Led by technology and other high-growth sectors, stocks spent much of the last week trending higher.

The primary reason for the advance was moderating inflationary figures. Due to the effects of the Fed’s monetary tightening, the latest CPI report showed that year-over-year inflation has now dipped to just 3%, down from 4% in May and below economist estimates. This sent expectations of another Fed rate hike lower and investors began thinking that the central bank may truly be nearly finished with its campaign of rate hikes. However, the producer price index (PPI) increased by 0.1% month-over-month in June, reversing the declining trend seen last month. Finally, consumers continued to feel bullish about their prospects with lower inflation and a still strong labor market, with the preliminary University of Michigan consumer sentiment report for July coming in at 72.6. This marked the second consecutive month of increase, reaching the highest level since September 2021 and underscoring an overall trend of increased confidence in the consumer economy.

Heading into the dog days of summer, investors will get a slight break next week in terms of the sheer amount of economic data to be digested. However, what is being released next week should be strong indicators of economic strength, overall at least. Starting on Tuesday, we’ll get to see the latest month-over-month retail sales figures, which unexpectedly rose 0.3% in May for the second month of increases. Analysts now expect consumer spending to continue growing by 0.3% in June as inflation continues to moderate. Measures of manufacturing activity are expected to be lower, with industrial production in June estimated to marginally rise by 0.1% on a month-over-month basis, following a 2% dip in May. Investors will also continue to see the effect of high interest rates on the housing market. Building permits shot up by 5.6% in May, after declining for two months. On Wednesday, analysts are predicting declining figures for June. At the same time, housing starts– which jumped by 21% month-over-month in May on the back of lower building costs– are expected to decline in June. Finally, investors will focus on the initial jobless numbers on Friday, which have moderated after the series of tech layoffs at the beginning of the year.

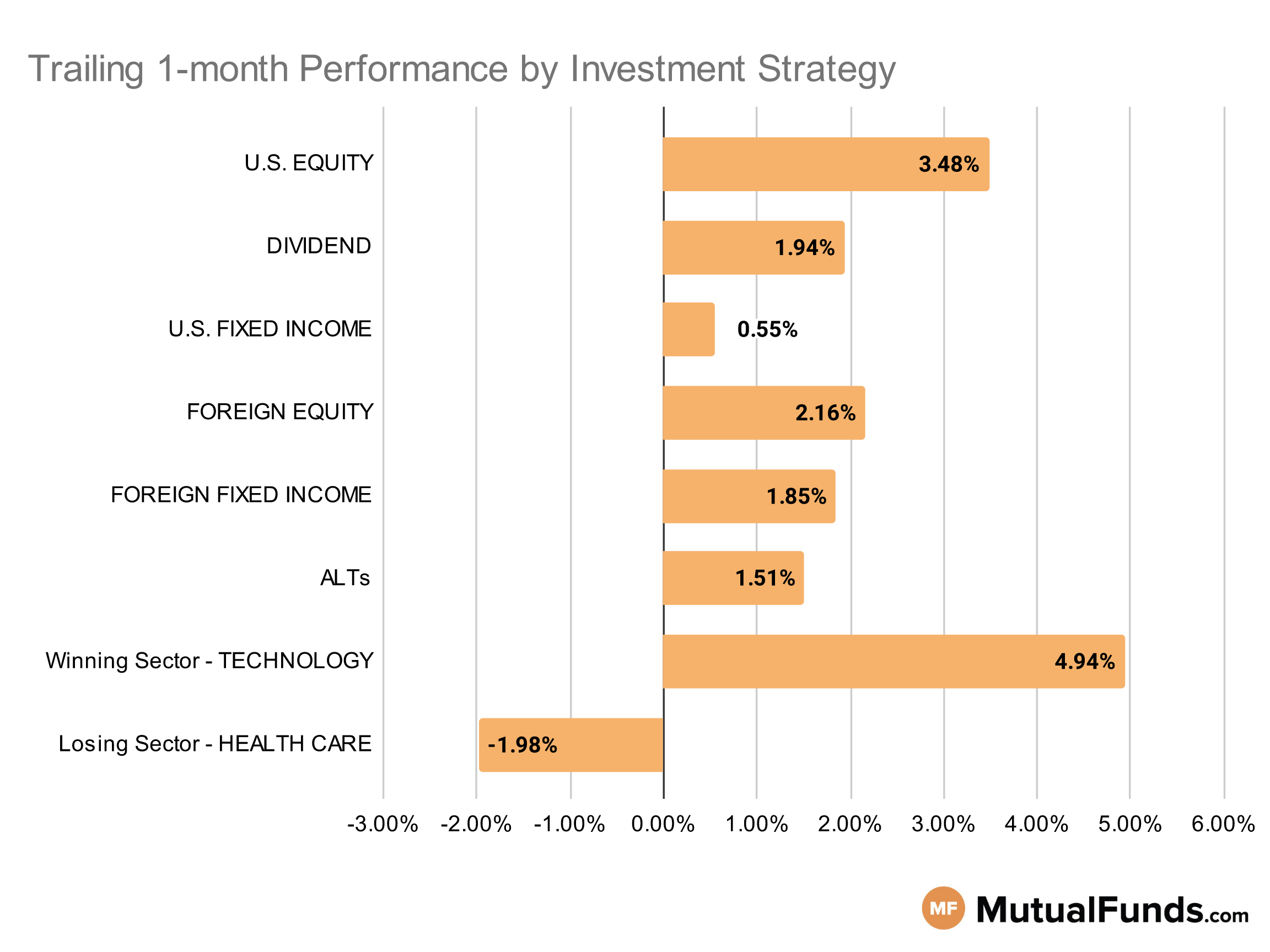

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Technology and Italian equity strategies performed well over the last trailing month. Meanwhile, healthcare, including biotech, strategies struggled.

U.S Equity Strategies

In U.S. equities, growth strategies continued to outperform well-diversified strategies.

Winning

- Touchstone Sands Capital Select Growth Fund (TSNCX) , up 6.43%

- Virtus Zevenbergen Innovative Growth Stock Fund (SCATX), up 6.21%

- First Trust US Equity Opportunities ETF (FPX) , up 5.13%

- iShares Russell Mid-Cap ETF (IWR), up 5.11%

Losing

- iShares Micro-Cap ETF (IWC), down -0.27%

- Emerald Growth Fund (HSPGX) , down -1.18%

- Voya U.S. Stock Index Portfolio (INGIX), down -6.14%

Dividend Strategies

When it comes to dividend income, sector and diversified strategies came up on top while small-cap and global dividend strategies struggled.

Winning

- HCM Dividend Sector Plus Fund (HCMNX) , up 5.16%

- Invesco BuyBack Achievers ETF (PKW), up 4.36%

- Vanguard Diversified Equity Fund (VDEQX) , up 4.01%

- WisdomTree U.S. MidCap Dividend Fund (DON), up 3.64%

Losing

- Janus Henderson Global Equity Income Fund (HFQAX) , down -0.97%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), down -1.33%

U.S. Fixed Income Strategies

In US fixed income, strategies focused on long duration and convertible debt emerged as winners, while municipal debt strategies struggled.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX) , up 4.36%

- iShares Convertible Bond ETF (ICVT), up 3.45%

- Fidelity Advisor® New Markets Income Fund (FNMIX) , up 2.53%

- SPDR® Portfolio Long Term Corporate Bond ETF (SPLB), up 1.93%

Losing

- VanEck Investment Grade Floating Rate ETF (FLTR) , down -0.08%

- ProShares Short 20+ Year Treasury (TBF), down -1.53%

- Nuveen High Yield Municipal Bond Fund (NHCCX) , down -1.59%

- Blackrock Strategic Municipal Opportunities Fund Of Blackrock Municipal Series Trust (MAMTX), down -1.63%

Foreign Equity Strategies

Among foreign equity strategies, Italian equity strategies performed well, while European equity strategies lost ground.

Winning

- iShares MSCI Italy ETF (EWI) , up 7.98%

- iShares MSCI France ETF (EWQ), up 5.66%

- Longleaf Partners International Fund (LLINX) , up 5.62%

- Artisan Developing World Fund (APHYX), up 4.86%

Losing

- T. Rowe Price Japan Fund (RJAIX) , down -1.19%

- Royce International Premier Fund (RYIPX), down -1.43%

- WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) , down -1.98%

- Xtrackers MSCI Europe Hedged Equity ETF (DBEU), down -4.13%

Foreign Fixed Income Strategies

Among foreign debt, while international treasury and emerging market debt strategies continue to perform well.

Winning

- iShares International Treasury Bond ETF (IGOV) , up 3.33%

- American Funds Emerging Markets Bond Fund (EBNFX), up 3.1%

- Invesco International Bond Fund (OIBIX) , up 2.76%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 2.76%

Losing

- Stone Harbor Emerging Markets Debt Fund (SHMDX), down -0.43%

Alternatives

Among alternatives, commodity focused strategies continue to outperform. On the other end, strategies focused on heding exposure to EAFE (Europe, Australasia, and the Far East) equities lost ground.

Winning

- iShares S&P GSCI Commodity-Indexed Trust (GSG) , up 6.48%

- ETFMG Alternative Harvest ETF (MJ), up 6.45%

- PIMCO CommoditiesPLUS® Strategy Fund (PCLAX) , up 5.96%

- PIMCO Commodity Real Return Strategy Fund (PCRIX), up 4.39%

Losing

- Abbey Capital Futures Strategy Fund (ABYIX) , down -1.62%

- American Beacon AHL Managed Futures Strategy Fund (AHLYX), down -2.04%

- iShares Currency Hedged MSCI EAFE ETF (HEFA) , down -2.46%

- Xtrackers MSCI EAFE Hedged Equity ETF (DBEF), down -5.04%

Sectors

Among the sectors, blockchain and oil services equity strategies emerged as the primary winners over the last trailing month. However, biotech strategies struggled.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 35.25%

- VanEck Oil Services ETF (OIH), up 18.37%

- American Beacon ARK Transformational Innovation Fund (ADNYX) , up 12.13%

- Baron Real Estate Fund (BREFX), up 7.15%

Losing

- Fidelity Advisor® Health Care Fund (FHCCX) , down -4.23%

- Fidelity® Select Health Care Services Portfolio (FSHCX), down -4.25%

- ProShares Short QQQ (PSQ) , down -5.15%

- SPDR® S&P Biotech ETF (XBI), down -6.15%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. To ensure quality and an adequate track record, the system places a minimum threshold on net assets of $100 million. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.