But in recent weeks, the rally has shown signs of expanding beyond tech giants as investors rethink the potential for a recession. Higher interest rates haven’t taken the toll many investors thought they would, and fears of an imminent downturn are starting to fade. Some investors have been reconsidering mid-cap growth stocks and other beaten-down sectors.

In this edition, we look at trending Mid-Cap Growth Equity Funds you can leverage to capitalize on an economic rebound.

Be sure to check out the Mid-Cap Growth Equity Funds page to explore all mutual funds, index ETFs, and active ETFs that can provide you exposure to this theme.

Top Performing Funds

The Transamerica Mid Cap Growth Fund (MCGAX) is top on our list with a 16.77% trailing 12-month return. But with a 1.23% expense ratio, it’s also the most expensive fund on our list.

The fund invests in a concentrated portfolio of high-conviction growth stocks using a disciplined strategy with a long-term orientation, a bias against cyclicality, and an emphasis on growth sectors. In particular, the managers target innovation, regulation, and demographic trends while taking a more prominent position in established growth sectors.

Currently, the $372 million portfolio consists of 31 stocks concentrated in information technology (26.53%), healthcare (24.59%), and consumer discretionary (12.49%), and primarily based in the U.S. (90%). The most significant individual components include Electronic Arts (4.87%), BWX Technologies (4.73%), and Freshpet Inc. (4.59%).

Source: BarChart.com.

2. Discovery SMID Cap Growth Fund (WFDAX)

The Discovery SMID Cap Growth Fund (WFDAX) comes in second with a 14.83% trailing 12-month return. With a 1.21% expense ratio, the fund is middle-of-the-road in terms of expense.

The fund managers seek to identify companies on the ‘right side of change’ using a non-formulaic approach to idea generation. In particular, they develop a bottom-up fundamental ‘edge’ through all-cap ‘surround company’ research. In addition, they balance risk across core holdings, developing situations, and valuation opportunities.

Currently, the $1.36 billion portfolio is concentrated in information technology (26.53%), industrials (22.18%), and healthcare (21.46%). The most significant holdings include Teledyne Technologies (2.72%), Casella Waste Systems (2.67%), and MercadoLibre (2.29%), reflecting a broader approach than the previous fund.

Source: BarChart.com.

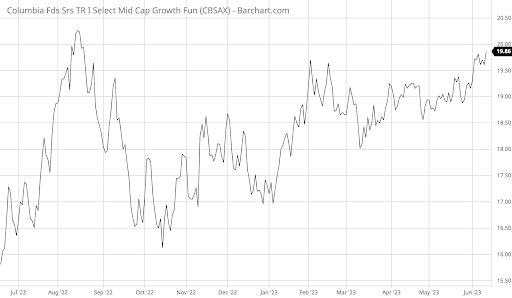

3. Columbia Select Mid Cap Growth Fund (CBSAX)

The Columbia Select Mid Cap Growth Fund (CBSAX) rounds out the list with a 13.74% return over the past 12 months. With a 1.13% expense ratio and no yield, the fund is the cheapest option on today’s list.

The fund managers leverage an intensive, bottom-up approach to invest in companies large enough to deliver stability but small enough to have significant growth potential. These companies typically operate within a favorable market structure with high barriers to entry and enjoy structural growth tailwinds over the intermediate to long term.

Currently, the $1.4 billion fund holds a concentrated portfolio of 57 companies in information technology (26.59%), healthcare (19.54%), and industrials (19.44%). The most significant components include West Pharmaceutical Services (3.7%), Cadence Design Systems (3.41%), and Bio-Techne (3.29%).

Source: BarChart.com.

The Bottom Line

All data as of June 8, 2023.

Methodology

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those funds with a minimum of $100 million in assets and a track record of at least one year.

When considering mutual funds, we ignore funds that are either closed to new investors or are unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.