Stocks whipsawed this week as investors looked for growth until better-than-expected economic data increased expectations of an interest rate hike by the Fed later this month.

The annual U.S GDP rate surged to 5.2% in Q3, higher than the preliminary estimate of 4.9% and forecasts of 5%. This was the highest level since the end of the pandemic back in 2021. Despite the pop in economic growth, the Fed’s favorite inflation metric- the PCE Price Index- clocked in at 0.2%, below both previous readings and estimates of 0.3%. This helped the major markets rebound a bit at the tailend of the week. Poor personal spending and income data, which both came in below estimates at just 0.2%, also helped drive the narrative that the Fed might keep rates unchanged at the next meeting. The markets also mourned the death of Berkshire Hathaway’s Charlie Munger. Munger, aged 99, was Warren Buffett’s right-hand man and helped shape the firm into the modern powerhouse it is today.

Heading into the last month of the year, investors will be looking for a so-called Santa Claus rally. Elevated inflation and interest rates remain a cause of concern and investors will get to see some economic data next week that should provide more clarity. This includes the Services PMI, which fell to 51.8 in October. This is just a smidge above contraction levels, with analysts now predicting a further cooling in the services economy in November when the data is released on Tuesday. Meanwhile, the labor market continues to be robust, with the JOLTS Report on Tuesday predicted to show nearly 9.4 million available jobs for October. Initial jobless claims for the week ending December 2 are also expected to show a resilient labor economy. This should help keep the unemployment rate low at 3.9% for November when it is released on Friday. Consumers certainly like their prospects heading into the holiday spending season. The preliminary reading of the Michigan Consumer Sentiment report for December is expected to increase slightly to 61.4 on Friday.

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

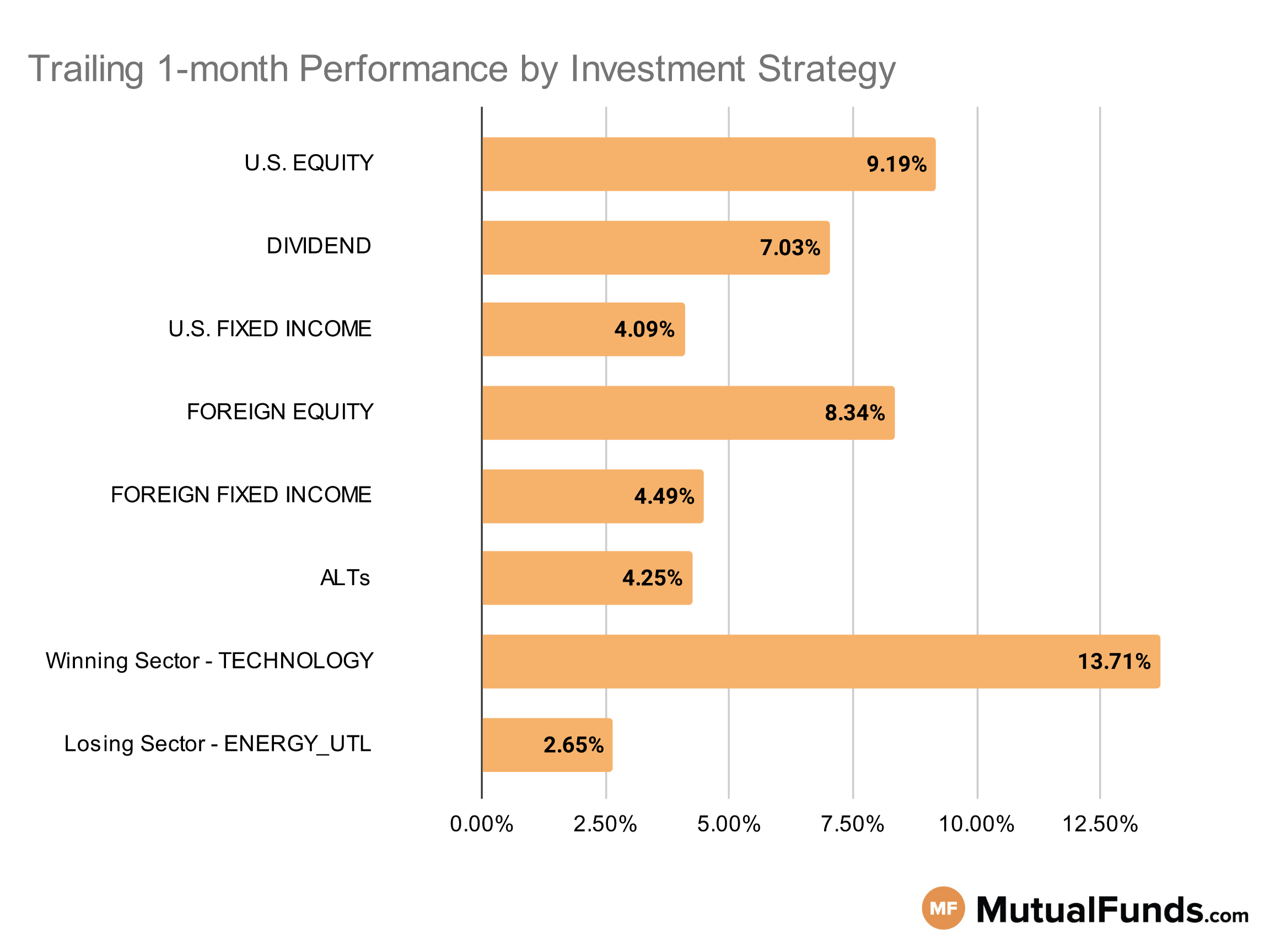

Overall, the U.S. stock markets continued their upward trajectory for the rolling month.

Growth focussed strategies including technology and biotechnology along with emerging market strategies posted some of the best performances over the rolling month. Meanwhile, commodities, including energy strategies struggled.

U.S Equity Strategies

Growth and value strategies continued to post positive performances over the trailing month.

Winning

- DFA World Core Equity Portfolio (DREIX) , up 18.06%

- JPMorgan Large Cap Growth Fund (SEEGX), up 18.03%

- Vanguard S&P Mid-Cap 400 Value Index Fund (IVOV) , up 13.97%

- Invesco S&P SmallCap 600 Revenue ETF (RWJ), up 12.17%

- iShares S&P Mid-Cap 400 Value ETF (IJJ) , up 7.17%

- iShares Core S&P Total U.S. Stock Market ETF (ITOT), up 6.68%

- Janus Henderson Small Cap Value Fund (JSIVX) , up 1.64%

- ClearBridge Large Cap Growth Fund (LMPLX), up 1.63%

Dividend Strategies

Several dividend strategies, including large and small cap, posted positive performances over the rolling month.

Winning

- MainStay Epoch U.S. Equity Yield Fund (EPLKX) , up 13.71%

- JPMorgan Diversified Return U.S. Equity ETF (JPUS), up 12.76%

- ProShares Russell 2000 Dividend Growers ETF (SMDV) , up 11.81%

- Eaton Vance Dividend Builder Fund (EVTMX), up 11.1%

- Schwab U.S. Dividend Equity ETF™ (SCHD) , up 5.09%

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL), up 4.38%

- Thornburg Investment Income Builder Fund (TIBAX) , up 0.51%

- First Eagle Global Income Builder Fund (FEBIX), up 0.2%

U.S. Fixed Income Strategies

In US fixed income, some inflation and municipal bond focused strategies posted solid performances over the rolling month.

Winning

- Lord Abbett Inflation Focused Fund (LIFFX) , up 14.86%

- Fidelity® Intermediate Municipal Income Fund (FLTMX), up 14.74%

- Fidelity® Total Bond ETF (FBND) , up 14.03%

- iShares GNMA Bond ETF (GNMA), up 10.68%

Losing

- PIMCO International Bond Fund (“U.S. Dollar-Hedged”:) , down -1.52%

- iShares Interest Rate Hedged Long-Term Corporate Bond ETF (IGBH), down -2.53%

- Vanguard Short-Term Corporate Bond Index Fund (VSCSX) , down -2.92%

- SPDR® Portfolio Aggregate Bond ETF (SPAB), down -8.8%

Foreign Equity Strategies

Emerging markets, including China, posted some of the best performances among foreign equities.

Winning

- WCM Focused International Growth Fund (WCMRX) , up 17.64%

- Fidelity Advisor® Emerging Asia Fund (FEAAX), up 15.85%

- SPDR® S&P China ETF (GXC) , up 15.4%

- iShares MSCI Pacific ex Japan ETF (EPP), up 14.72%

- Vanguard Emerging Markets Government Bond Index Fund (VGAVX) , up 1.79%

- Fidelity® Series Canada Fund (FCNSX), up 1.78%

Losing

- Schwab International Equity ETF™ (SCHF) , down -0.35%

- FlexShares Morningstar Developed Markets ex-US Factor Tilt Index Fund (TLTD), down -1.16%

Foreign Fixed Income Strategies

Emerging market bond and international treasury strategies posted some of the best performances in the foreign fixed income space.

Winning

- Ashmore Emerging Markets Total Return Fund (EMKIX) , up 12.51%

- Janus Henderson Developed World Bond Fund (HFARX), up 9.99%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX) , up 5.56%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 4.93%

- PIMCO Emerging Markets Bond Fund (PEBCX) , up 2.6%

- Vanguard Emerging Markets Bond Fund (VEMBX), up 2.43%

- iShares International Treasury Bond ETF (IGOV) , up 0.48%

Losing

- VanEck Emerging Markets High Yield Bond ETF (HYEM), down -16.95%

Alternatives

Among alternatives, emerging markets emerged as winners over the rolling month, while commodities struggled.

Winning

- iShares MSCI Emerging Markets Min Vol Factor ETF (EEMV) , up 20.55%

- Global X U.S. Preferred ETF (PFFD), up 16.39%

- SEI Institutional Managed Trust Global Managed Volatility Fund (SVTAX) , up 11.63%

- BlackRock Event Driven Equity Fund (BILPX), up 10.67%

Losing

- Columbia Convertible Securities Fund (COVRX) , down -1.44%

- First Trust Global Tactical Commodity Strategy Fund (FTGC), down -4.39%

- BNY Mellon Global Real Return Fund (DRRIX) , down -6.65%

- Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF (BCI), down -37.42%

Sectors

Among the sectors, technology and biotechnology continued to outperform others, while energy strategies remained in red.

Winning

- Invesco NASDAQ 100 ETF (QQQM) , up 53.09%

- First Trust NYSE Arca Biotechnology Index Fund (FBT), up 41.91%

- John Hancock Funds II Blue Chip Growth Fund (JBGCX) , up 30.97%

- USAA Nasdaq 100 Index Fund (UANQX), up 21.77%

- Vanguard Energy Index Fund (VENAX) , up 1.47%

Losing

- MFS Utilities Fund (MMUFX), down -1.15%

- Fidelity® MSCI Energy Index ETF (FENY) , down -10.63%

- First Trust NASDAQ-100-Technology Sector Index Fund (QTEC), down -26.18%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.