIM Jennison Emerging Markets Equity Opportunities Fund (PDEZX) , up 4.21%

- Delaware Emerging Markets Fund (DEMRX), up 3.94%

Losing

- Oberweis International Opportunities Institutional Fund (OBIIX) , down -4.14%

- SPDR® S&P China ETF (GXC), down -5.15%

- SPDR® Dow Jones International Real Estate ETF (RWX) , down -5.19%

- Voya International Index Portfolio (IIIAX), down -6.62%

Foreign Fixed Income Strategies

Among foreign debt, while emerging market local currency based debt strategies continue to post marginal gains, international treasury strategies lost.

Winning

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX) , up 0.14%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 0.04%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , down -0.67%

- SEI Institutional Investments Trust Emerging Markets Debt Fund (SEDAX), down -0.72%

Losing

- Ashmore Emerging Markets Total Return Fund (EMKIX) , down -2.08%

- PIMCO Emerging Markets Bond Fund (PEBCX), down -2.24%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX) , down -3.35%

- iShares International Treasury Bond ETF (IGOV), down -3.69%

Alternatives

Among alternative strategies, Japanese hedged strategies continued to win. On the other end, gold and natural resource based strategies struggled.

Winning

- WisdomTree Japan Hedged Equity Fund (DXJ) , up 7.98%

- iShares Currency Hedged MSCI Japan ETF (HEWJ), up 7.8%

- Fidelity® Contrafund® Fund (FCNKX) , up 4.88%

- AQR Managed Futures Strategy Fund (AQMIX), up 4.84%

Losing

- SPDR® S&P Global Natural Resources ETF (GNR) , down -6.16%

- PIMCO Commodity Real Return Strategy Fund (PCRIX), down -6.41%

- FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR) , down -6.58%

- Fidelity® Select Gold Portfolio (FSAGX), down -11.05%

Sectors

Among the various sectors, technology strategies, especially semiconductors continued to win over the last trailing month. However, real estate, gold and silver strategies lost.

Winning

- Fidelity® Select Semiconductors Portfolio (FSELX) , up 18.51%

- VanEck Vectors Semiconductor ETF (SMH), up 17.45%

- Fidelity Advisor® Semiconductors Fund (FIKGX) , up 16.41%

- iShares PHLX Semiconductor ETF (SOXX), up 14.62%

Losing

- Sprott Gold Equity Fund (SGDLX) , down -8.6%

- Franklin Gold and Precious Metals Fund (FGPMX), down -10.51%

- ETFMG Prime Junior Silver Miners ETF (SILJ) , down -12.43%

- iShares Mortgage Real Estate Capped ETF (REM), down -14.29%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietory system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and adequate track record, the system places a minimum threshold on net assets of $500 million. Fund performance data is calculated for the trailing one month, based on change in NAV.

Here is a summary of different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.