As optimism regarding Chinese stimulus dwindled, profit-taking led to a dip in stocks on Tuesday. However, Federal Reserve Chairman Jerome Powell’s statement to Congress about being close to peak interest rates sparked a bullish response, leading to a rebound. His indication that the tightening period might end soon was seen in a positive light. The economic data throughout the week included several Energy Information Administration (EIA) storage reports, suggesting minor increases in natural gas and gasoline stocks. A hint from FedWatch tools about a potential pause at the upcoming Federal Reserve meeting, given the easing inflation and overall economic conditions, also shaped the market dynamics.

Looking ahead to the next week, the focus will be on several key economic data. Starting with the Durable Goods Orders on Tuesday, a decline of 0.9% is predicted after a 1.1% rise in April, reflecting concerns about a possible recession. The ISM Manufacturing PMI is also anticipated to reflect a contraction in industrial activity, with a predicted increase to 49 from May’s 46.9. In contrast, personal spending is expected to rise by 0.4%, suggesting that consumers are still spending, albeit not on major items. Additionally, personal income figures are projected to rise by 0.3%, to be reported on Friday. The week will conclude with the Fed’s preferred inflation measure, the United States Core PCE Price Index, which is expected to marginally drop to 0.3% in May after a spike in April, suggesting a possible easing in Fed’s stringent interest rate stance.

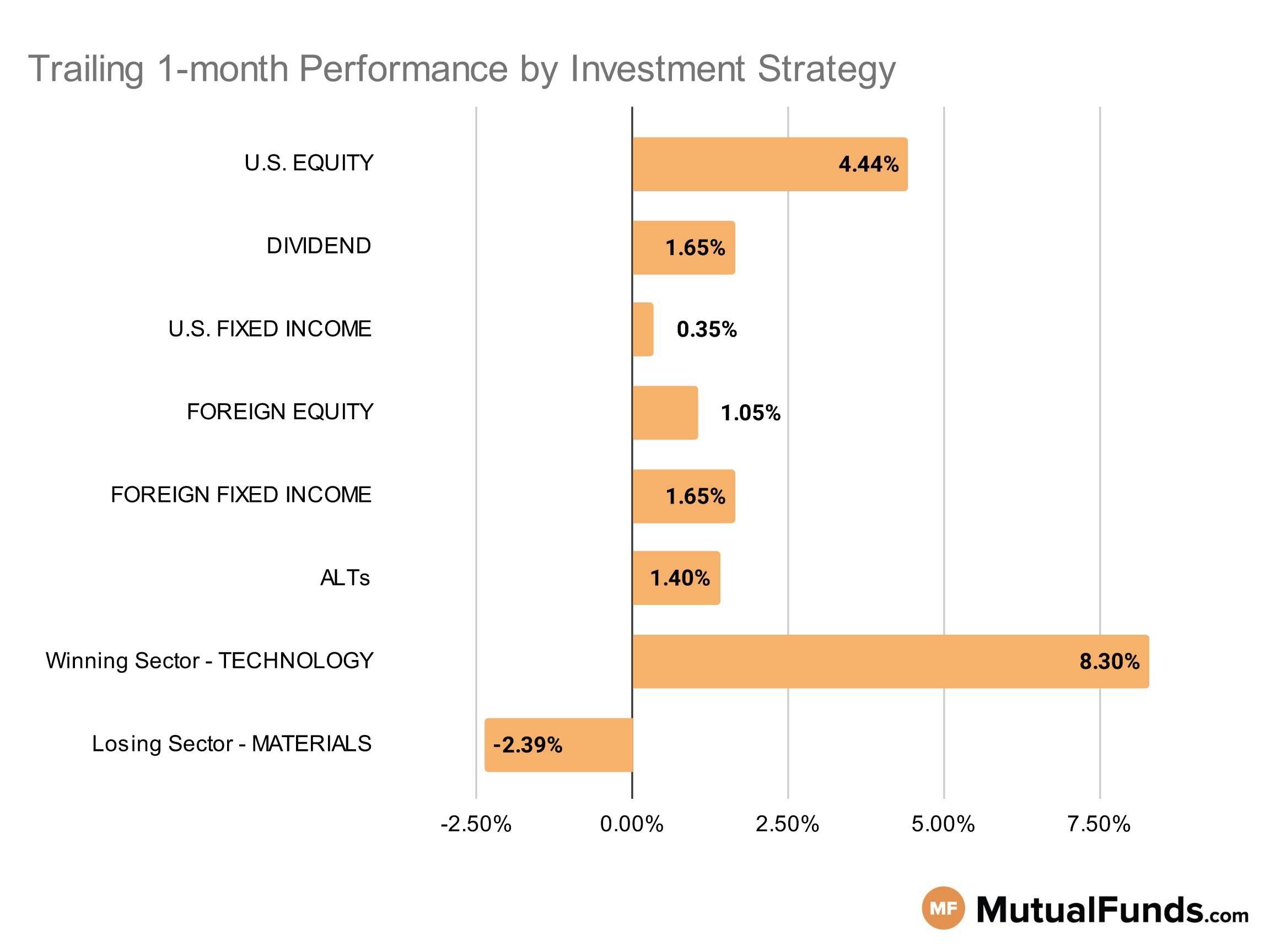

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

U.S Equity Strategies

In U.S. equities, large-cap growth strategies outperformed others over the last trailing month. On the other end, small-cap value strategies struggled.

Winning

- Edgewood Growth Fund (EGFIX) , up 9.45%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG), up 9.02%

- Vanguard Mega Cap Growth Index Fund (VMGAX) , up 8.92%

- Fidelity® Nasdaq Composite Index® ETF (ONEQ), up 8.43%

Losing

- SPDR® S&P 600 Small Cap Value ETF (SLYV) , up 1.93%

- Invesco S&P SmallCap 600 Revenue ETF (RWJ), up 1.68%

- Columbia Mid Cap Index Fund (NMPAX) , up 0.97%

- Columbia Small Cap Value Fund II (CRRRX), down -0.31%

Dividend Strategies

When it comes to dividend income, quality dividend strategies came up on top while international dividend strategies lost.

Winning

- Vanguard Diversified Equity Fund (VDEQX) , up 5.36%

- WisdomTree U.S. Quality Dividend Growth Fund (DGRW), up 5.07%

- FlexShares Quality Dividend Index Fund (QDF) , up 4.09%

- Vanguard Dividend Growth Fund (VDIGX), up 3.39%

Losing

- Vanguard Equity Income Fund (VEIRX) , up 1.2%

- Thornburg Investment Income Builder Fund (TIBAX), up 0.4%

- First Trust Dow Jones Global Select Dividend Index Fund (FGD) , down -0.91%

- SPDR® S&P International Dividend ETF (DWX), down -1.29%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on covertibles and high yielding municipal bonds emerged as winners, while intermmediate duration treasury strategies remained on the losing end.

Winning

- iShares Convertible Bond ETF (ICVT) , up 4.45%

- SPDR® Nuveen S&P High Yield Municipal Bond ETF (HYMB), up 2.67%

- Eaton Vance High Yield Municipal Income Fund (EIHYX) , up 2.29%

- Eaton Vance National Municipal Income Fund (EANAX), up 1.99%

Losing

- Vanguard Intermediate-Term Treasury Index Fund (VIIGX) , down -1.12%

- iShares 3-7 Year Treasury Bond ETF (IEI), down -1.13%

- Vanguard Intermediate Term Treasury Fund (VFIUX) , down -1.2%

- ProShares Short 20+ Year Treasury (TBF), down -2.24%

Foreign Equity Strategies

Among foreign equity strategies, Latin American and emerging market strategies did well, while Swiss strategies lost ground.

Winning

- iShares MSCI Brazil ETF (EWZ) , up 9.96%

- iShares Latin America 40 ETF (ILF), up 9.11%

- Causeway Emerging Markets Fund (CEMIX) , up 5.89%

- Delaware Emerging Markets Fund (DEMRX), up 4.91%

Losing

- Causeway International Value Fund (CIVIX) , up 0.91%

- Columbia Overseas Value Fund (COSZX), down -0.69%

- iShares MSCI Switzerland ETF (EWL) , down -3.87%

- SPDR® Dow Jones International Real Estate ETF (RWX), down -4.59%

Foreign Fixed Income Strategies

Among foreign debt, while emerging market and high yield debt strategies posted gains, internatioal treasury strategies struggled to post any significant gains.

Winning

- VanEck Emerging Markets High Yield Bond ETF (HYEM) , up 2.94%

- Eaton Vance Emerging Markets Local Income Fund (EEIIX), up 2.53%

- Eaton Vance Emerging Markets Local Income Fund (EEIIX) , up 2.53%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 2.01%

Losing

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , up 0.76%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), up 0.4%

Alternatives

Among alternatives, Japanese hedged equity strategies continue to outperform. On the other end, cannabis and natural resource focussed strategies lost ground.

Winning

- WisdomTree Japan Hedged Equity Fund (DXJ) , up 10.26%

- iShares Currency Hedged MSCI Japan ETF (HEWJ), up 8.08%

- SEI Institutional Managed Trust Global Managed Volatility Fund (SVTAX) , up 1.12%

- SEI Institutional Managed Trust Global Managed Volatility Fund (SVTAX), up 1.12%

Losing

- Vanguard Mortgage-Backed Securities Index Fund (VMBSX) , flat 0%

- Vanguard Mortgage-Backed Securities Index Fund (VMBSX), flat 0%

- SPDR® S&P Global Natural Resources ETF (GNR) , down -1.47%

- ETFMG Alternative Harvest ETF (MJ), down -7.25%

Sectors

Among the sectors, technology strategies, especially semiconductors continued to win over the last trailing month. However, platinum and palladium strategies struggled.

Winning

- VanEck Vectors Semiconductor ETF (SMH) , up 14.33%

- iShares PHLX Semiconductor ETF (SOXX), up 12.45%

- Vanguard Information Technology Index Fund (VITAX) , up 9.57%

- Vanguard Industrials Index Fund (VINAX), up 6.65%

Losing

- Vanguard Energy Fund (VGENX) , down -0.24%

- Vanguard Energy Index Fund (VENAX), down -1.51%

- Aberdeen Standard Physical Palladium Shares ETF (PALL) , down -11.5%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT), down -12.48%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietory system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and adequate track record, the system places a minimum threshold on net assets of $100 million. Fund performance data is calculated for the trailing one month, based on change in NAV.

Here is a summary of different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.