Stocks rose this week as key IPOs as well as the Federal Reserve’s stance on interest rates continued to provide optimism to investors.

Stocks rose last week as key IPOs as well as the Federal Reserve’s stance on interest rates continued to provide optimism to investors. Shares of Reddit surged as the social media’s IPO began trading this week and was the first real test of risk for the markets. The Federal Reserve’s decision to keep interest rates steady and forecast 3 cuts this year has led to increased risk appetite among market participants.. The latest Federal Open Market Committee (FOMC) meeting kept benchmark rates at 5.5%. Policymakers also see another three rate reductions in 2025. No real new information came from the central bank’s press conference, leading investors to buy tech and other growth sectors. Elsewhere, weekly jobless claims still pointed to a bullish labor market, while housing received a boost from an uptick in building permits and housing starts.

Next week’s focus will shift to inflation, with all eyes on the Federal Reserve’s favorite measure of price changes, the Core PCE Price Index. The metric increased by 0.4% in February, which was the largest gain in over a year. The prolonged inflationary environment has continued to put pressure on the central bank to keep interest rates steady. Also adding to those inflationary pressures have been strong GDP readings. The economy is expected to grow by 3.2% in the fourth quarter after a surprise 4.9% jump registered in the third quarter. Investors will also see personal spending and income data for February, with personal income seeing a more-than-expected jump in January. For February, analysts now expect both measures to grow by 0.3%. Durable goods data is also expected to rebound next week, jumping by 1.7% in February, reversing January’s 6.1% decline. Finally, Federal Reserve Chair Jerome Powell will give a speech on Friday, with investors tuning in to see if the central bank changes the messaging around the future path of interest rates.

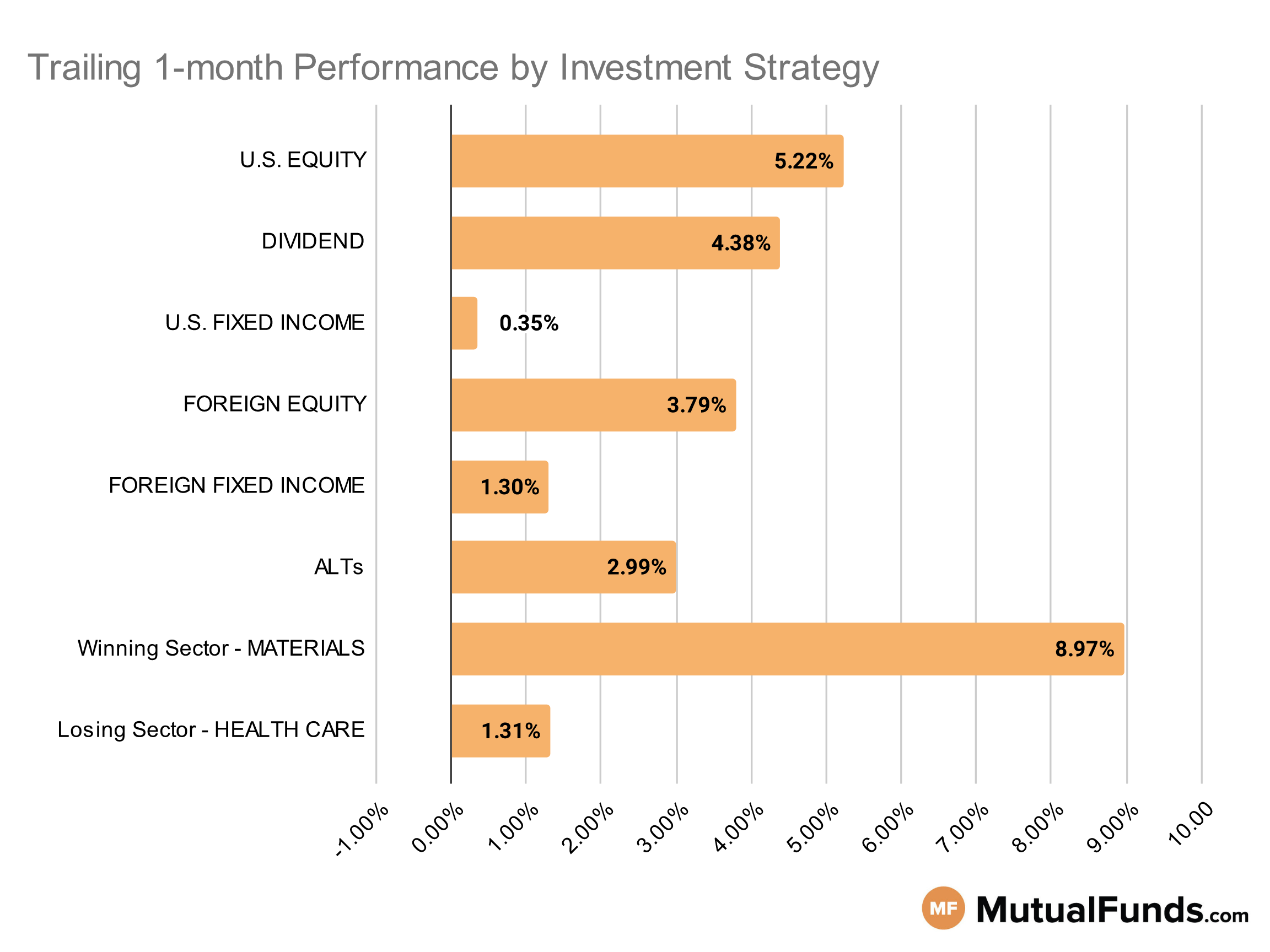

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, the U.S. stock markets maintained their positive momentum for the rolling month.

Material strategies, especially silver, gold, and copper, continued to post solid performances for the rolling month. Meanwhile, clean energy-focused strategies struggled.

U.S Equity Strategies

Among U.S. equities, small and mid-cap growth strategies continued to post solid performance over the rolling month.

Winning

- Invesco Small Cap Value Fund (VSMIX), up 9.87%

- Vanguard S&P Mid-Cap 400 Growth Index Fund (VMFGX), up 9.69%

- SPDR® S&P 400 Mid Cap Growth ETF (MDYG), up 9.39%

- iShares S&P Mid-Cap 400 Growth ETF (IJK), up 9.38%

- SPDR® S&P 600 Small Cap Value ETF (SLYV), up 1.96%

- iShares S&P Small-Cap 600 Value ETF (IJS), up 1.92%

Losing

- VALIC Company I Stock Index Fund (VSTIX), down -1.61%

- Brown Capital Management Small Company Fund (BCSIX), down -3.17%

Dividend Strategies

Several dividend growth-focused strategies continued to post positive performances over the rolling month.

Winning

- Fidelity® Dividend Growth Fund (FDGFX), up 8.69%

- Fidelity Advisor® Dividend Growth Fund (FDGTX), up 8.65%

- First Trust Rising Dividend Achievers ETF (RDVY), up 7.9%

- Invesco BuyBack Achievers ETF (PKW), up 6.75%

- ProShares Russell 2000 Dividend Growers ETF (SMDV), up 1.52%

- SPDR® S&P International Dividend ETF (DWX), up 1.47%

- Principal Global Diversified Income Fund (PGBAX), up 0.76%

Losing

- VALIC Company I Dividend Value Fund (VCIGX), down -2.15%

U.S. Fixed Income Strategies

In US fixed income, longer duration and convertible bond strategies posted positive results.

Winning

- PIMCO StocksPLUS® Long Duration Fund (PSLDX), up 3.13%

- Federated Hermes Capital Income Fund (CAPAX), up 2.44%

- Invesco CEF Income Composite ETF (PCEF), up 2.07%

- iShares Convertible Bond ETF (ICVT), up 1.79%

Losing

- SPDR® Nuveen Bloomberg Barclays Short Term Municipal Bond ETF (SHM), down -0.31%

- ProShares Short 20+ Year Treasury (TBF), down -0.72%

- American Funds Strategic Bond Fund (ANBFX), down -0.77%

- VALIC Company I Core Bond Fund (VCBDX), down -2.85%

Foreign Equity Strategies

Among foreign equities, Japanese and Italian equity strategies posted solid growth numbers, while Indian and Brazilian strategies struggled.

Winning

- Matthews Japan Fund (MJFOX), up 8.61%

- iShares MSCI Italy ETF (EWI), up 7.95%

- JPMorgan Europe Dynamic Fund (JFESX), up 7.69%

- iShares MSCI Intl Momentum Factor ETF (IMTM), up 7.27%

Losing

- Virtus Vontobel Emerging Markets Opportunities Fund (VREMX), down -0.93%

- Grandeur Peak International Opportunities Fund (GPIIX), down -1.16%

- iShares MSCI Brazil ETF (EWZ), down -3.38%

- WisdomTree India Earnings Fund (EPI), down -3.85%

Foreign Fixed Income Strategies

Emerging market debt strategies continue to lead the pack, among foreign fixed income strategies/

Winning

- TCW Emerging Markets Income Fund (TGEIX), up 3.01%

- Fidelity Advisor® New Markets Income Fund (FNMIX), up 2.88%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), up 2.66%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), up 1.38%

- T. Rowe Price International Bond Fund (PAIBX), up 0.29%

Losing

- Templeton Global Bond Fund (TGBAX), down -0.27%

- SPDR® Bloomberg Barclays Emerging Markets Local Bond ETF (EBND), down -0.39%

- VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), down -0.53%

Alternatives

Among alternatives, gold strategies posted strong results over the rolling month, while event and market-neutral strategies were in the red.

Winning

- Fidelity® Select Gold Portfolio (FSAGX), up 10.72%

- ETFMG Alternative Harvest ETF (MJ), up 9.01%

- Invesco DB Agriculture Fund (DBA), up 8.73%

- BlackRock Commodity Strategies Portfolio (BCSAX), up 6.7%

- Janus Henderson Mortgage-Backed Securities ETF (JMBS), up 0.42%

- SPDR® DoubleLine Total Return Tactical ETF (TOTL), up 0.18%

Losing

- BlackRock Event Driven Equity Fund (BILPX), down -0.1%

- Victory Market Neutral Income Fund (CBHAX), down -1.18%

Sectors

Among the sectors material strategies posted strong results, while strategies focused on clean energy were in red.

Winning

- ETFMG Prime Junior Silver Miners ETF (SILJ), up 17.24%

- Global X Copper Miners ETF (COPX), up 16.25%

- Sprott Gold Equity Fund (SGDLX), up 13.87%

- Fidelity Advisor® Semiconductors Fund (FIKGX), up 13.86%

Losing

- Fidelity Advisor® Health Care Fund (FHCCX), down -0.92%

- VALIC Company I Blue Chip Growth Fund (VCBCX), down -5.17%

- ALPS Clean Energy ETF (ACES), down -6.99%

- Invesco WilderHill Clean Energy ETF (PBW), down -7.77%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.