The broader markets lacked direction last week as economic data releases and market news continued to spur volatility.

The Israel-Hamas issues persisted, sending oil prices higher as the conflict escalated. Bond yields climbed once again as both geopolitical concerns and comments by Fed Chair Jerome Powell indicated more rate hikes, sending investors out of fixed income and into cash. Further accelerating that move was a strong retail sales report. Consumer spending has been a bright spot for the economy, with September’s retail sales rising 0.7%, easily surpassing estimates of 0.3%. Additionally, permits for new construction clocked in higher than expected, while housing starts also surprised to the upside. Industrial production figures for September also increased by 0.3%, beating expectations. Finally, the labor market is as healthy as ever, with initial jobless claims for the week ending October 14 coming in at just 198,000, well below previous figures and estimates of 210,000.

Next week, investors will see the release of several pieces of key economic data, including the gross domestic product (GDP) growth rate for the third quarter. GDP rose by an annualized rate of 2.1% in the second quarter of 2023, marginally lower than first quarter numbers. Analysts are currently expecting the third quarter GDP growth rate to nearly double and come in at 4% on Thursday, as the effects of lower inflationary pressures and expanding manufacturing activity are factored in. Speaking of manufacturing activity, on Thursday we’ll see the month-over-month durable goods orders report, which is expected to show a rise of 1% in September, beating last month’s tepid 0.2% growth. Consumers are also expected to be in good health, with personal income and spending expected to rise by 0.4% on Friday. But investors aren’t out of the woods just yet in terms of market volatility-inducing data. The Fed’s favorite measure of inflation, the Core PCE Price Index, will be released on Friday. Analysts expect the month-over-month number to rise by 0.3% in September, indicating a rise compared to the last three readings.

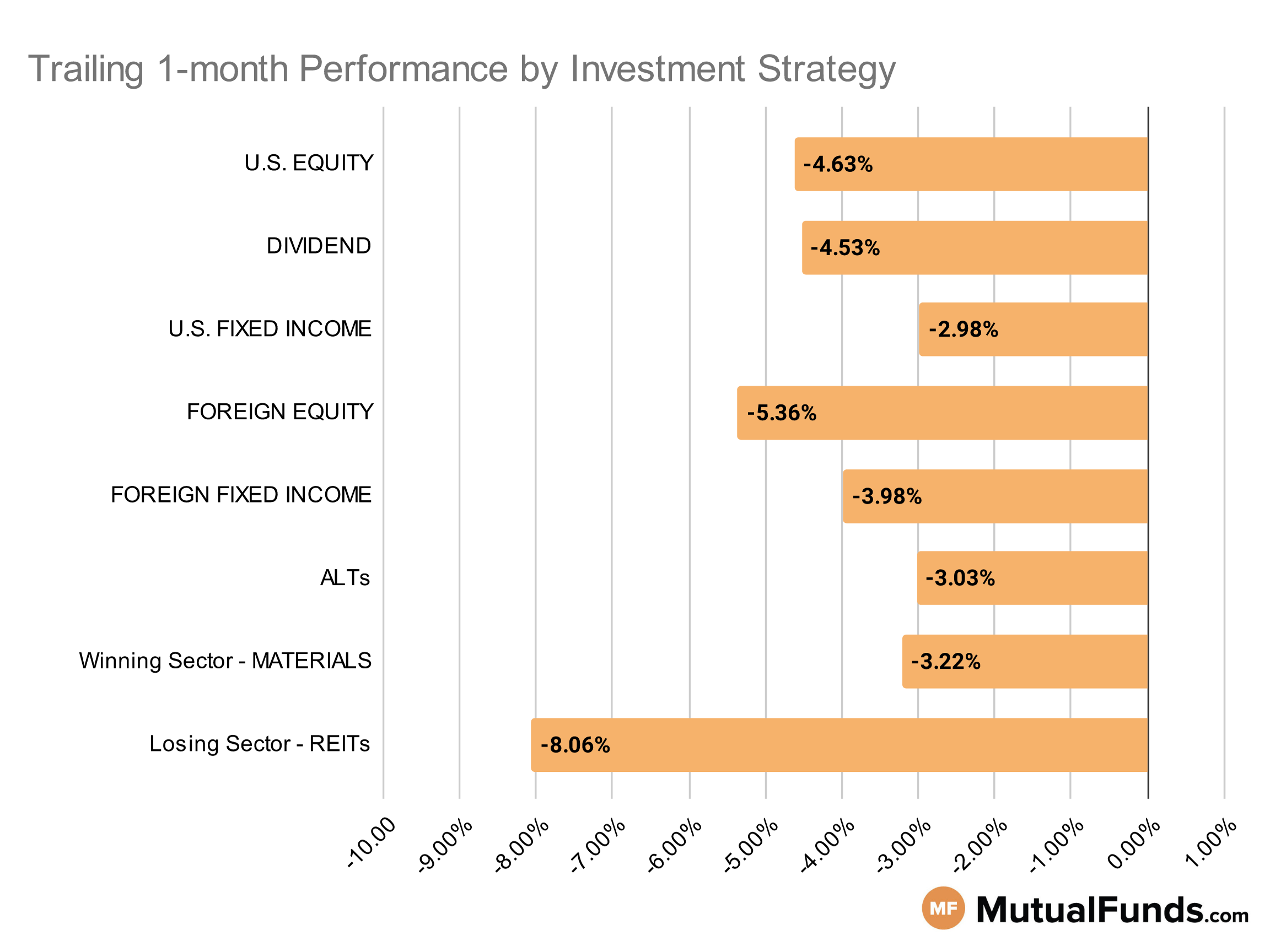

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets were slightly down for the rolling month.

Strategies focused on shorting long-term U.S. treasuries and healthcare stocks continue to outperform other strategies for the rolling month, while Russian equity and cannabis-focused strategies struggled.

U.S Equity Strategies

None of the key U.S equity strategies managed to post any significant gains over the trailing one month, with several growth strategies continuing with their struggles.

Losing

- Amana Mutual Funds Trust Growth Fund (AMIGX) , down -1.36%

- T. Rowe Price Large-Cap Growth Fund (TRLGX), down -1.81%

- Schwab U.S. Large-Cap Growth ETF™ (SCHG) , down -2.56%

- Franklin LibertyQ U.S. Equity ETF (FLQL), down -3.02%

- iShares Russell 2000 Growth ETF (IWO) , down -7.44%

- iShares Micro-Cap ETF (IWC), down -8.1%

- Vulcan Value Partners Small Cap Fund (VVISX) , down -10.7%

- Gabelli Small Cap Growth Fund (GABSX), down -14.4%

Dividend Strategies

None of the key dividend strategies posted positive performance over the trailing month.

Losing

- Eaton Vance Dividend Builder Fund (EVTMX) , down -2.53%

- BNY Mellon Equity Income Fund (DQIRX), down -2.79%

- FlexShares Quality Dividend Index Fund (QDF) , down -2.95%

- O’Shares U.S. Quality Dividend ETF (OUSA), down -3.51%

- Principal Small-MidCap Dividend Income Fund (PMDIX) , down -6.36%

- First Trust Dow Jones Global Select Dividend Index Fund (FGD), down -6.37%

- HCM Dividend Sector Plus Fund (HCMNX) , down -6.49%

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL), down -6.93%

U.S. Fixed Income Strategies

In US fixed income, strategies to short US long term treasuries performed better than long-only fixed income strategies over the rolling one month.

Winning

- ProShares Short 20+ Year Treasury (TBF) , up 11.24%

- iShares Floating Rate Bond ETF (FLOT), up 0.39%

- DFA One Year Fixed Income Portfolio (DFIHX) , up 0.2%

- JPMorgan Strategic Income Opportunities Fund (JSOSX), up 0.17%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL) , down -10.04%

- iShares 20+ Year Treasury Bond ETF (TLT), down -10.81%

- PIMCO Extended Duration Fund (PEDPX) , down -16.09%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -16.27%

Foreign Equity Strategies

None of the key foreign equity strategies managed to post any significant gains over the trailing one-month

However Indian equity strategies managed to limit losses, unlike Mexican and Russian equity strategies that lost significant ground.

Losing

- WisdomTree India Earnings Fund (EPI) , down -1.05%

- Fidelity® Emerging Asia Fund (FSEAX), down -1.31%

- Fidelity Advisor® Emerging Asia Fund (FEAAX) , down -1.38%

- iShares MSCI India ETF (INDA), down -1.49%

- T. Rowe Price Japan Fund (RJAIX) , down -9.19%

- Artisan International Small-Mid Fund (APHJX), down -9.43%

- iShares MSCI Mexico ETF (EWW) , down -11.67%

- VanEck Vectors Russia ETF (RSX), down -50%

Foreign Fixed Income Strategies

None of the foreign fixed income strategies posted gains over the trailing one month, with emerging market debt strategies struggling the most.

Losing

- iShares International Treasury Bond ETF (IGOV) , down -2.57%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), down -2.67%

- T. Rowe Price International Bond Fund (PAIBX) , down -2.68%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -3.02%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , down -4.14%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -5.55%

- John Hancock Funds Emerging Markets Debt Fund (JEMIX) , down -5.69%

- Stone Harbor Emerging Markets Debt Fund (SHMDX), down -5.89%

Alternatives

Among alternatives, some managed futures strategies continues to post marginal gains. However, cannabis, preferred stock and mortgage based strategies continued to struggle.

Winning

- AQR Managed Futures Strategy Fund (AQMIX) , up 1.95%

- PIMCO TRENDS Managed Futures Strategy Fund (PQTIX), up 1.86%

Losing

- IQ Merger Arbitrage ETF (MNA) , down -0.44%

- Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF (BCI), down -0.55%

- Fidelity Advisor® Mortgage Securities Fund (FIKUX) , down -5.27%

- Janus Henderson Contrarian Fund (JCNCX), down -7.7%

- SPDR® ICE Preferred Securities ETF (PSK) , down -8.85%

- ETFMG Alternative Harvest ETF (MJ), down -21.46%

Sectors

Among the sectors, healthcare strategies outperformed, while clean energy strategies continued to struggle.

Winning

- Fidelity® Select Health Care Services Portfolio (FSHCX) , up 4.73%

- Goldman Sachs MLP Energy Infrastructure Fund (GLPSX), up 2.78%

- iShares U.S. Healthcare Providers ETF (IHF) , up 2.57%

- SPDR® Gold Shares (GLD), up 2.16%

Losing

- MFS Utilities Fund (MMUFX) , down -9.92%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -11.33%

- Invesco WilderHill Clean Energy ETF (PBW) , down -18.01%

- ALPS Clean Energy ETF (ACES), down -20.86%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.