Stocks whipsawed last week as investors continued to take profits after the recent Fed-induced rallies.

Both the Dow and NASDAQ were hit hard, breaking nine-day winning streaks before snapping back later heading into the weekend. Key to that bounce-back was the third quarter GDP figure for the U.S., which showed growth down to 4.9%. This was below estimates of 5.2%. While still bullish, the slightly lower number indicated that the Fed may not need to raise rates further and could begin cutting them in the new year. Initial jobless claims clocked in lower than expected as well. The Fed also may not need to raise rates thanks to dwindling inflationary numbers. The Fed’s favorite measure, Core PCE, increased by 0.1% in November, below estimates and the previous month’s reading. With that, investors pushed the overall market higher into the Christmas holiday weekend.

With the markets closed on Monday for the Christmas holiday and many investors likely to take time off during the week, economic data will be light. Several regional manufacturing indicators will be released, including both the Richmond and Dallas Fed indexes. Arguably the biggest data release of the week will be jobless claims data on Thursday. Initial jobless claims have been mixed over the last few weeks, but showing a strong labor market overall. Analysts expect the number to come in at 207,000 for the week ending December 23, roughly within a few thousand of previous few weeks’ figures. Housing data will be released on Thursday, with monthly pending home sales expected to increase by 0.6% in November. However, year-to-date, the number of homes sold is expected to decline by 6%. Finishing out the week will be various EIA energy data on Thursday, all expected to show a bullish, yet slowing picture.

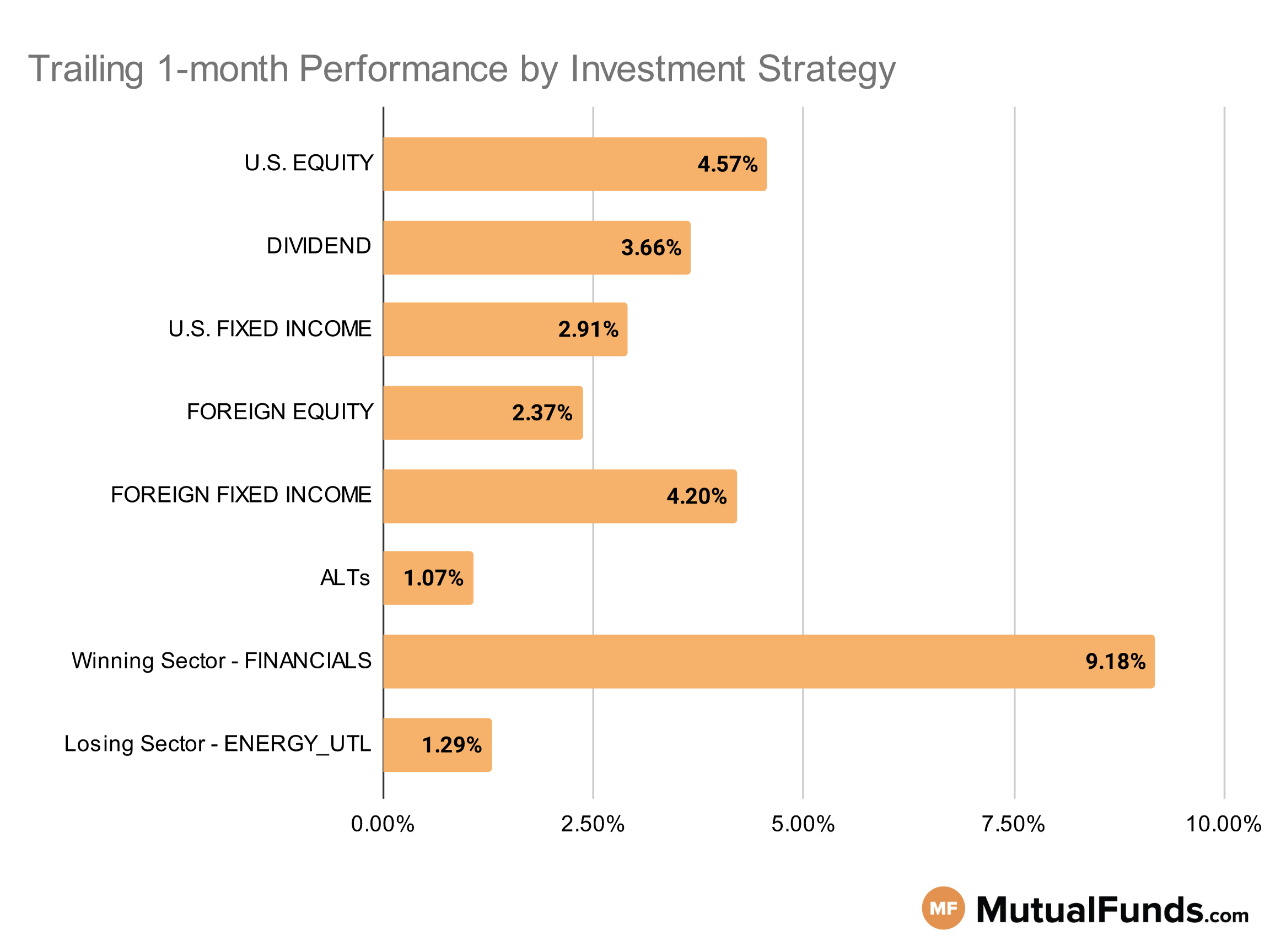

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets continued their upward trajectory for the rolling month.

Growth focused strategies, including innovatie technology, and small cap strategies continue to post some of the strongest performances over the rolling month. Meanwhile, large cap and commodity strategies struggled.

U.S Equity Strategies

Several small-cap growth strategies outperformed their larger counterparts over the trailing month.

Winning

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX) , up 18.47%

- Wasatch Ultra Growth Fund (WAMCX), up 16.9%

- iShares Micro-Cap ETF (IWC) , up 15.23%

- iShares S&P Small-Cap 600 Value ETF (IJS), up 13.78%

- Invesco Dynamic Large Cap Growth ETF (PWB) , up 3.77%

- iShares Core S&P U.S. Growth ETF (IUSG), up 3.59%

Losing

- Mercer US Large Cap Equity Fund (MLCGX) , down -32.31%

- Lazard US Equity Concentrated Portfolio (LEVOX), down -40.78%

Dividend Strategies

Several dividend strategies, including mid/small cap and international, continue to post strong performances over the rolling month.

Winning

- Invesco S&P Ultra Dividend Revenue ETF (RDIV) , up 11.92%

- WisdomTree U.S. SmallCap Dividend Fund (DES), up 11.8%

- Principal Small-MidCap Dividend Income Fund (PMDIX) , up 9.42%

- Fidelity® Equity Dividend Income Fund (FEQTX), up 5.89%

- iShares Core High Dividend ETF (HDV) , up 3.16%

- SPDR® S&P International Dividend ETF (DWX), up 2.61%

Losing

- Invesco Rising Dividends Fund (ONRDX) , down -3.45%

- Cullen High Dividend Equity Fund (CHDEX), down -4.56%

U.S. Fixed Income Strategies

In US fixed income, long duration bond focused strategies continued to post solid performances over the rolling month.

Winning

- Vanguard Extended Duration Treasury Index Fund (VEDIX) , up 13.18%

- Fidelity® SAI Long-Term Treasury Bond Index Fund (FBLTX), up 9.71%

- iShares 20+ Year Treasury Bond ETF (TLT) , up 9.25%

- SPDR® Portfolio Long Term Treasury ETF (SPTL), up 8.7%

Losing

- SPDR® Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) , down -0.45%

- GMO Opportunistic Income Fund (GMOLX), down -3.16%

- Calamos Market Neutral Income (CVSIX) , down -3.62%

- ProShares Short 20+ Year Treasury (TBF), down -10.28%

Foreign Equity Strategies

Developing markets, Swedish and Mexican equity strategies outperformed Chinese and Taiwanese equity strategies.

Winning

- Lord Abbett Developing Growth Fund (LADVX) , up 11.89%

- Artisan International Small-Mid Fund (APHJX), up 9.72%

- iShares MSCI Sweden ETF (EWD) , up 9.72%

- iShares MSCI Mexico ETF (EWW), up 9.35%

Losing

- Fidelity® China Region Fund (FHKCX) , down -4.41%

- MFS International Intrinsic Value Fund (MGIAX), down -7.06%

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) , down -8.93%

- iShares MSCI Taiwan ETF (EWT), down -8.98%

Foreign Fixed Income Strategies

International treasury and emerging market bond strategies continued to post some of the best performances in the foreign fixed income space.

Winning

- iShares International Treasury Bond ETF (IGOV) , up 6%

- John Hancock Funds Emerging Markets Debt Fund (JEMIX), up 5.99%

- JPMorgan Emerging Markets Debt Fund (JEDAX) , up 5.86%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 5.22%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND) , up 2.72%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), up 2.37%

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX) , up 1.48%

- Invesco International Bond Fund (OIBIX), up 1.14%

Alternatives

Among alternatives,gold and low volatility strategies continue to post strong results over the rolling month, while managed futures and commodities struggled.

Winning

- Invesco S&P SmallCap Low Volatility ETF (XSLV) , up 8.89%

- Fidelity® Select Gold Portfolio (FSAGX), up 7.97%

- Virtus InfraCap U.S. Preferred Stock ETF (PFFA) , up 7.95%

- Columbia Convertible Securities Fund (COVRX), up 6.63%

Losing

- BlackRock Tactical Opportunities Fund (PCBAX) , down -7.66%

- iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT), down -8.08%

- Invesco DB Commodity Index Tracking Fund (DBC) , down -8.69%

- AQR Managed Futures Strategy Fund (AQMIX), down -10.22%

Sectors

Among the sectors technology and healthcare strategies posted strong results, while cannabis and oil strategies continued to struggle.

Winning

- Amplify Transformational Data Sharing ETF (BLOK) , up 33.99%

- ARK Fintech Innovation ETF (ARKF), up 24.47%

- American Beacon ARK Transformational Innovation Fund (ADNYX) , up 19.35%

- Eventide Healthcare & Life Sciences Fund (ETAHX), up 16.71%

Losing

- Invesco DB Oil Fund (DBO) , down -9.89%

- AdvisorShares Pure US Cannabis ETF (MSOS), down -12.43%

- MassMutual Blue Chip Growth Fund (MBCZX) , down -15.58%

- MassMutual Select Blue Chip Growth Fund (MBGFX), down -18.44%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.