Last week, as expected, the Federal Reserve decided not to increase its policy interest rate, keeping the benchmark Fed Funds Rate at 5.5%, a 22-year high.

While market participants expected the move and initially drove stocks higher, Chairman Powell threw cold water on hopes for a dovish pivot. During his press conference, Powell mentioned that the central bank could raise rates at least one more time this year if inflation did not meet the Fed’s target. This continued to put pressure on high-flying tech stocks, despite successful IPOs of ARM, Instacart, and Klaviyo. For the week ending September 16, initial jobless claims clocked in at 201,000, lower than projections and highlighting a robust labor market. Meanwhile, cracks seem to be appearing in the housing market, with U.S. housing starts tumbling 11.3% to a seasonally-adjusted annual rate of 1.283 million units in August – the lowest level reported in three years. However, building permits unexpectedly surged, showing that homeowners have potentially incorporated higher mortgage rates into their plans. Meanwhile, heading into the weekend, the looming government shutdown weighed on equities and drove up bond yields.

After the Fed’s decision to pause interest rate hikes, next week investors will get a variety of data confirming whether or not this was the right decision. Chief among these statistics will be consumer spending and income data. Month-over-month, personal spending jumped by over 0.8% in July, the most since January. Analysts predict another strong jump of 0.6% when the latest data is revealed on Friday. Personal income data on Friday is also expected to increase, reflecting the strong labor market. On Friday, investors will also closely monitor the latest reading of the Core PCE (personal consumption expenditure) Index – the Federal Reserve’s preferred measure of inflation. While the measure showed a 0.2% month-over-month increase in July, analysts expect a similar rise in August that would indicate that the Fed’s path of rate hikes is working. Earlier during the week, investors will also get to see the final GDP growth reading for the second quarter. On Thursday, the final reading is expected to come in at 2.1%, the same as the second estimate reported in late August.

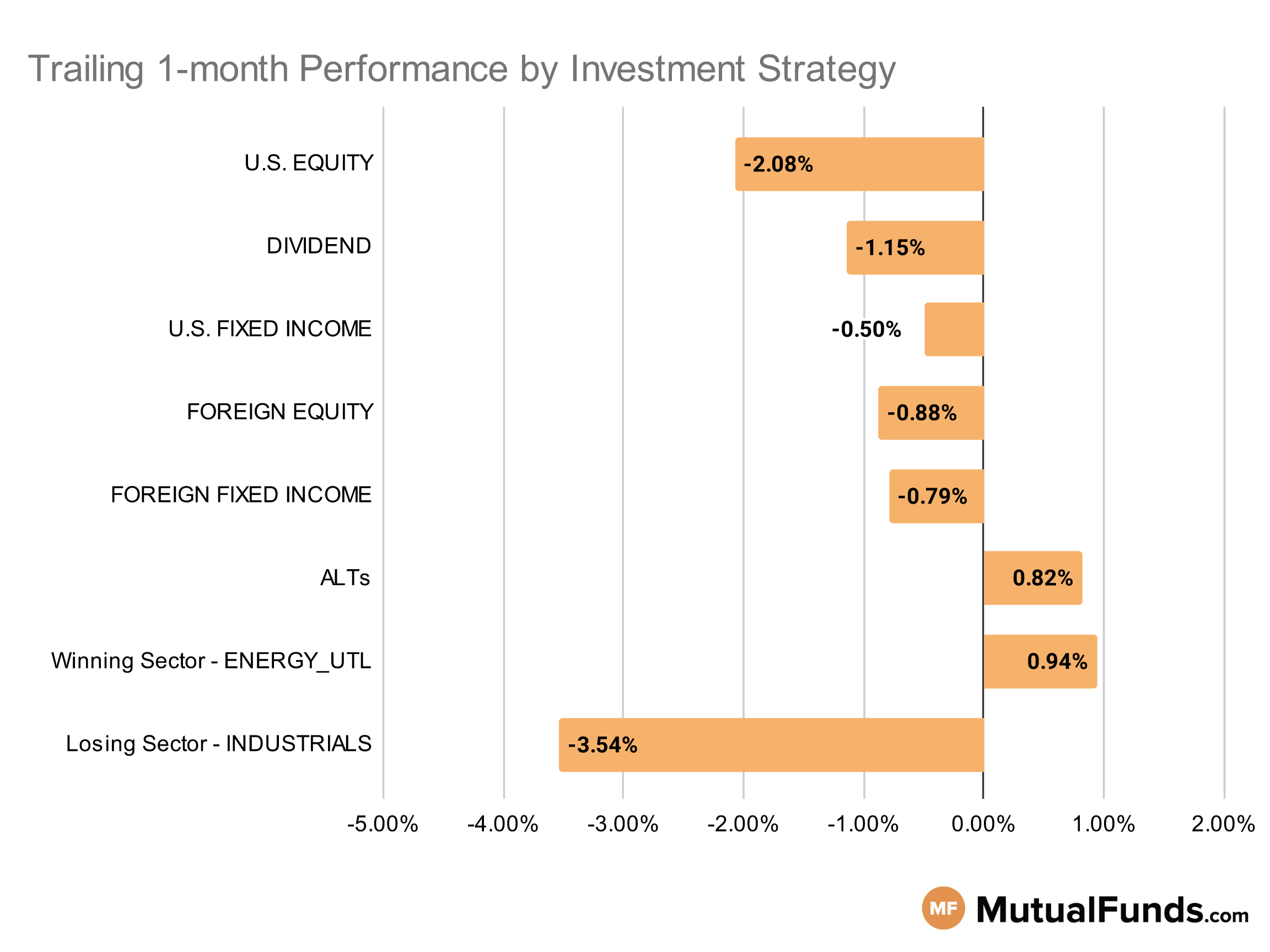

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets were slightly down for the rolling month.

Several canabis ETFs continue to outperform others on a rolling month basis. Japanese equity and energy strategies also posted positive performances. At the same time, strategies focused on long-duration bonds and small caps continued to struggle.

U.S Equity Strategies

Several growth strategies continue to post better performance than their value counterparts.

Winning

Losing

- Schwab Fundamental U.S. Large Company Index ETF (FNDX) , down -0.86%

- iShares Core S&P U.S. Value ETF (IUSV), down -1.05%

- iShares Russell 2000 Growth ETF (IWO) , down -4.26%

- iShares Micro-Cap ETF (IWC), down -5.04%

- Fidelity® SAI U.S. Value Index Fund (FSWCX) , down -8.58%

- Hartford MidCap HLS Fund (HIMCX), down -8.96%

Dividend Strategies

Global dividend strategies posted better performance than US-based small-cap and dividend growth strategies.

Winning

- First Trust Dow Jones Global Select Dividend Index Fund (FGD) , up 2.25%

- Thornburg Investment Income Builder Fund (TIBAX), up 1.79%

- Janus Henderson Global Equity Income Fund (HFQAX) , up 0.85%

- SPDR® S&P International Dividend ETF (DWX), up 0.3%

Losing

- ALPS Sector Dividend Dogs ETF (SDOG) , down -2.92%

- Principal Small-MidCap Dividend Income Fund (PMDIX), down -3.05%

- ProShares Russell 2000 Dividend Growers ETF (SMDV) , down -3.67%

- Hartford Dividend and Growth HLS Fund (HIADX), down -9.44%

U.S. Fixed Income Strategies

In US fixed income, floating rate and interest rate hedging strategies continue to perform better than longer duration strategies.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 2.16%

- Franklin Floating Rate Daily Access Fund (FCFRX), up 1.18%

- City National Rochdale Fixed Income Opportunities Fund (RIMOX) , up 1.04%

- iShares Interest Rate Hedged Long-Term Corporate Bond ETF (IGBH), up 0.88%

Losing

- PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund (LTPZ) , down -2.58%

- iShares 20+ Year Treasury Bond ETF (TLT), down -2.71%

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , down -3.5%

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), down -4.4%

Foreign Equity Strategies

Japanese equity and international value strategies performed well over the trailing month, while international small-cap, European, and Saudi Arabian equity strategies struggled.

Winning

- iShares International Select Dividend ETF (IDV) , up 3.46%

- JPMorgan BetaBuilders Japan ETF (BBJP), up 3.34%

- Fidelity® SAI International Value Index Fund (FIWCX) , up 2.72%

- DFA International Value III Portfolio (DFVIX), up 2.57%

Losing

- SPDR® EURO STOXX 50 ETF (FEZ) , down -3.47%

- iShares MSCI Saudi Arabia ETF (KSA), down -3.92%

- PGIM Jennison International Opportunities Fund (PWJQX) , down -5.25%

- Brown Capital Management International Small Company Fund (BCSVX), down -5.36%

Foreign Fixed Income Strategies

Foreign government bond and emerging market high-yield bond strategies continue to perform better than emerging market local currency-based bond strategies.

Winning

- DFA World ex U.S. Government Fixed Income Portfolio (DWFIX) , up 0.73%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 0.67%

- T. Rowe Price Emerging Markets Bond Fund (PREMX) , up 0.24%

Losing

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -0.61%

- T. Rowe Price International Bond Fund (PAIBX) , down -1.47%

- PIMCO Emerging Markets Local Currency and Bond Fund (PELPX), down -1.57%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , down -2.1%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -2.45%

Alternatives

Among alternatives, cannabis-focused strategies performed better than volatility and contrarian strategies.

Winning

- ETFMG Alternative Harvest ETF (MJ) , up 24.24%

- WisdomTree Japan Hedged Equity Fund (DXJ), up 7.48%

- PIMCO CommoditiesPLUS® Strategy Fund (PCLAX) , up 5.21%

- PIMCO RAE Worldwide Long/Short PLUS Fund (PWLBX), up 3.58%

Losing

- VanEck Vectors Agribusiness ETF (MOO) , down -1.44%

- Putnam Convertible Securities Fund (PCONX), down -1.55%

- Invesco S&P SmallCap Low Volatility ETF (XSLV) , down -1.82%

- Janus Henderson Contrarian Fund (JCNCX), down -3.1%

Sectors

Among the sectors, cannabis-focused strategies continue to outperform others by a significant margin. Real estate and clean energy strategies struggled.

Winning

- AdvisorShares Pure US Cannabis ETF (MSOS) , up 55.09%

- Global X Uranium ETF (URA), up 11.27%

- Fidelity® Select Energy Portfolio (FSENX) , up 3.3%

- First Eagle Gold Fund (FEGIX), up 2.94%

Losing

- Fidelity® Real Estate Investment Portfolio (FRESX) , down -7.14%

- Fidelity® Select Defense & Aerospace Portfolio (FSDAX), down -7.47%

- ARK Genomic Revolution ETF (ARKG) , down -9.18%

- Invesco WilderHill Clean Energy ETF (PBW), down -9.46%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.