The S&P 500 rose more than 14% since the beginning of the year, but almost all those gains stem from AI-focused tech stocks. Investors seeking markets with a broader rally may want to consider international exposure. Argentina, Turkey, and other countries have seen significant growth across large swaths of their economies.

Higher commodity prices and a weaker dollar have helped boost many Latin American countries, shielding them from the effects of inflation and easing their dollar-denominated debt burdens. Meanwhile, recent election polls in Brazil, Argentina, and Guatemala favor centrist politicians who could bring stability to their economies.

At the same time, Turkey, Greece, and other European economies have seen strong returns over the past year. While Turkey may struggle to recover from a devastating earthquake, Greece’s stocks have risen following the New Democracy party’s successes in national elections that could draw foreign investors back into the country’s markets.

In this edition, we look at trending International Equity Funds you can leverage to capitalize on opportunities outside of the U.S.

Be sure to check out the International Equity Funds page to explore all mutual funds, index ETFs, and active ETFs that can provide you exposure to this theme.

Trending Funds

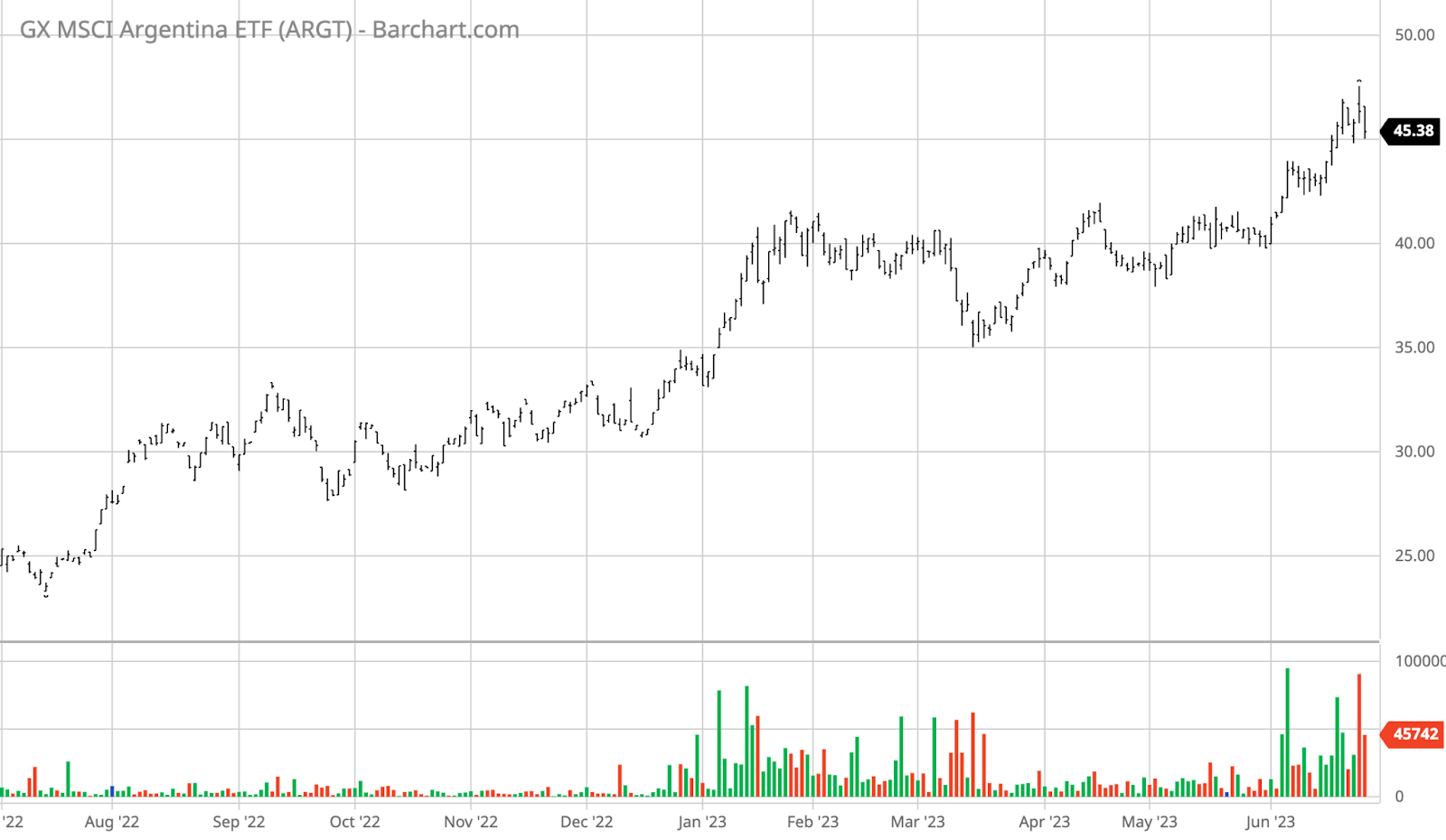

1. Global X MSCI Argentina ETF (ARGT)

The Global X MSCI Argentina ETF (ARGT) comes in first place with an 82.38% return over the trailing 12-month period. With a 0.59% expense ratio and 2.08% yield, the fund offers low expenses and a relatively attractive yield.

Argentina’s stock market rose to its highest levels since 2019 ahead of the national presidential primaries in August. After markets collapsed in 2020, cheap valuations, strong fundamentals, and the upcoming election have led to a surge in optimism. As a result, many investors are betting that the country could see a new bull market near-term.

The fund’s largest holdings include MercadoLibre Inc. (17.59%), YPF SA (9.83%), and Grupo Galici (9.00%). And, of course, MercadoLibre has seen strong performance, rising 62% over the past 12 months. Meanwhile, the largest sector exposures include consumer discretionary (28.1%), consumer staples (15.7%), and financials (13.6%).

Source: BarChart.com.

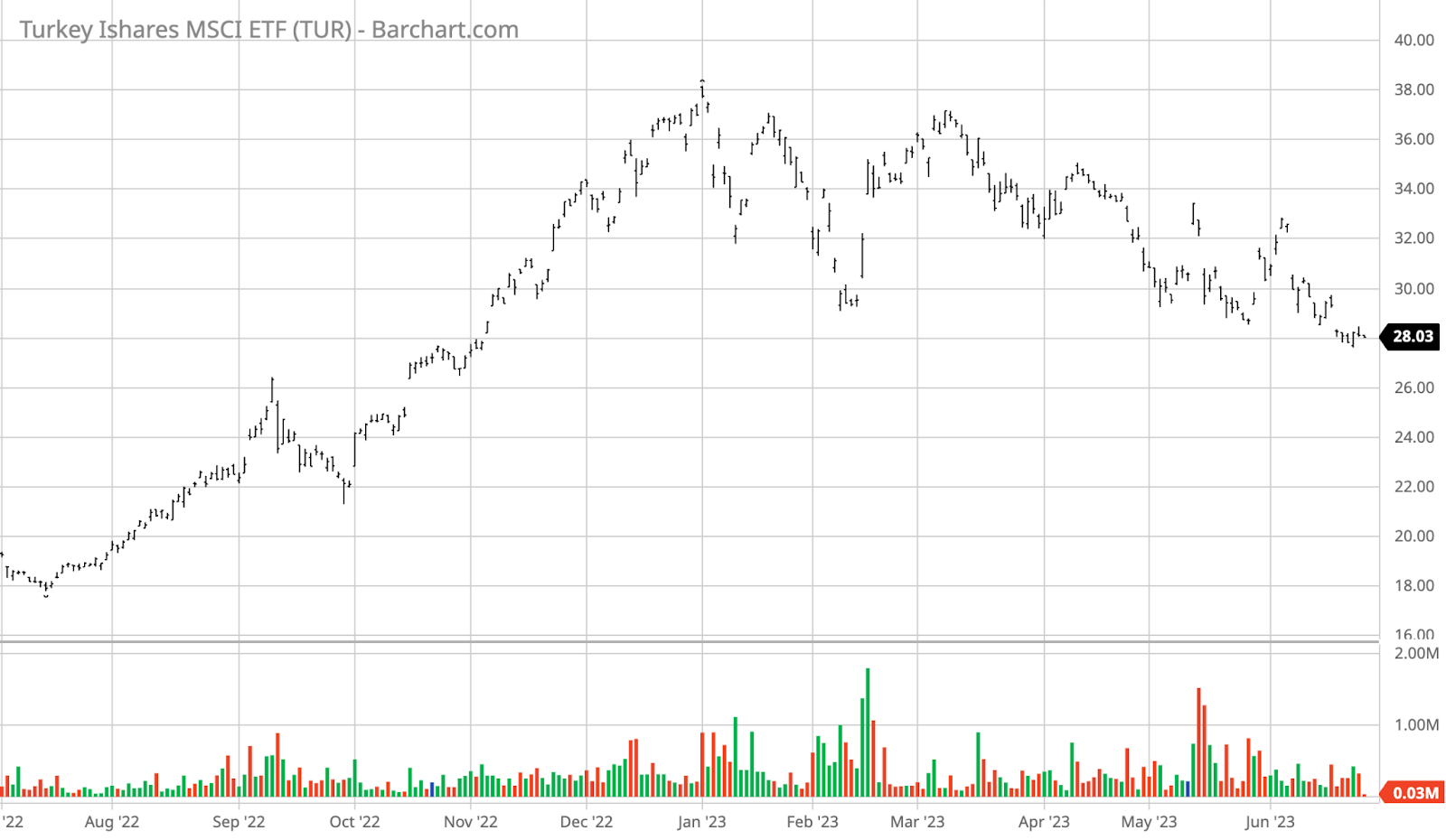

2. iShares MSCI Turkey ETF (TUR)

The iShares MSCI Turkey ETF (TUR) comes in second place with a 53.37% return over the trailing 12-month period. With a 0.58% expense ratio and a 2.38% yield, the fund also offers a relatively low expense and strong yield in today’s market.

Turkey’s stock market soared between July 2022 and January 2023 as President Erdogan cut interest rates despite rising inflation. Since a devastating earthquake earlier this year, the stock market hasn’t been able to recover and has continued its move lower. As a result, its outlook is much less certain than the other funds on our list.

The fund has the strongest exposure toward industrials (29.42%), materials (18.81%), and financials (15.58%), offering investors a different sector profile than the previous Argentina ETF. Meanwhile, the largest individual holdings include Kurk Hava (7.30%), KOC Holding (5.88%), and BIM Birlesik Magazalar (5.77%).

Source: BarChart.com.

3. Global X MSCI Greek ETF (GREK)

The Global X MSCI Greek ETF (GREK) comes in third place with a respectable 53.02% return over the past 12 months. With a 0.57% expense ratio and 2.20% yield, the fund is comparable in expense and yield to the other funds on our list.

Earlier this week, the New Democracy party’s Kyriakos Mitsotakis decisively won the general election and promised to implement investor-friendly policies over his tenure. As a result, investors already betting on a market-friendly win sent the fund’s shares even higher, signaling foreign investors may have more interest in the country.

The fund includes outsized exposure to financials (31.9%), industrials (18.7%), and consumer discretionary (13.8%), meaning investors are betting big on the country’s banking sector. Meanwhile, the largest individual holdings include Eurobank Ergasia (10.54%), Mytilineos (8.65%), and Hellenic Telecom (8.06%).

Source: BarChart.com.

The Bottom Line

International equities could allow investors to invest in a broader rally than the U.S. stock market. However, many of the catalysts driving the funds on our list higher are speculative, making diversification essential to reduce risk. That said, long-term geopolitical changes could help propel Argentinian and Greek stocks higher over the long term.

All data as of June 22, 2023.

Methodology

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those funds with a minimum of $100 million in assets and a track record of at least one year.

When considering mutual funds, we ignore funds that are either closed to new investors or are unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.