We’re talking about tax-gains harvesting.

No, that wasn’t a typo. While tax-loss harvesting has long been a technique for investors to reduce taxes, being proactive with our gains and harvesting those returns can be equally as tax efficient for investors. While tax-gains harvesting takes some planning to implement, it can help save investors plenty in taxes and reduce what they pay Uncle Sam every year.

Learn more about portfolio management on our Portfolio Management Channel.

Loss Versus Gains Harvesting

The thing about tax-loss harvesting is that it works well in the short term. Investors take advantage of short-term losses in their portfolios. But what about the long term? How can we be proactive with our long-term gains?

This is where tax-gains harvesting can come in.

Just like tax-loss harvesting involves selling your losers, tax-gain harvesting is about pruning long-term winners to help reduce taxes. That may seem like a misnomer; after all, taxes are paid on gains when sold. But investors can time their sales to reduce taxes and, in many cases, pay 0% on their gains.

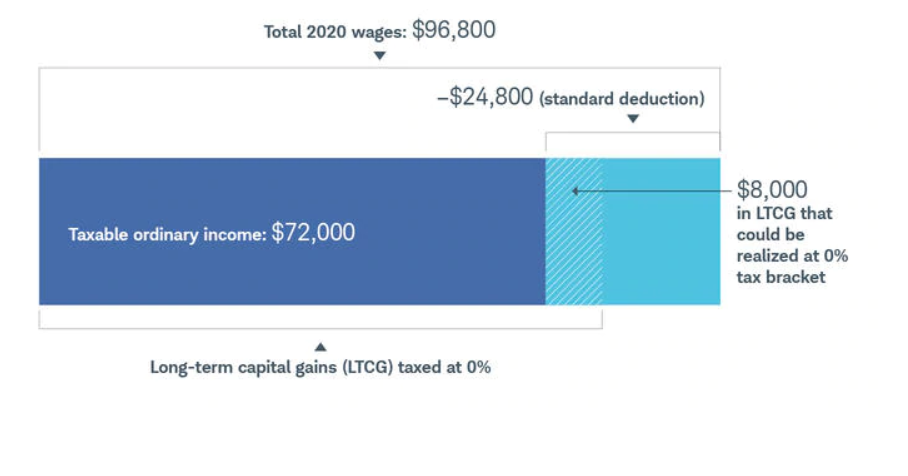

The reason why tax-gain harvesting can work is that some investors can pay 0% long-term capital gains rate on their sales. Individuals who have taxable income of less than $40,000 or married couples with less than $80,000 in earnings fall into this category. While that may seem low at first, remember, this is after the standard deduction and contributions to retirement accounts. The reality is that there is some wiggle room with higher taxable incomes. The beauty is that investors can pay that 0% capital gains rate up to the $40,000 or $80,000 amounts.

This example from investment manager Charles Schwab highlights tax-gain harvesting in action.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

How to Tax-Gain Harvest

One situation is if you happen to find yourself in a lower tax bracket. Part-time workers, self-employed individuals, retirees, etc. all face fluctuating income. In that, investors may benefit from timing their sales to take advantage of a higher 0% capital gains amount. For example, if you’re a part-time worker and your hours get cut—reducing your pay from $35,000 to $30,000—you would have an extra $5,000 to work with in terms of taking long term gains. By timing your sales in lean years, you can reduce or pay no taxes on more of your gains.

The reverse is true as well. If you anticipate a raise, promotion or boost to your income in the following year, harvesting gains today to reduce taxes now makes plenty of sense.

Second, combining tax-gains harvesting with tax-loss harvesting is a win-win. Investors can offset gains with losses, then take advantage of the 0% capital gains rate on additional gains on the same or different position. So, if investors have a really bad stock, they can use that to their advantage to reduce the stake in winners.

Finally, tax-gain harvesting can help reduce concentrated portfolios. Retirees with large company stock positions or investors who have seen position size get away from them can harvest their gains proactively. Selling to harvest gains in low tax years is better than not.

Some Caveats for Tax-Gains Harvesting

Secondly, unlike tax-loss harvesting that can be done throughout the year, tax-gain harvesting is best done at year end. Here, investors will basically know how much money they’ve made during the year, what their income picture looks like, etc. They can harvest gains accordingly. Doing it during the year or beforehand can actually backfire if they get a surprise bonus or windfall. It’s best to wait until December.

The Bottom Line

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.