India recently surpassed China as the world’s most populous country, with more than 1.4 billion people. While it’s currently the fifth-largest economy in the world, Prime Minister Narendra Modi’s growth plans aim to put it on par with the U.S.,China, and the European Union. And many analysts don’t think it’s an implausible goal.

India’s gross domestic product grew by 6.1% in the first quarter, with investment rising to its highest share of GDP in over a decade. While protectionism and sectarianism could jeopardize its success, Goldman Sachs predicts that its existing growth will help it overtake the EU economy by 2050 and the U.S. economy by 2075.

The country is also a leading exporter of talent, with 281 million migrants worldwide. In America, almost 80% of Indian migrants over school age have at least an undergraduate degree and earn a median household income of almost $150,000 per year. As a result, India wields more ‘soft power’ than many other countries via its diaspora.

In this edition, we look at trending India Equity Funds you can leverage to capitalize on opportunities outside of the U.S.

Be sure to check out the India Equity Funds page to explore all mutual funds, index ETFs, and active ETFs that can provide you exposure to this theme.

Trending Funds

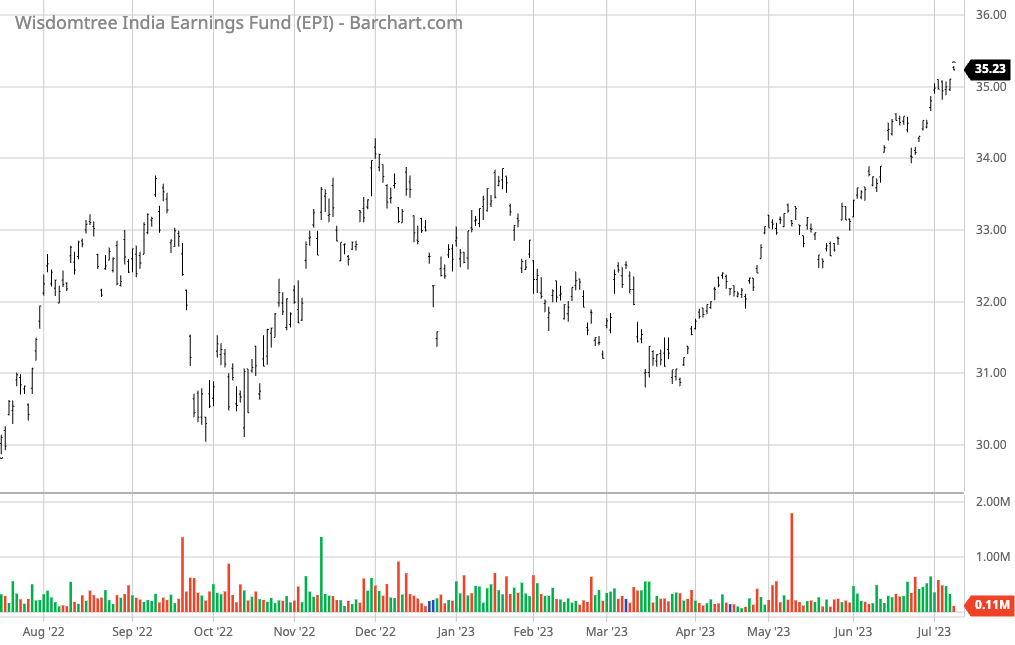

1. WisdomTree India Earnings ETF (EPI)

The WisdomTree India Earnings ETF (EPI) comes in first place with a 17.10% return over the trailing 12-month period. With a 0.84% expense ratio and a 0.17% 12-month yield, the fund offers the highest yield at a reasonable expense.

The fund focuses on companies with positive trailing 12-month earnings that meet market cap and liquidity requirements. Then, the managers weigh the portfolio by earnings to provide exposure to the fastest-growing and most profitable companies in the country. Unlike market cap-weighted funds, this strategy can help reduce concentration risks.

Currently, the portfolio holds 420 equities, with diverse exposure to materials (23.72%), energy (18.04%), financials (16.07%), and information technology (11.20%). The largest holdings include companies like Reliance Industries Ltd. (7.06%), Tata Steel Ltd. (6.22%), ICICI Bank Ltd. (4.21%), and Infosys Ltd. (3.63%).

Source: BarChart.com.

2. iShares MSCI India Small-Cap ETF (SMIN)

The iShares MSCI India Small-Cap ETF (SMIN) comes in second place with a 15.99% trailing 12-month return. With its 0.74% expense ratio and 0.08% 12-month yield, the fund is the cheapest option on our list.

The fund focuses on small public companies in India, which could offer more growth potential than larger companies. After all, it’s easier to double $10 million in revenue than $10 billion in revenue. While these companies are inherently riskier, the fund holds a diversified portfolio of more than 400 stocks to help mitigate any individual risk factors.

Currently, the portfolio offers diverse exposure to several industries, including industrials (21.55%), materials (18.99%), financials (16.91%), and consumer discretionary (12.57%). The largest holdings include Cummins India Ltd. (1.23%), IDFC First Bank Ltd. (1.21%), Ashok Leyland Ltd. (1.13%), and Persistent Systems Ltd. (1.10%).

Source: BarChart.com.

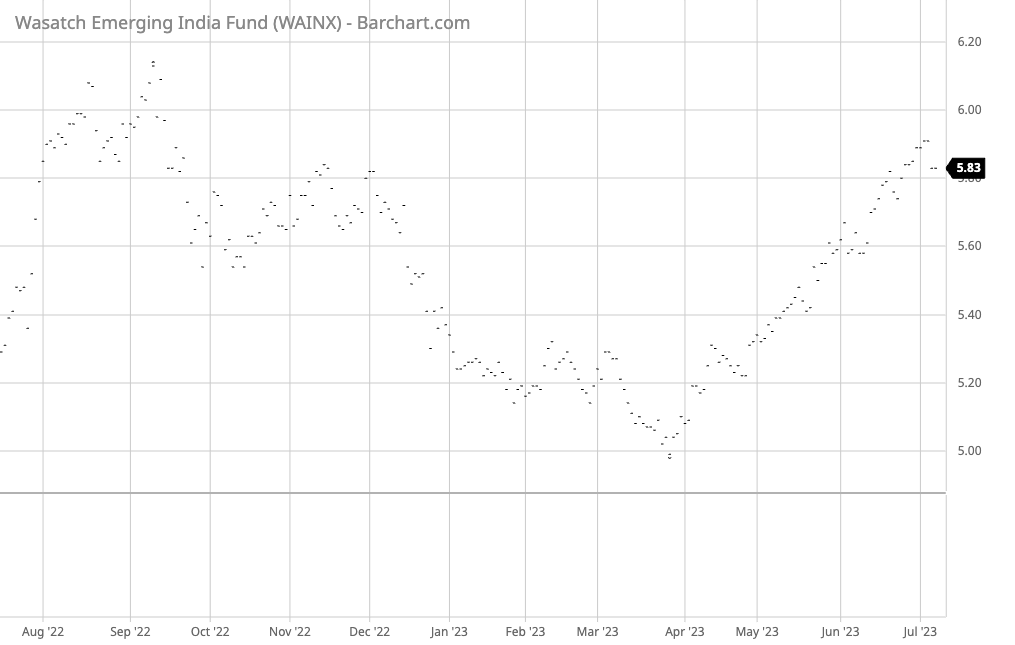

3. Wasatch Emerging India Investor (WAINX)

The Wasatch Emerging India Investor Fund (WAINX) rounds out the list with a 12.34% trailing 12-month return. As the only mutual fund on our list, it’s the most costly option with a 1.51% expense ratio but offers active management.

The fund uses a bottom-up approach to identify companies with outstanding long-term growth potential. In particular, the managers look for strong financials, a sustainable competitive advantage, industry-leading management teams, and earnings growth greater than the relevant sector or industry.

The portfolio consists of 20 to 60 positions (currently 27), with a concentration in financials (36.2%), industrials (13.8%), healthcare (13.3%), and information technology (11.6%). The largest holdings include companies like HDFC Bank Ltd. (9.7%), Bajaj Finance Ltd. (9.5%), Elgi Equipments Ltd. (8.1%), and AU Small Finance Bank Ltd. (7.6%).

Source: BarChart.com.

The Bottom Line

There’s little doubt that India has tremendous growth potential, and many investors are looking to increase exposure. The funds on our list provide an excellent starting point for exposure to earnings growth, small-cap stocks, or an actively managed portfolio, depending on your investment goals, risk tolerance, and other objectives.

All data as of July 6, 2023.

Methodology

MutualFunds.com analyzes the search patterns of our visitors every two weeks to find the top trending funds. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

First, we select the top trending theme from more than 200 themes listed on MutualFunds.com based on the percentage increase in monthly viewership. Then, we choose the top three funds with the highest one-year trailing total returns from the top trending theme. To ensure funds’ quality and staying power, we only look at those funds with a minimum of $100 million in assets and a track record of at least one year.

When considering mutual funds, we ignore funds that are either closed to new investors or are unavailable for investment outside registered accounts such as retirement or 529.

Fund performances are reported based on trailing 12-month total returns.