Stocks continued their whipsaw pattern last week as the combination of earnings, mixed economic data, and several successful initial public offerings (IPOs) contributed to volatility.

Earnings for Facebook owner Meta Platforms were mixed as the firm continued to spend big on the metaverse, which sent shares crashing. Meanwhile, strong quarterly reports from Microsoft and Google helped buoy the market. Stocks also faltered after the latest GDP reading, which clocked in at an annualized rate of 1.6%. This was compared to the 3.4% rate reported in the previous quarter and was below expectations of 2.5%, representing the lowest growth since the end of the pandemic at the beginning of 2022. Meanwhile, inflation stayed strong with the latest core personal consumption expenditures (PCE) price index increasing by 2.8% from a year ago in March, the same as in February and slightly above market estimates. Markets shrugged off this hot inflation reading at the tail end of the weak, staging a strong rebound on Friday.

Volatility could reign once again next week as the Federal Reserve makes its next decision on interest rates. While investors previously expected cuts to occur already, analysts now forecast the central bank to keep rates steady at 5.5%. However, the latest FedWatch tool has started to factor in a rate increase thanks to stubbornly high inflation. The issue will remain mixed economic data, putting the Federal Reserve in a tough place to make the next move. The ISM manufacturing purchasing managers’ index (PMI) is expected to slip to 49, showing a slight contraction in industrial activity. The ISM Services PMI, which has been a bright spot in recent weeks, is also expected to slip. All of this dwindling data coupled with still high inflation has increased the risk of stagflation, potentially making the investment environment volatile going forward.

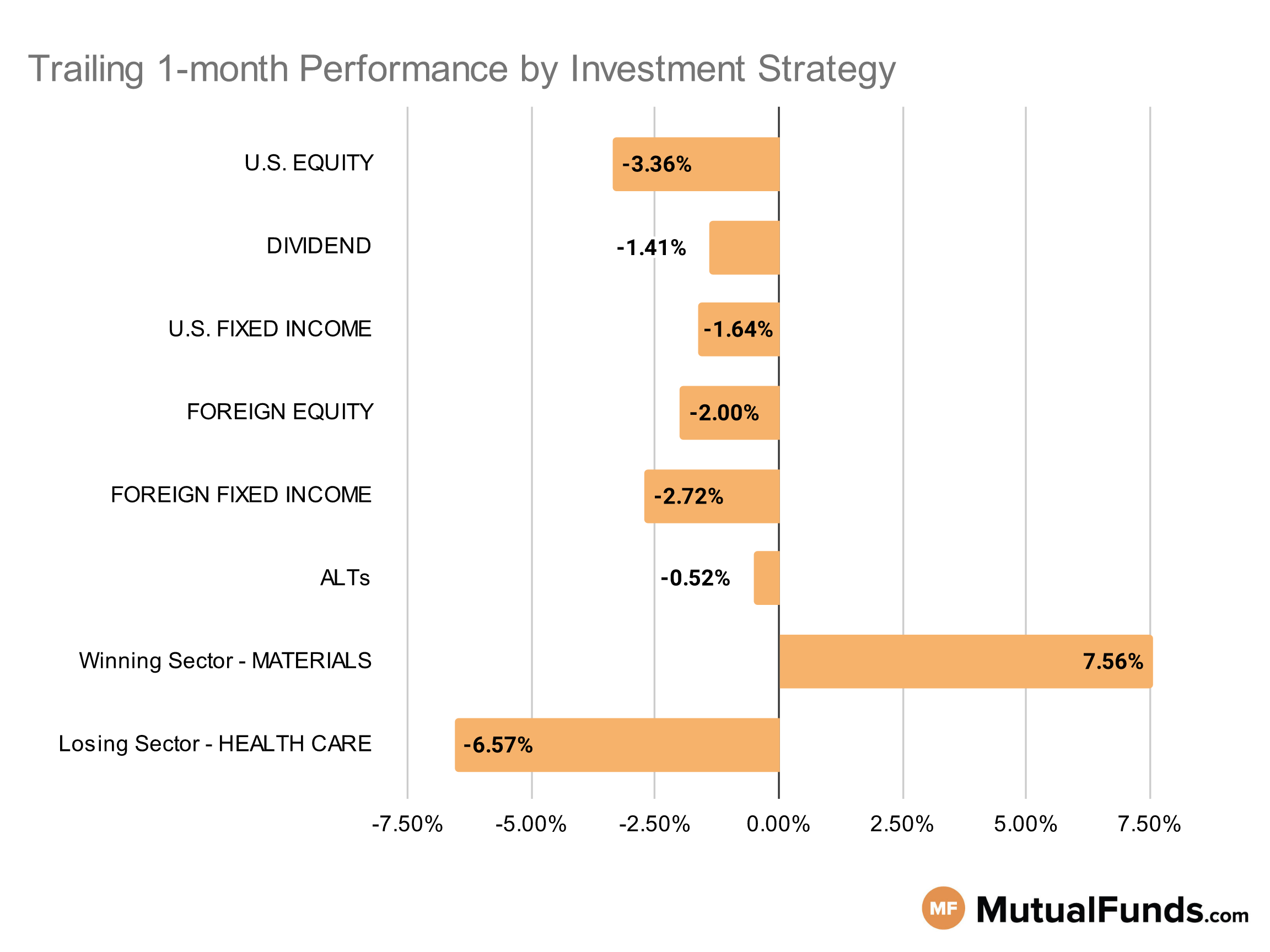

Given this economic backdrop, let us see how this impacts the performance of various investment strategies.

Investment Strategy Scorecard

Overall, major U.S. stock indices were down for the rolling month.

Precious metal strategies, especially silver and gold, continued to post positive returns for the rolling month. Meanwhile, some tech and biotech strategies remained in the red.

U.S Equity Strategies

Among U.S. equities, some large-cap value strategies posted marginal gains while several growth-focused strategies struggled.

Winning

- Neuberger Berman Large Cap Value Fund (NPNRX), up 1.14%

- Eaton Vance Large-Cap Value Fund (EHSTX), up 0.2%

Losing

- iShares Core S&P U.S. Value ETF (IUSV), down -1.58%

- Schwab U.S. Large-Cap Value ETF™ (SCHV), down -1.69%

- iShares Russell 2000 Growth ETF (IWO), down -5.94%

- First Trust US Equity Opportunities ETF (FPX), down -6.34%

- Virtus Zevenbergen Innovative Growth Stock Fund (SCATX), down -7.73%

- Morgan Stanley Institutional Fund, Inc. Growth Portfolio (MSEGX), down -9.82%

Dividend Strategies

Some high dividend strategies posted marginal gains.

Winning

- iShares Core High Dividend ETF (HDV), up 1.44%

- Legg Mason Low Volatility High Dividend ETF (LVHD), up 0.64%

- Franklin Equity Income Fund (FREIX), up 0.48%

- Neuberger Berman Equity Income Fund (NBHAX), up 0.46%

Losing

- Invesco BuyBack Achievers ETF (PKW), down -3.05%

- FlexShares Quality Dividend Index Fund (QDF), down -3.29%

- Vanguard Diversified Equity Fund (VDEQX), down -3.32%

- HCM Dividend Sector Plus Fund (HCMNX), down -4.06%

U.S. Fixed Income Strategies

In US fixed income, long duration debt strategies continued to struggle.

Winning

- ProShares Short 20+ Year Treasury (TBF), up 7.01%

- T. Rowe Price Dynamic Global Bond Fund (TRDZX), up 1.16%

- JPMorgan Strategic Income Opportunities Fund (JSOSX), up 0.7%

- ProShares Investment Grade—Interest Rate Hedged (IGHG), up 0.51%

Losing

- SPDR® Portfolio Long Term Treasury ETF (SPTL), down -5.95%

- iShares 20+ Year Treasury Bond ETF (TLT), down -6.39%

- PIMCO Extended Duration Fund (PEDPX), down -9.17%

- Vanguard Extended Duration Treasury Index Fund (VEDIX), down -9.45%

Foreign Equity Strategies

Among foreign equities, Indian and Chinese equity strategies posted solid performances, while Japanese strategies continued to struggle.

Winning

- WisdomTree India Earnings Fund (EPI), up 5.06%

- iShares MSCI China ETF (MCHI), up 4.98%

- Fidelity Advisor® Focused Emerging Markets Fund (FAMKX), up 2.58%

- Fidelity® China Region Fund (FHKCX), up 1.88%

Losing

- iShares MSCI Japan ETF (EWJ), down -6.65%

- iShares MSCI South Korea ETF (EWY), down -6.68%

- Matthews Japan Fund (MJFOX), down -7.49%

- JOHCM International Select Fund (JOHIX), down -7.93%

Foreign Fixed Income Strategies

The majority of foreign fixed income strategies were in the red, with some global debt strategies struggling the most.

Losing

- Eaton Vance Emerging Markets Debt Opportunities Fund (EIDOX), down -0.76%

- VanEck Emerging Markets High Yield Bond ETF (HYEM), down -1.41%

- Fidelity Advisor® New Markets Income Fund (FNMIX), down -1.76%

- iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), down -2.76%

- SPDR® Bloomberg Barclays International Treasury Bond ETF (BWX), down -3.23%

- iShares International Treasury Bond ETF (IGOV), down -3.35%

- Invesco International Bond Fund (OIBIX), down -3.69%

- Templeton Global Bond Fund (TGBAX), down -5.07%

Alternatives

Among alternatives, gold posted strong results over the rolling month, while preferred stock and contrarian strategies struggled.

Winning

- Fidelity® Select Gold Portfolio (FSAGX), up 13.43%

- Invesco DB Agriculture Fund (DBA), up 6.73%

- Parametric Commodity Strategy Fund (EAPCX), up 6.03%

- Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF (BCI), up 4.94%

Losing

- Columbia Mortgage Opportunities Fund (CLMAX), down -4%

- Fidelity® Contrafund® Fund (FCNKX), down -4.16%

- VanEck Preferred Securities ex Financials ETF (PFXF), down -4.49%

- ETFMG Alternative Harvest ETF (MJ), down -6.52%

Sectors

Among the sectors precious metal strategies continued to post strong results, while some tech and biotech strategies struggled.

Winning

- Global X Silver Miners ETF (SIL), up 22.39%

- ETFMG Prime Junior Silver Miners ETF (SILJ), up 20.51%

- Franklin Gold and Precious Metals Fund (FGPMX), up 13.89%

- First Eagle Gold Fund (FEGIX), up 12.76%

Losing

- AdvisorShares Pure US Cannabis ETF (MSOS), down -10.33%

- Eventide Healthcare & Life Sciences Fund (ETAHX), down -10.98%

- SPDR® S&P Biotech ETF (XBI), down -11.3%

- American Beacon ARK Transformational Innovation Fund (ADNYX), down -12.5%

Methodology

Every week, MutualFunds.com provides a snapshot of the performance of some key mutual funds and ETFs to highlight the trending investment strategies across different sectors, geographic regions, asset classes and themes. MutualFunds.com uses a proprietary system to scan through thousands of relevant mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on the change in NAV.

Here is a summary of the different strategies covered in this article:

- U.S. equity strategies typically cover different equity investing styles (growth/value/blend) and market capitalizations (small/mid/large).

- Dividend strategies focus on generating income via different equity routes (high yield/dividend growth/foreign dividend/quality dividend)

- U.S. fixed income strategies focus on debt securities issued by U.S. entities and can cover different types of debt (corporate/municipal/high-yield/investment-grade/government/asset-backed) and maturity profiles (short/medium/long).

- Foreign equity strategies cover equity strategies applied to non-U.S. markets based on the level of economic growth (emerging/developed), regions (Asia/Europe/Africa), and market capitalizations (small/mid/large).

- Foreign fixed-income strategies focus on debt securities issued outside the U.S. markets and can cover different regions (Asia/Europe/Africa) and regions based on the level of economic development (emerging/developed).

- Alternative strategies cover non-traditional investments (currencies, hedge funds strategies, derivatives, volatility-based), real estate, and commodities.

- Sector strategies cover dedicated exposure to various sectors of the U.S. economy including technology, healthcare, financial, and industrial among others.